Tomorrow, we get results for September employment. Bloomberg consensus is for +55K, compared to +42K at the originally scheduled release date (and +22K in August). Here are key indicators followed by the NBER Business Cycle Dating Committee.

SP500 and Bitcoin: Past Peak?

As of today’s close:

Rejoinder to Comments on House Price Affordability

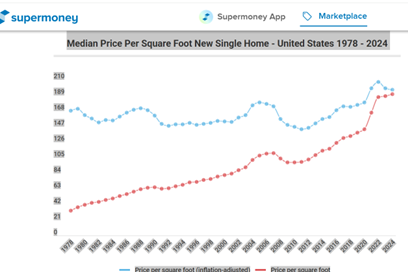

In commenting on my post yesterday on house affordability, Bruce Hall brings my attention to this Supermoney article by Andrew Latham, which states:

…the price per square foot has remained pretty stable [from 1978?] right until 2020. Look at the price per square foot (inflation-adjusted) for new homes in the graph below.

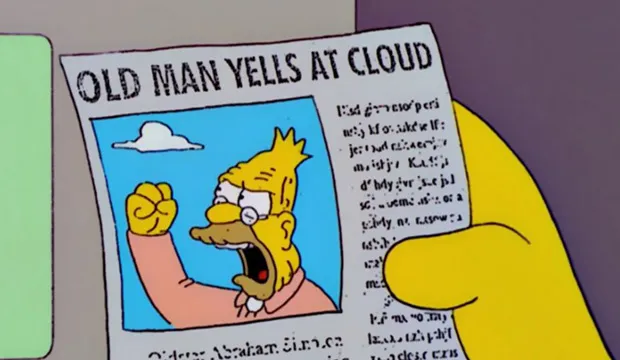

Grampa Simpson on Whining Whiners about House Affordability

To quote:

We read much about how housing is now “unaffordable”, but is that true?

We bought a 2300 sf home in 1979 with a 10.5% mortgage interest rate (a step up from our 1200 sf starter home). It was a bit of a strain, but our second child was on the way so we bit the bullet. Now it seems that this generation whines about housing being unaffordable and wants the government to “do something” about it.

Taylor (1999) on Miran (2025)

Really, a 50 bps drop in the Fed funds rate in December? What does a Taylor rule say?

Affordability, Illustrated

The AIER’s Everyday Price Index vs. 2024 stochastic trend, and CPI:

“Until we hear Brazil get mentioned, I wouldn’t get excited”

That’s Jason Miller, supply chain expert at MSU, noting 40% tariff to remain on Brazilian coffee (and other) exports to the United States, according to ABCNews.

How Would One Detect Wag the Dog?

On November 12, a small tranche of emails from the Epstein estate were released. Interest in Jeffrey Epstein as measured by Google Trends spiked.

The Trump Agenda and the Housing Stock

Think deportations and construction labor force (not housing demand), and tariffs and construction costs.

Truflation’s “Strategic Adviser”: BLS should “…expand the use of public-private partnerships”

Longer quote from EJ Antoni in Townhall: