Under the Tax Cuts and Jobs Act, no enormous surge in capital investment appeared, above and beyond what could be explained by aggregate demand changes. From the conclusion to U.S. Investment Since the Tax Cuts and Jobs Act of 2017, by Emanuel Kopp, Daniel Leigh, Susanna Mursula, and Suchanan Tambunlertchai.

The Trade Balance: Macro Dominates Tariffs

Like I said four years ago. By Trump’s own criterion, the trade war was lost. My view – that was a stupid criterion in any case.

The Market’s Expectations of Inflation and Real Rates over the Next Five Years

As of today, the five year constant maturity Treasury yield has stabilized for the last month at about 0.9%. The inflation breakeven implied by the spread between Treasurys and TIPS has plateaued at 2.52%. After accounting for the estimated term premium and liquidity premium, the implied inflation rate is 1.90% .

“Re-examining the Effects of Trading with China on Local Labor Markets: A Supply Chain Perspective”

From the paper by Zhi Wang, Shang-Jin Wei, Xinding Yu & Kunfu Zhu:

The United States imports intermediate inputs from China, helping downstream US firms to expand employment. Using a cross-regional reduced-form specification but differing from the existing literature, this paper (a) incorporates a supply chain perspective, (b) uses intermediate input imports rather than total imports in computing the downstream exposure, and (c) uses exporter-specific information to allocate imported inputs across US sectors. We find robust evidence that the total impact of trading with China is a positive boost to local employment and real wages. The most important factor is employment stimulation outside the manufacturing sector through the downstream channel. This overturns the received wisdom from the reduced-form literature and provides statistical support for a key mechanism hypothesized in general equilibrium spatial models.

Ungated version here. This is a slightly older paper (2018). A paper with related findings by Feenstra and Sasahara (2018) here, while ungated working paper version is here.

This is a reminder that import competition has direct impacts, but international trade allows firms access to lower cost inputs, and benefiting from comparative advantage. Separate from the question of net benefits is whether costs imposed on those negatively impacted outweigh those who gain, either in dollar or “util” terms.

Infrastructure Investment and Taxes

I talked about infrastructure investment and taxes on WPR yesterday. Will higher corporate tax rates and closing of loopholes in the taxation of corporations raise prices of goods produced? Given what happened in the wake of the 2017 reduction in corporate tax rates (i.e., lots of stock buybacks, not much higher investment), I think a resulting price increase not likely. On the other hand, the infrastructure spending could have an impact on productivity and hence prices.

Employment Surges to 5.5% below Feb 2020

The economy added 916,000 jobs in March, above the Bloomberg consensus of 647,000.

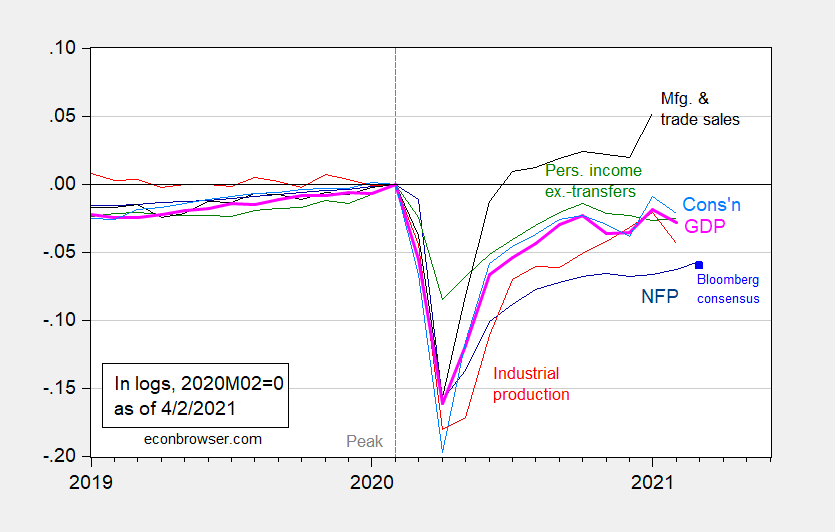

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 4/1 for March nonfarm payroll employment (light blue square), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (3/1/2021 release), NBER, and author’s calculations.

On the strength of the labor market, see Baum and Klein at EconoFact.

Business Cycle Indicators at the Beginning of April

The Bloomberg consensus is for an increase of 674 thousand jobs in March (GS says 775K). That’s heady news, offsetting the somewhat less upbeat news from the estimate of February monthly GDP released by IHS Markit today – a decrease of 0.9% after upward revision in January’s figure by 0.3% (not annualized). Even if expectations are met, employment will still be 5.8% below that recorded at the NBER peak in February 2020. In the context of key macro indicators followed by the NBER Business Cycle Dating Committee:

Did the Lockdown Cause More Suicides?

A common assertion made by those opposed to public health measures such as lockdowns was that suicides were rising markedly – see e.g., Carney/Washington Examiner via AEI, Arthur Laffer and Stephen Moore, and blog commenters like sammy. The data are in. This article indicates suicides actually went down in 2020, 5.6% relative to 2019.

On the Economic Outlook and More

Three quarters of an hour of me talking on the UW Department of Political Science’s 1050 Bascom Podcast, on “insights into how Covid-19 has impacted the US economy as well as international finance and global trade — and what the future might hold.”

On “Socioeconomic Roots of Academic Faculty”

From the paper:

Tenure-track faculty play a special role in society: they train future researchers, and they produce much of the scholarship that drives scientific, technological, and social innovation. However, the professoriate has never been demographically representative of the general population it serves. For example in the United States, Black and Hispanic scholars are underrepresented across the tenure-track, and while women’s representation has increased over time, they remain a minority in many academic fields. Here we investigate the representativeness of faculty childhood socioeconomic status and whether it may implicitly limit eorts to diversify the professoriate in terms of race, gender, and geography. Using a survey of 7218 professors in PhD-granting departments in the United States across eight disciplines in STEM, social sciences, and the humanities, we find that the estimated

median childhood household income among faculty is 23.7% higher than the general public, and faculty are 25 times more likely to have a parent with a PhD. Moreover, the proportion of faculty with PhD parents nearly doubles at more prestigious universities and is stable across the past 50 years. Our results suggest that the professoriate is, and has remained, accessible mainly to the socioeconomically privileged. This lack of socioeconomic diversity is likely to deeply shape the type of scholarship and scholars that faculty produce and train.