A couple years ago, Ryan LeCloux and I were cataloging the ways in which to track the individual state economies, at higher than annual frequency (paper here). I think that topic will be of interest again. State employment figures for April will come out on the 22nd, Philadelphia Fed coincident indices on the 27th.

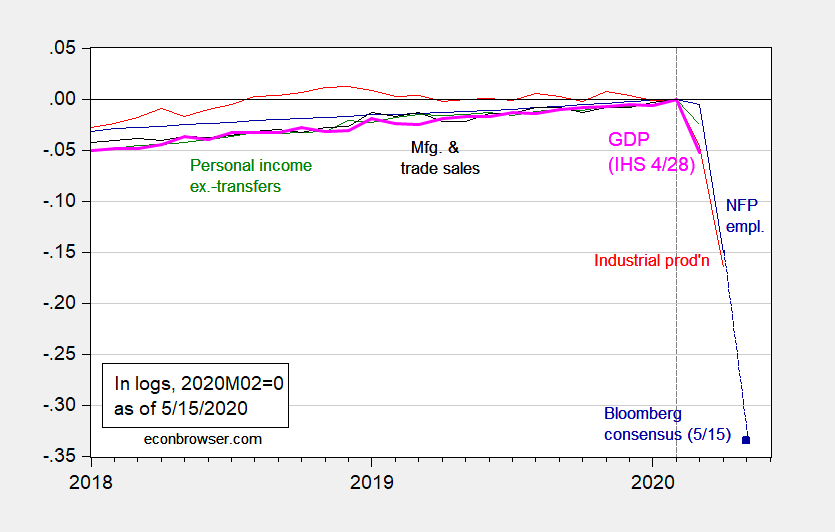

For now, consider the evolution of the coincident indices going from February to March.