In previous posts [1] [2], I described how in data up to the beginning of 2016, the Fama puzzle was overturned for major currencies. One question was whether the change would persist post-crisis and post-Zero Lower Bound (ZLB) exit. The short answer is, so far, yes.

Comparing shipping costs and industrial production as measures of world economic activity

That’s the title of my latest contribution at Vox CEPR Policy Portal.

Of Sugar Highs, Uncertainty, and Recession

Growth is already slated to decelerate, but in the absence of the Tax Cuts and Jobs Act, it might have decelerated even more; on the other hand in the absence of crazy high policy uncertainty, growth might have been faster…

Continue reading

Guess the Expiration Price of July 2019 Soybean Futures

On July 12, 2019, the soybean futures contract (CBOT) for July 2019 expires (first delivery on 7/16). On July 12, 2018, the closing price was 885.75 (data from ino.com here). What’s your guess on what the expiration price will be?

Recession Watch, July 2019

With the release of nonfarm payroll employment (NFP) numbers today, we have a new set of readings on indicators emphasized by the NBER BCDC (used in dating the end of the 2001 recession), since my last post on recession indicators. While NFP continues to trend upwards, industrial production, personal income excluding current transfers, manufacturing and trade industry sales are all below recent peaks. Monthly GDP has risen to match the last peak in January 2019.

George Washington and Victory at IAD

Source: Terry Australis

Nonfarm Payroll Employment Growth in Context

Blockbuster (absolute level) growth number for nonfarm payroll employment. But does the percentage growth rate in NFP dispell the prospect of recession in the near future? I don’t think so.

Guest Contribution: “Economic Policy Uncertainty and Recession Probability – July 2019 Update”

Today, we are fortunate to present a guest contribution written by Paweł Skrzypczyński, economist at the National Bank of Poland. The views expressed herein are those of the author and should not be attributed to the National Bank of Poland.

Judy Shelton Confuses Me: On Interest Rates, Currency Manipulation

With Judy Shelton’s nomination to be a Fed governor, it behooves us to consider her views on the world. I will point out two salient (there are many) areas of confusion about her views: (1) interest rates and monetary policy easing, and (2) currency manipulation.

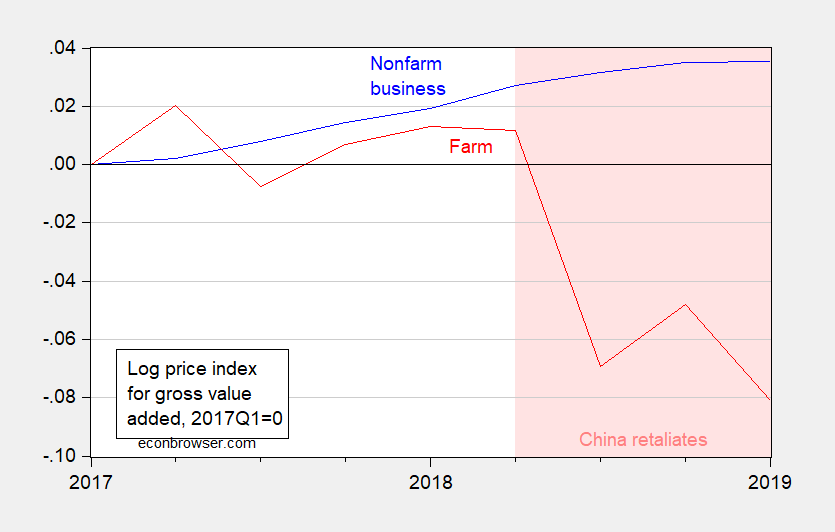

The Trump Administration Is No Friend of the Farmer: Part 15,327

Price index for gross value added in farm sector is falling (cumulative 8% under Trump) while that in the nonfarm business is rising (cumulative 3.5%).

Figure 1: Log price index for gross value added in nonfarm business sector (blue), and farm sector (red), 2017Q1=0. Pink shading denotes period during which China has tariffed US soybeans. Source: BEA 2019Q1 3rd release, authors’ calculations.