From Daily Signal. Paragraph continues:

Final Sales to Domestic Purchasers – Nowcasts and Tracking

Goldman Sachs says +0.3% q/q AR in Q3:

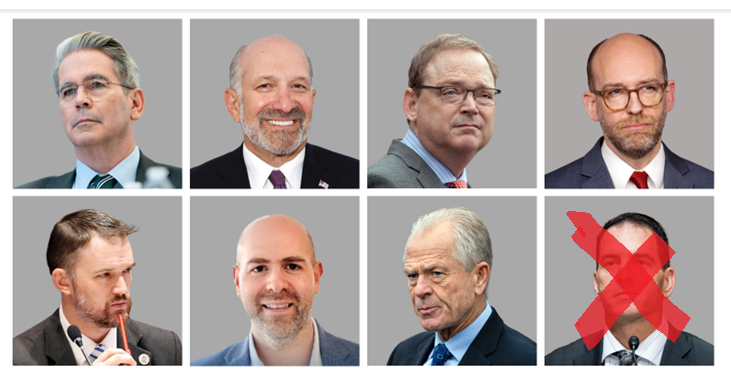

Deputy Treasury Secretary Michael Faulkender Out

EJ Antoni Tries to Estimate Crowding Out using 2SLS

Or at least the response of interest rates to deficits, controlling for investment and global saving.

Continue reading

Guest Contribution: “Monthly Household Income Estimates at the White House”

Today we present a guest post written by Matías Scaglione of the data science and economic consulting firm Motio Research.

Is the Sensitivity of Muni Bond Rates to 10 Year Treasury 0.04?

That’s the implication of this table:

Bringing Prices Down: How’s It Going?

As promised by Donald Trump?

“We’re going to have prices down- I think you’re going to see some pretty drastic price reductions.”

Associated Press, Trump holds a press conference at Mar-a-Lago, YouTube (January 7, 2025).

Residential Investment: Nowcast down 5.9% q/q AR

Based on residential investment construction July release (starts 1.428 mn > 1.29 mn Bbg consensus; permits 1.354mn < 1.39mn Bbg consensus):

EJ Antoni in August: “…an increasing number of indicators say the recession has arrived in the broader economy.”

trillions of dollars that appear to be economic growth are just borrowing from the future — a debt that will eventually have to be repaid with taxes or inflation. Both will kill growth.

“Reserves, Sanctions and Tariffs in a Time of Uncertainty”

Is gold supplanting the dollar? Did the use of sanction by the US reduce holdings of dollars by targeted central banks? Did the 2018-19 tariffs reduce holdings of dollars by countries hit with Section 232 tariffs? Jeff Frankel, Hiro Ito and I address these questions in a new paper.