Guest Contribution: “Protectionism Is Nothing New for Republicans”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

Mr. Trump’s Separation Policy and a Little Bit of History

In America, have we ever by policy rather than by law separated family members, including children, from other family members, while awaiting processing? The answer is yes, and we don’t need to go too far back in history.

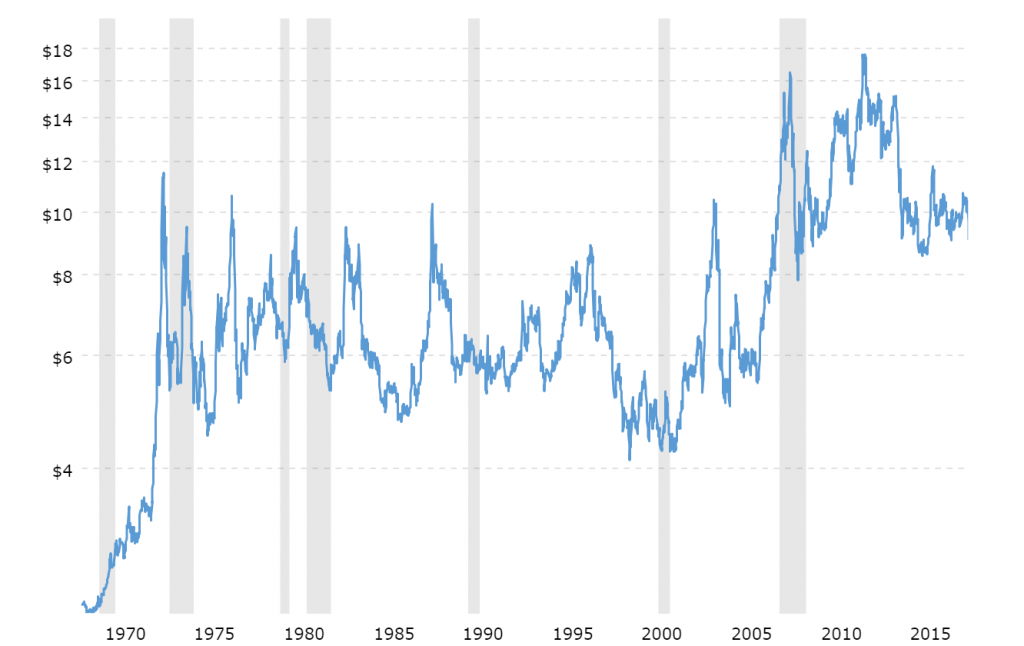

45 Years of Nominal Soybean Prices

Source:Source: MacroTrends.

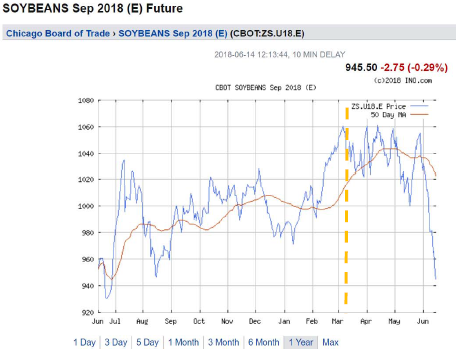

Soybean Futures in Free Fall: Front and Back Months

Reader Ed Hanson asks if it makes a difference to look at front month or back month futures in discerning the impact of news on soybean prices. The answer is no.

Below, I present graphs of soybean futures over the past year for contracts expiring in July, August, September, November, and January 2019 (all accessed on 6/15, from ino.com):

Continue reading

On the Eve of Disruption

(Apologies to P.F.S./B.McG) Soybean, hog prices and corn prices dove even before the Section 301 import tax hit list was announced. (Orange dashed line denotes Trump announcing imminent Section 232 tariffs). Why?

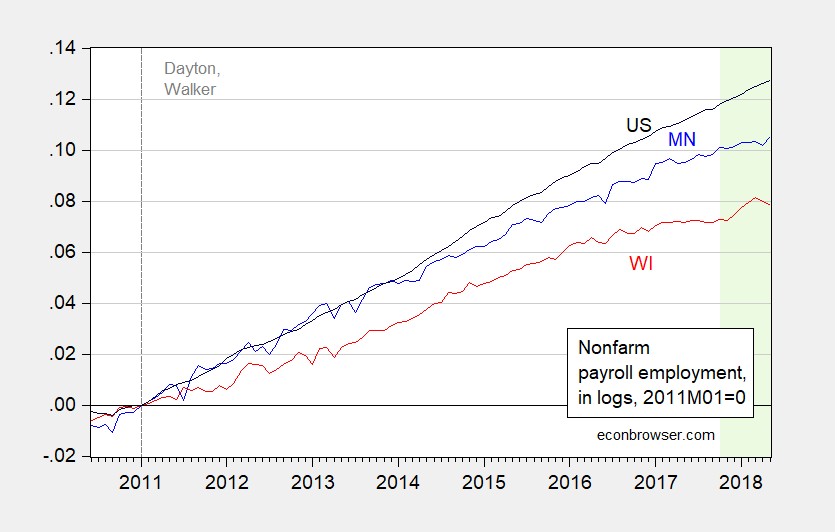

Wisconsin NFP Employment Continues Decline

It’s below peak, and April numbers revised down.Private employment 17,500 below Governor Walker’s target of an additional 250,000 jobs by January 2015. From WI DWD today.

Figure 1: Nonfarm payroll employment in Minnesota (blue), Wisconsin (red), and US (black), all in logs normalized to 2011M01=0. Light green shaded dates indicates data not yet benchmarked using QCEW data. Source: WI DWD, MN DEED, BLS and author’s calculations.

Continue reading

Guest Contribution: “Red and Blue: One Country or Two?”

Today we are fortunate to have a guest contribution by Helen Popper, professor of economics at Santa Clara University.

Democrats and Republicans differ. Blue and Red states differ. Blue and Red economies differ; but, how different are they? Are they as different as economies from two distinct countries?

Why Consult Ag Futures?

Because, they’re pretty good predictors of future prices (at least at the 3 and 12 month horizons) — better than a random walk, and better than a time series model. For empirics on corn, wheat and soybeans, see Chinn and Coibion, Journal of Futures Markets (2014).

And in Ohio…Contemplating 25% Tariffs on Soybeans

From Brown, Sheldon,AEDE Agricultural Report 2018-001, May 2018:

Through calculations made based on a representative west central Ohio farm, and assuming an average degree of Chinese substitution between U.S. and Brazilian soybean import, it is estimated that average net income per year (2018-2024) would drop from $63,577 to $26,107 under the proposed tariff, which translates to a 59% decrease in net farm income.

The US tariffs on steel and Chinese retaliation induces this effect through “higher machinery costs, lower corn, soybean and pork prices for U.S. agricultural producers”.