Today we are pleased to present a guest contribution written by Andrés Fernández (IDB), Michael W. Klein (Tufts), Alessandro Rebucci (Johns Hopkins Univ.), Martin Schindler (IMF and JVI) and Martín Uribe (Columbia Univ.). This post is based upon this paper. The findings, interpretations, and conclusions expressed in this article are entirely those of the authors. They do not necessarily represent the views of the InterAmerican Development Bank, the International Monetary Fund, the Joint Vienna Institute, their Executive Directors, or the countries they represent.

Benchmarked Wisconsin Private Nonfarm Payroll Declines

While the BLS state level data will come out on Monday (see discussion here), the individual states release slightly earlier. Wisconsin released employment data today.

The Wisconsin Employment Boom Will Be Revised Away

Not so certain the slowdown will be similarly erased.

China: The Trilemma and Reserves, Again

From Bloomberg:

The yuan strengthened after China’s central bank raised its fixing for a fourth day and data showed a less-than-estimated drop in the nation’s foreign-exchange reserves.

Senator Sanders and Financial Regulation

Today I was reminded that Senator Sanders voted against TARP. That made me conclude that Senator Sanders’ position on financial regulation is truly unique.

[graphic update 3/8 10:15 pm Pacific]

Continue reading

Spreads and Recession Watch, March 2016

Five Thirty Eight warns us to prepare for a (not likely imminent) recession; Wall Street Journal‘s Real Time Economics cautions “All Clear on Recession Risk? Not Yet”, even if the latest employment indicate continued growth. Time to review market indicators of the outlook.

Visualizing Textbook and Alternative Interpretations of the Friedman Analysis of the Sanders Economic Plan

Now that the dust has (kind of) settled on exactly what is and is not in Gerald Friedman’s interpretation of the Sanders economic plan, I thought it useful to contrast the textbook (at least the one I use, Olivier Blanchard/David Johnson‘s) view of how a fiscal stimulus works, versus that in which a one-time spending increase yields a permanent increase in output, in a graphical format.

Mass Shooting Statistics, 3/3/16

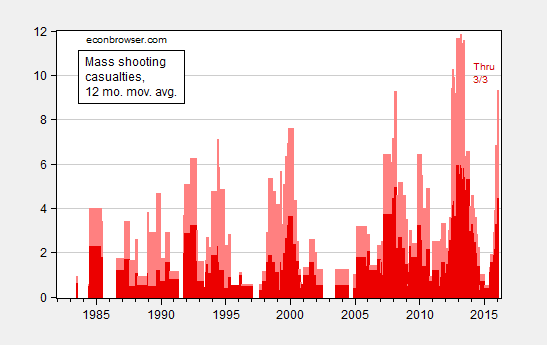

Figure 1: 12 month moving average of mass shooting casualties; deaths (dark red), wounded (pink). Source: Mother Jones, GunViolenceArchive.org. for 2/26/2016 data, and author’s calculations.

For a per capita depiction, see this post. The upward trend is obvious there as well.

“Is Currency Devaluation Overrated?”

That’s the title of a symposium in the current issue of The International Economy. Martin Feldstein, Ted Truman, Joe Gagnon, Bill Cline, Mohamed El-Erian, Cathy Mann, and José de Gregorio (among many others) contribute.

Economic Slack, Again

I keep on seeing comparisons between the Great Depression and the Great Recession (e.g., [1]), and how a big fiscal stimulus could result in a big and sustained jump in output. I think it useful to visually compare the extent of downturn in both cases.