A recent article (N. Brophy, Appleton Post-Crescent) outlined some of the causes and implications of heightened inflation. The article lays out some of Wisconsin-specific effects. The discussion is somewhat constrained since BLS only reports limited region-specific CPI data, and none limited to Wisconsin, so the author makes some inferences linked to housing prices, energy and wage costs. Nonetheless, there are some interesting regional differences.

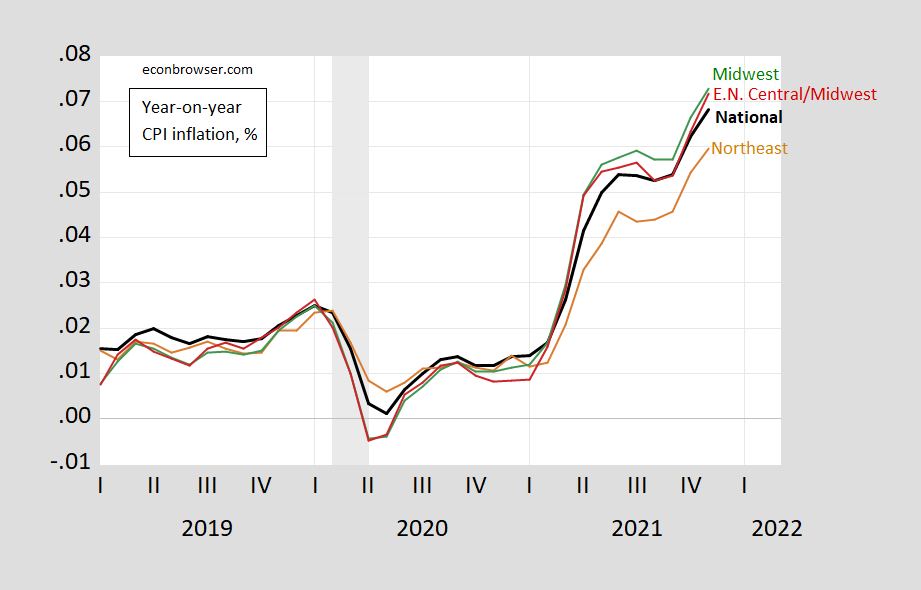

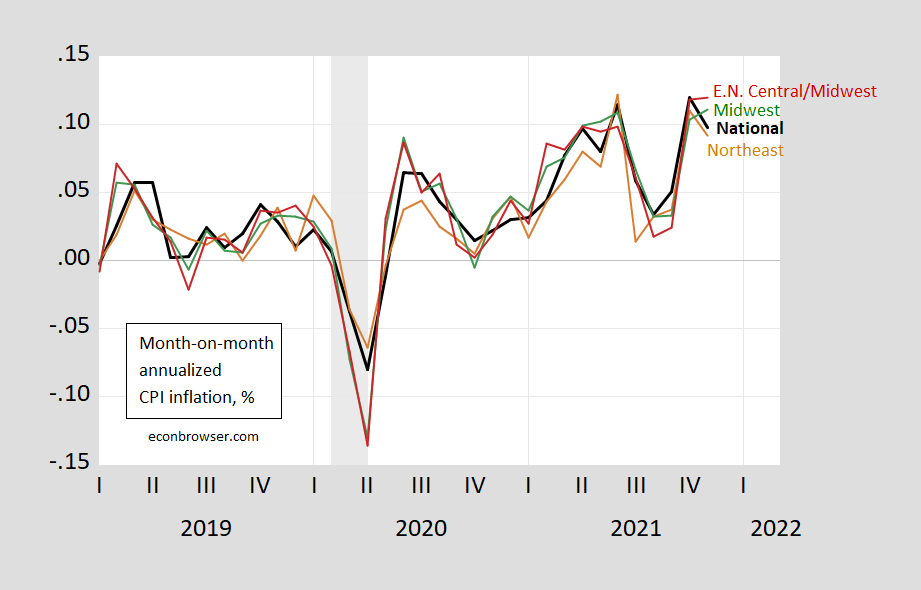

Here is a comparison of rates, with a zoom into the closest to Wisconsin (East North Central division of the Midwest region (breakdown here). First, year-on-year, second month-on-month annualized, through November.

Figure 1: CPI-all inflation, year-on-year for nation (bold black), Northeast region (orange), Midwest region (green), East North Central division of Midwest region (red), all in % (decimal format), using not seasonally adjusted data. NBER defined recession dates peak to trough shaded gray. Source: BLS, NBER and author’s calculations.

As noted earlier, year-on-year inflation rates can obscure more recent developments.

Figure 2: CPI-all inflation, month-on-month annualized for nation (bold black), Northeast region (orange), Midwest region (green), East North Central division of Midwest region (red), all in % (decimal format), using seasonally adjusted data. Seasonal adjustment using Census X12 by author, except for national CPI. NBER defined recession dates peak to trough shaded gray. Source: BLS, NBER and author’s calculations.

The November WSJ article (by Dougherty and Guilford) notes that the South and Midwest lead in inflation, attributing the differential to motor fuel and grocery prices. For Wisconsin, Brophy notes:

The cost of housing continues to increase as well. In Wisconsin, the median home price is up 7.6% from November 2020, according to the Wisconsin Realtor’s Association.

Natural gas is up about 25% over the last year, and electricity costs are 5% higher.

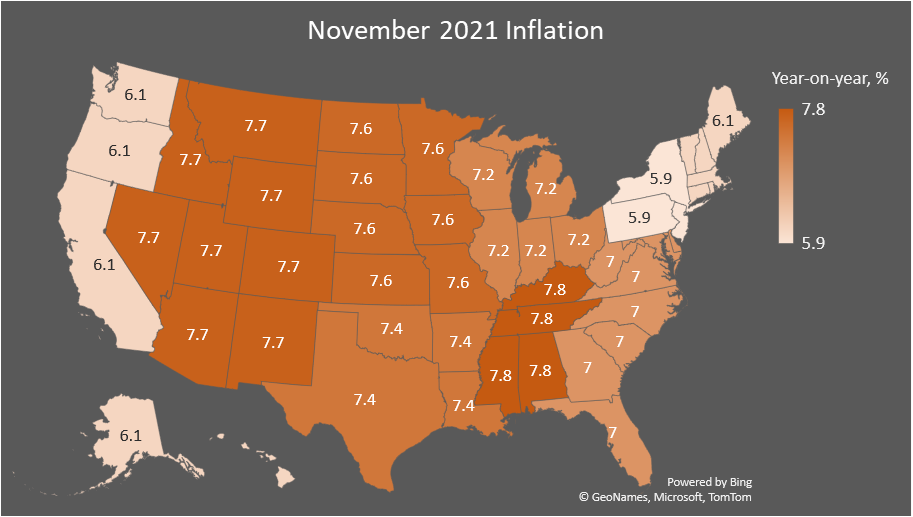

Here’s a map of inflation differentials, by BLS divisions.

Figure 3: November CPI inflation rates by BLS division, year-on-year, %. Source: BLS.

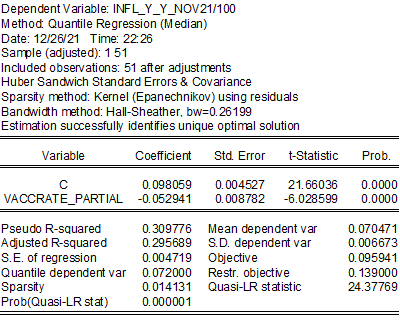

Is there a correlation of inflation rates with observable factors? One candidate variable noted is vaccination rates. Using end-June partial vaccination rates, one finds a negative correlation – higher inflation is associated with lower vaccination rates. A quantile regression indicates each one percentage point increase in partial vaccination rates is associated with a 0.5 0.05% [corrected 12/28, h/t AS] percentage point decrease in y/y inflation, with a t-statistics of 6.0 (simple OLS yields a similar estimate).

Graphically:

Figure 4: Scatterplot of year-on-year November inflation versus end-June partial vaccination rate. Source: BLS, USAFacts (as of June 24).

See also Wisconsin experts, in E. Gunn (Wisconsin Examiner) on inflation.

Update, 12/27 10:30am Pacific:

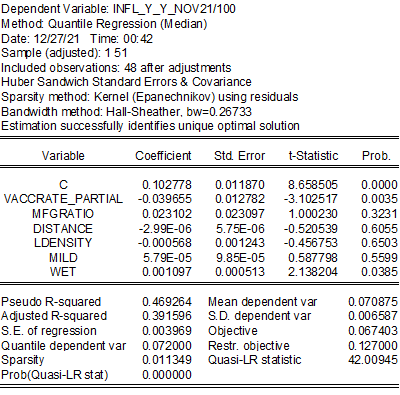

Reader Econned asks for details off the regression results.

For the simple bivariate quantile regression results reported above.

If augmented with some control variables used in some cross-state growth regressions (see this post), one obtains slightly higher adjusted R-squared, and slightly smaller coefficients on the vaccine rate (as of end-June).

Where the control variables are:

mfg is ratio of manufacturing output to GDP in 2019, from BEA state level GDP data)

ldensity Log population density

wet Precipitation (less precipitation = higher values)

mild Temperature extremes (less extreme = higher values)

distance Proximity to water (closer = higher values)

By the way, if I estimate using two-stage least squares the bivariate regression specification, but instrumenting using mfg, ldensity, wet, mild and distance as IV’s, I still obtain a significant negative coefficient on vaccination rates.

(See this post for description of ldensity, wet mild, distance data provided by Professor Neumark, and file of control variables).

Update, 10:45am Pacific:

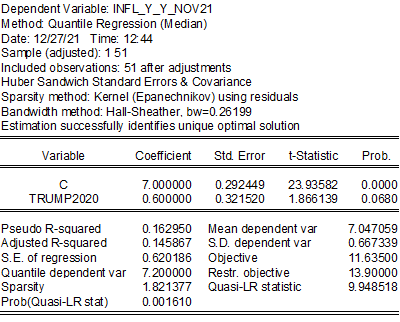

If you are wondering if states that voted for Trump in the 2020 election are experiencing higher inflation, then the answer would be yes.

If you are wondering if vaccination rates should be treated as endogenous, the answer is yes, although the rub is in selecting an appropriate instrument. I use a dummy variable, whether the state fought on the side of the Confederacy (so that one could arguably say that variable was predetermined with respect to vaccination rates at least).

“Is there a correlation of inflation rates with observable factors? One candidate variable noted is vaccination rates. Using end-June partial vaccination rates, one finds a negative correlation – higher inflation is associated with lower vaccination rates.”

The map make clear that the West Coast and the Northeast states, which are generally blue states, all report inflation rates between 5.9% and 6.1%. These states tend to have more of their populations vaccinated. Which only goes to show that wearing a MAGA hat tends to not only endanger one’s life but also leads to a higher cost of living.

Angela Winker had some interesting observations on the issue of transportation. Of course your comments were insightful. But this Rick Reid’s comments about demand-pull v. cost-push left me a bit cold thinking I was listening to the usual talking heads on the TV.

Aren’t your error bars much wider than any regional differences you imagine you are seeing?

If I’m a vegetarian in Texas, do I even care if meat prices are inflating? Shouldn’t meat cost $infinity?

Why do economists ignore standard errors?

Why have so much fervent faith in government statistics, without investigating at all how much error is associated with those measurements?

rsm: Economists don’t ignore standard errors. However, you have seen in the various instances I have provided, no essential conclusion have been changed when inspecting standard errors. So, please stop being a johnny-one-note on this. Don’t you have any other insights?

Correlation versus Causation. Old story and it might be more helpful to see where/if/how lower vaccination rates impact on the different economic sectors (Medical/hospital usage as example) and their inflation rates.

In trying to assess causation, we rely on Granger and on theory. Don’t have a time series, so no Granger. There is, however, an obvious reason to think the flow of causation could be from illness to economic disruption to upward price pressure.

So no, causation is not proven, but dismissing the likely link between vaccination (masking, distancing, public events…) and higher rates of inflation with a trite “correlation is not causation” is to ignore reality.

Macroduck: For economic causality, it is really hard, and Granger is not enough. However, I have used TSLS, using the state characteristics used in regression 2 (see update) with no big difference in the vaccination coefficient. On the other hand, Southern states have a clear association (positive) with inflation, and vaccination rates if instrumented using a Trump 2020 election dummy retains a negative coefficient (see second update).

I wonder if there’s any way to collect the appropriate data to compare states where more private employers had mandates for vaccines vs states where private employers did not enact a mandate (or to a lesser extent, % of those employed) on vaccines and see which of the two had higher consumption expenditures over time??

The pandemic data is too noisy to try this??

I guess the BEA will release that states’ consumption expenditures number around October ’22?? Then somebody would have to figure out how well each state did on enforcing vaccine mandates over the same timespan and go from there?? I think the numbers would be interesting to see.

Agreed, Granger is not enough. The sentence I deleted before sending was all wordy and annoying, about the impossibility of proving causation in social sciences.

That said, one does what one can – as you did. Looking for likely causes is necessary, and beyond a certain level (which I do wish we could get beyond a little more often in comments here), “correlation in not causation” is wasted electrons.

@ Menzie

Menzie I am still taking baby steps on this stuff. When you say “IV’s” in the post, you mean “instrumental variables” and not independent variables, yes?? The variables have some effect on each other?? Which is part of the reason “simple” OLS doesn’t work for this?? I know you get so sick of these low level questions but can you throw me a bone??

“If I’m a vegetarian in Texas, do I even care if meat prices are inflating?”

Hey vegan boy – why don’t you publish your own consumer price index? BLS provides the detail data and I’m sure you can figure out how to use Excel some day. But of course provide your precious confidence intervals. Which of course begs the question as to your IQ which I’m told measures in the teens. How wide does the confidence interval have to be for you to claim you are possibly a genius.

Can you show these regression models in their entirety? I’m interested in seeing the other variables that you chose to control for and their respective coefficient estimates. Thanks.

Econned: See the update to the post.

It’s kind of you (zero sarcasm) to share the regression results Menzie. Thank you Sir.

Interesting correlation there, Menzie, but this is one of those cases where I am trying to figure out what might be behind this beyond just some random coincidence. I suppose that there might be weaknesses in transportation and distribution in places with more people sick from the pandemic.

The other one might be less housing construction happening, again because of more sick people I do not know if these explain it, and they both look pretty weak to me, but possibly playing a role.

Barkley Rosser: Agree, it’s just a correlation. See the update, where I add in a bunch of variables I sometimes use in cross-state growth regressions (usually in relation to the Arthur Laffer-ALEC Economic Outlook index).

Menzie,

I have not looked through all the new comments yet, so somebody may have commented on this, but looking at the more compete picture of your regressions it seems the other variable that shows up as somewhat significant is Wet. Is this tied to the Confederacy variable so when you account for that Wet disappears as a significant variable?

Barkley Rosser: Wet retains its significance even if South is included.

Menzie,

Thanks. If this is not tied to the South variable, as apparently it is not, I confess I have fewer explanations for it as a causal factor than I do for the vaxx rate, which I could come up with a few vague arguments, with some others arguing the vaxx rate effect may be working through labor markets. On Wet, I would think more wet would mean more food production that would tend to keep food prices down rather than push them up. Hard to think of anything else. Hurricanes or rainstorms destroying things or messing up transportation maybe?

For those who enjoy the occasional trivial datapoint, I picked up some gasoline today for $2.55.

I’d like to say something more to the general reader than to Menzie, because I think Menzie already “gets” this. The reason I like to share the price I pay is because in fact I know my region’s/state’s gas prices are lower compared to the nation, and I thought people might be curious. I enjoy reading “trivial” data from time to time. I enjoy reading “trivial” data, precisely because it is trivial data. I like reading “The Farmer’s Almanac” sometimes, especially around the Christmas time/New Years. In fact I may look for it next time I’m at my favorite grocers (which surprised me some weeks back that they did carry it on their little magazine stand). It reminds me of my father, who had his Master’s degree in Education, but also just enjoyed reading the Farmer’s Almanac. He would never have used for a PhD thesis, and although I was never as sharp as my Dad, neither would I. It’s something read for fun. I share the prices of my local stations in the same spirit. I bet even Menzie has some “trivial” readings he does from time to time, though he might not be keen in sharing them. It’s a very human trait I think.

Moses,

So, we, or at least i, am not keeping track of all your reports. How does this price compare to what you have been paying recently?

Where i am there has been a several cents decline, but it has not been all that dramatic.

As it is, I, who was first out the door catching the decline in crude prices must note that they have been going back up again. Brent is now over $78. We may not see a whole lot more declines in retail gasoline prices, although there is definitely a lag from crude to pump. We shall get some more decline in retail prices for awhile, even if the crude prices keep going up.

I don’t see any more than about maybe a 24–36 hour lag at the stations. If you overlay Brent prices on top of gasoline prices they follow each other pretty closely. The gap between the two may vary, but the movement in prices is pretty close to “simultaneous”.

I will say the part that mildly surprises me or irks me is how prices can vary in a relatively small area. There’s as much as a 20cent price difference in stations not far from my home. So, it’s quite odd in my opinion. Maybe that relates to “price competition” between nearby stations, but again if it’s true competition one might expect the price differences to be narrower. As everyone knows, geographically “isolated” stations always charge more~~that doesn’t account for the differences I see here.

Moses,

This is about the last thing I want to pick an argument with you about, but I have requested this previously and you have never answered.

WHICH WAY ARE THE PRICES MOVING?

You have already told us many times that OK is lower than the nation and how there are these local variations where you are, which most of us also see where we are, with this something that has been going on forever. But now you have two statements here without a word about whether this latest price report shows an increase, a decline, or no change, much less by how much, and also what the trend has been over the last month or more, much less from last week.

Please, can you give us an answer to the question we are all intereted in rather than all this same old same old you have repeatedly informed us of?

Well, I can’t be certain until I get an update from a reverse-indicator I use known as the “BarkleyJr.&Kopits Mutually-Moronic Metric”. The last update I saw on the “Barkley&Kopits Mutually-Moronic Metric” was here back in March, when they both said by years end 2021 that $100 was very much in the cards :

https://econbrowser.com/archives/2021/03/oil-prices-and-oil-futures#comment-250311

Barkley Junior said in March: “Steven,

I do not rule out $100 per barrel,”

And here is another one of my favorite exchanges with Barkley Junior on oil prices:

https://econbrowser.com/archives/2021/07/public-service-announcement-real-rates-are-still-low#comment-256010

And here: https://econbrowser.com/archives/2021/07/public-service-announcement-real-rates-are-still-low#comment-255960

…….. Where Barkley Junior had the tremendous pain of admitting I ended up being correct on Iran waiting until Raisi took power to negotiate that Barkley said “is one of the most incoherent, stupid, and ignorant posts I have ever seen you put up here.”

“BTW, since Moses is so keen on showing me to be an A$$, I shall grant him being right on something else. It now looks that indeed Iran is not going to reenter negotiations on the JCPOA with the US until after Raisi becomes president next month. It seems the two sides have agreed on the basic timeline of getting back into the agreement. What is holding back agreement is nonsense positions being taken by each side.”

https://www.reuters.com/world/middle-east/exclusive-iran-not-ready-nuclear-talks-until-raisi-takes-over-source-2021-07-14/

https://www.reuters.com/business/energy/opec-meets-agree-oil-supply-boost-prices-rise-2021-07-18/

Well folks, you guessed it, per what Barkley Junior said was my: “one of the most incoherent, stupid, and ignorant posts I have ever seen you put up here.” Rouhani never re-opened negotiations, it was Raisi. I was right, Virginia narcissist: WRONG

If Barkley Junior and Kopits mind-meld and give me their reverse-indicator for 2022 oil prices, then I’ll see if I can make a forecast for dumb and dumber.

Here’s two last links in the name of “Good times with Barkley and Kopits”:

https://econbrowser.com/archives/2021/09/trilemma-indices-updated#comment-258933

https://econbrowser.com/archives/2021/06/five-year-inflation-breakeven-sp500-and-the-dollar#comment-254782

Moses,

Oh, this is bizarre. Somehow you have still not answered this simple question that is of interest to most here and which you should know the answer to.

Instead you revert to a completely out of it rant. I accurately noted that crude oil prices are highly volatile, so starting from earlier this year the range of possible outcomes, indeed within reasonable confidence intervals, was from $40 per barrel to $100 per barrel. That it did not get to either of those does not remotely prove that I was wrong. It was Kopits who was pushing hard on the $100 figure being somehow likely.

I note the recent post here by Anonymous (I think that is who posted it, although maybe it was somebody else, but not Kopits or you, Moses) who noted “the funnel” that is published regularly for certain categories of crude prices, a future projection of the outer bounds of the 95% confidence intervals estimated on actual data, the sort of thing our pathetic rsm keeps begging for all the time here. Of course, that funnel widens as one goes further out in time.

So, let me remind you, if you saw it and have forgotten, or inform you in case you missed it, showing up on a recent thread I am not going to track down, that the outer bounds of that funnel for one year from how are at the top nearly $160 per barrel while the bottom is under $30 per barrel. This is a much wider set of bounds than I put forward, which you ridiculed. I fully stand by my forecast as being the most credible and scientific, compared to people like you and Kopits who put out specific numbers.

I regularly ridicule rsm for his CI obsession, but the hard fact, which I have repeartedly pointed out here, is that there has historically been a lot of volatility in crude oil prices, with there having been quite a few years in the past where they have moved up or down by many times what the outer bounds of what I forecast were. But I get that you do not know or like or understand history.

Oh, and one more time: is that #2.55 price you got higher, lower, or unchanged from your last report here? At least some of us would genuinely like to know, with most of those probably more interested in learning that then yet again seeing such a silly and poorly informed rant out of you like this one.

Moses Herzog: I do not believe $100 was Barkley Rosser‘s central projection, either in May or November. I certainly could not rule out $100 at either of those junctures, given (1) the prediction interval using futures prices, or (2) using time series models based on regressions using futures prices, or (3) using an ARIMA model.

On the other hand, I think Mr. Kopits did view $100 as likely.

@ Menzie, the following is said with an underlying respect for you reaching roughly exosphere levels

My only reply to this would be, I rather think it was ridiculous to think it would ever break $100 in the year 2021 with a pandemic and a highly probable chance of variants popping up out of the myriad mutations. With a product that a significant portion of demand is satisfied domestically.

Let’s just play a little game of “get inside Charley Cheswick’s brain” shall we?? Let’s give Barkley the benefit of the doubt. Let’s say Barkley thought that the odds were between 3–5% that oil would raise above $100 dollars before the end of 2021. To me, that’s a hard sell. But if you’re willing to take up for him, I’ll “spot” him that number. Is that fair enough?? Am I being even-handed and fair-minded enough to say Barkley had it there at 3%–5% over the last about 9 months (and 20–30 comments?? You can arbitrate that number if you think it’s high) he had to come running to Kopits’ defense on this. Again and again and again……. Then the next question becomes who becomes so quick to take umbrage and touchy, and continually short-fused to take arms and take the torch of an event they only see a 5% chance of occurring?? So Junior could “save me” from the embarrassment of egg on my face of an event no one in their right mind thought was ever going to happen (excluding a proclamation of war) in the year 2021?!?!?!?!? I dare you not to crack a smile and tell me that one.

More likely Junior’s psychosis of your choosing.

Moses,

You are becoming increasingly absurd here. You go on a rant and Menzie totally dismisses your position and supports mine.

But what is the truly absurd part here is that you still have not answered the simple question I asked initially in a low key way without any ranting about anybody’s forecasts: is the price you reported on you paid that you accompanied with a lot of stuff you have already told us and everybody knows, higher, lower, or unchanged from what you paid before. Does this price show gasoline prices rising, falling, or not changing where you are?

Why is it so hard for you to provide an answer to this simple question? Dare I ask if you have gone senile and cannot remember what you paid the last time before this one?

Careful Junior, the last time you used words like “absurd” to describe my comments, Rouhani, Juan Cole, and the great turban-headed one led you down the bouquet fragrant path of “I don’t really know what the ____ I’m talking about” and all you found at the end was a puddle of toilet water.

Moses,

Why do you refuse to answer the simple and interesting question about whether this price you reported represents upward, downward, or no movement? Why?

You are beginning to resemble some co-conspirator of Trump refusing to testify before the Jan. 6 committee. It is beginning to look like you would claim executive privilege not to answer even if you were to get subpoenaed. Anyway, I guess we are not going to get the answer, just a lot of increasingly off-the-wall ranting given that Menzie has completely shot you down. Hey, I admit when I am wrong, and you drag up some old examples of that as somehow an appropriate response to a simple question about whether the price you reported is up, down, or no movement? Just how far out of your mind are you right now?

Thank you for posting this Menzie. I’ve been wondering about regional variations for a while. The data you show above is consistent with some casual observations I can make about prices in the Boston metro region.

-Gas prices have stayed flat in my immediate neighborhood for a few months, but have been dropping a little bit outside of the denser, urban areas

-The big run up in food prices during the middle part of the year matches the steepest part of your first graph. My weekly grocery seems to have stabilized recently

-God help you if you need to buy a car or truck—inventory is crappy and prices are high for new and used vehicles

There are obvious political ramifications to these regional differences. Any politician from the American “heartland” who tries to downplay the impact of rising costs on family budgets is going to get taken to the cleaners at the polls next fall. Even though the CPI is bending downwards I think it’s going to take more than a year for people to adjust to new price levels—or realize that a few items are getting cheaper.

Most of it is yry fuel costs ala 2011. Vaccinations??? Oh please, try harder.

Month on month inflation running at a 9-12% inflation rate on an annualized basis…

Source for this spin? Oh yea – something you heard on Fox and Friends.

It’s on the graph above. Take a look.

@”Princeton”Kopits

Obviously you preferred the record job losses in services and high unemployment during donald trump’s squat time where he encouraged illness and death of hundreds of thousands of Americans by telling people to ignore vaccines. Was that the “plan” you sent to the White House when they ignored your attempts to visit the brainless orange mammal at 1600 Pennsylvania Avenue??

Steven,

So, I just checked. It was 0.8% in November, which is down from 0.9% in October, but still high, pushing into the zone you claim. It was 0.9% in JuJune, but lower for the months in between then and October. December might be noticeably lower again, given that even though crude oil prices are rising again, it looks that retail gasoline prices have actually been declining somewhat this month.

Just reading the graph above, Barkley. Fig. 2

OK – everyone seems to be focused on annualized month by month numbers, which strikes me as a rather misleading statistic given the incredible volatility of things. Now I get if there was a recent permanent shift in things, this focus might be warranted but I take it you do not believe this is the case. But what I do know – I am not a professional forecaster. Oh wait – we have the data on their forecasts and it seems they do not believe inflation will remain this high. And using TIPS v. nominal interest rates, the markets do not believe this either. But what do they know?

Annualized m/m is noisy. The benefit of annualizing (which I’m sure you know) is direct comparability with y/y numbers. It’s common to take a 3-month average to cut down on noise while still getting a look at short-term developments. Reading off of a chart makes averaging difficult.

Now, that is an interesting correlation. Assume the relationship is robust.

What is driving it? Local labour market effects determined by the impact of the C-19 virus on labour supply?

I have no personal interest in getting head of the science here but cannot help but wonder about the policy impact of this finding if it can somehow be effectively communicated to large numbers of voters. What would really clinch this result, is if it could be replicated in other jurisdictions (e.g., Canada).

————————————

In passing, I reckon the reaction to the Omicron variant borders on hyper-vigilant but that the scary rhetoric should induce more hold-outs to get vaccines. That has to be positive, for a number of reasons. Among others, this virus is in charge of the economy.

Erik,

Well, we are still trying to figure omicron out, but it increasingly looks like vaccines are not as good against it as they have been against others, but there is probably still some evidence of keeping people out of hospitals more, cases are not as severe, although it also seems omicron is not as deadly, certainly not as deadly as delta has been, even against the unvaxxed.

My wife is vaxxed and boosted, but has come down with it and is having a pretty bad case. I am still negative so far.

Given all the uncertainty – hyper-vigilant may be the right course of action. Best wishes to your wife.

pgl,

Thanks. Her condition has worsened. her O level is so low she may need to be hospitalized after all. She has heart and other problems, aside from being in her upper 60s.

I’m wondering if semi-small supplements of vitamin D might help?? (You obviously want to ask her doctor to make sure it isn’t fighting against other medicines etc, or redundant) they are giving her. I’m middle aged and I try to take 400-800 IUs per day since the virus contagion got bad. Some say older can take as much as 2000 IUs per day, but that could be bad if she is high cholesterol and it raises her calcium too high.

I have an older relative who was diagnosed with anemia relatively recently. So they increased their kidney bean intake, black bean intake, green beans intake in the daily diet~~because it has decent percent of iron. Even sprinkling a small amount of kidney beans or black beans into a salad can raise iron levels. Does she like unshelled Pumpkin seeds?? Those are packed with iron.

Obviously I don’t think your wife is necessarily anemic, the point is moderately increasing iron intake (in consultation with her doctor’s current advice) could help with blood oxygen. Vitamin D intake might be too little too late as it relates to her virus, but it is supposed to help with lung infections and immune system strength. She’s older so she might increase the Vitamin D, but depending on (conditional to) her personal situation 400-800 IUs of Vitamin D per day is pretty safe range I think.

If they are already giving her these with an IV “drip” or whatever then you obviously don’t want to be doing this, or making it redundant~~so you gotta check with her doctor.

Moses,

She is already taking a bunch of D3 among other things.

She has serious heart problems.

All the best to your wife. My son and soon to be daughter in law are both vaccinated and have come down with it. I assume it’s omicron. It has been hard on them both, but they are on the mend now.

Back to the economic correlation. I also wonder if inflation is lower on the west coast and in the northeast because prices were already high in those areas. Could it be that some level of migration is happening that is causing inflation to moderate in high cost areas and to increase in relatively low cost areas? That’s a complete stab in the dark with no methodology to back it up. I just find it hard to understand why vaccination percentages would correlate to inflation at all.

Willie: I was wondering the same thing – but we don’t have CPI’s that are *levels*, we have CPI’s that are “indices”. What I was thinking of doing was using the BEA price parities (available on annual basis through 2020) to see if reversion is occurring. However, I am lazy (i.e., I could import into Stata matching using ISO codes or FIPS, and then conjoin with CPI inflation rates — but that is much too much work for a blog post, when I’m trying to catch up on all the stuff I put on hold for the Fall semester).

If inflation is wage driven in services, and workers are staying out for that reason (or because of scarce childcare for the same reason), and infection rates are higher (infection rates do correlate with vaccination rates in cross-section), then one can see a reason why vaccination rates might matter.

@ WIlllie

Just for my own personal curiosity, had they gotten the booster (the third shot) yet?? I normally try not to ask personal questions but I’d be grateful if you enlightened me. I realize two people does not constitute a reliable statistical “sample”, but again I’d be thankful for your sharing.

Barkley,

Sorry to hear about your wife. May she get better soon.

The Omicron variant strikes me as a step in the direction of this virus becoming endemic. People can work if they have the sniffles but cannot work if intubated in an ICU.

Given some of the recent excitement in regards to lack of do-it-yourself testing kits, I remain hopeful that this variant will scare more into getting vaccinated.

Thanks, Erik. I have just given you a hard time on an earlier thread, but then I responded to you giving me a hard time.

We do not know for sure which variant she has, although as we we were in DC over a weekend when there was a major outbreak of omicron, ir probably is. But she has these extra issues, not just age, but especially heart and other problems. These issues led her to retire two and a half years ago. She is having a hard time, but still managing to hold just above the O level that puts one in the hospital.

She is fully vaxxed and boosted, so this makes me hopeful she will make it without having to go to the hospital, but she needs some serious improvement.

A few reviews of an odd movie called Don’t Look Up:

https://www.rottentomatoes.com/m/dont_look_up_2021

I have not seen it but Kevin Drum says he watched it last night. Kevin wonders whether it was about climate change denial or was it about COVID-19 denial. Either way – our Usual Suspects could have starred in this movie.

It turns out that the folks who set prices (corporations) can be asked how much they expect to raise prices.

https://www.wsj.com/articles/these-food-items-are-getting-more-costly-in-2022-11640601008?mod=hp_lead_pos10

Money quote: “ Higher wage, material and freight costs are prompting industries from manufacturing to retail to raise prices of goods, creating an environment in which some executives say they have room to charge more.”

Wouldn’t that information be extremely useful in making inflation forecasts? Unfortunately it seems that nobody is interested in conducting surveys of business pricing plans on a regular, systematic basis. Instead economists believe that “households’ and firms’ expectations of future inflation are a key determinant of actual inflation. A review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations, and a case is made that adhering to it uncritically could easily lead to serious policy errors.“

https://www.federalreserve.gov/econres/feds/why-do-we-think-that-inflation-expectations-matter-for-Inflation-and-should-we.htm

This raises two questions: why are economists content to use surveys of consumers, who are price takers who are clueless about future inflation? And why are the businesses that set prices not surveyed as to their plans?

It seems that, yet again, businesses’ role in inflation is mysteriously ignored.

You are still peddling this? Dude – find a reliable source. Assuming you have a clue what the word reliable even means.

Let’s be clear what Jeremy Rudd (who speaks for his own research and not necessarily the views of the other economists at the FED wrote in his abstract:

Economists and economic policymakers believe that households’ and firms’ expectations of future inflation are a key determinant of actual inflation. A review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations, and a case is made that adhering to it uncritically could easily lead to serious policy errors.

Oh wait – your thesis is we should trust the expectations of the firms but Jeremy says your thesis rests on extremely shaky foundations. And of course you cannot be bothered to note that is what he really wrote. And I bet you failed to read the actual paper – as usual.

I would ask you to be more honest about your own links but then again history says you will not.

I just read Jeremy Rudd’s paper and I can guarantee that JohnH did not read it. Rudd never said firms form more reliable expectations of inflation that households. Not at all. What his paper was all about was ripping at the Lucas-Friedman-Phelps foundation of expected inflation augmented Phillips curve which is an entirely different matter.

Now I get that it is a bit much for JohnH to grasp actual macroeconomics so permit me to boil this down to the Economics for Dummies version. Rudd is basically saying that the expectations of short-run inflation by firms do not matter. Quite the opposite of this little parade by JohnH as he stands on his little soap box and screams like a clown.

Of course businesses have more reliable expectations of inflation than consumers, who are clueless. And I have said as much several times. It’s an integral part of their budget and financial planning processes.

But where is the regular, systematic report of business expectations?

A separate point Is that what pgl can’t seem to grasp is that business pricing decisions are informed by their inflation expectations but are entirely separate and distinct. And given the indisputable fact that it is business that sets prices, economists should have some curiosity about business pricing plans…but apparently they don’t.

Economists treat inflation as if no one sets prices. Imagine reviewing a novel as if it had no author. Imagine reviewing a plot without discussing the protagonist. Sounds inconceivable, from what I see, that’s how it’s done in the “science” of economics.

I know that there is discussion of business pricing in the literature and in classes. What I’m talking about is applied economics—what is happening today in the real world. That’s where economists routinely remain silent about business decisions as a major force behind many phenomena…including inflation.

JohnH: I’ve been citing Coibion-Gorodnichenko for the past several months. You commented on this post several times, seemingly not taking note of this survey measure of business expectations, for reasons that are inexplicable to me.

“JohnH

December 27, 2021 at 1:04 pm

Of course businesses have more reliable expectations of inflation than consumers, who are clueless. And I have said as much several times.”

Of course Rudd’s paper had nothing to do with this assertion of JohnH sine a shred of evidence. JohnH did what he always does – sees a snippet in a paper that he failed to actually read and then cherry pick quote that snippet as if Rudd was providing evidence of his new little thesis. Which Rudd of course did not do.

This is insulting not only to your readers but more importantly to the author of the paper JohnH has misrepresented and abused. But hey – this is what he often does. Alas.

From the legend of your figure 1:

CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares].

Maybe the C-G firm expectations survey (which JohnH insists is never reported) is more reliable than those surveys of consumer expectations but the point of your post strikes me that the survey of professional forecasts is more reliable that this C-G survey. A point JohnH has never actually addressed. And of course nowhere in the Rudd paper JohnH linked to (but failed to actually read) did the author address this particular issue.

pgl: I wouldn’t want to make too much of the accuracy or inaccuracy of the Coibion-Gorodnichenko survey given the small sample (compared to Michigan or compared to SPF). But it is true that Coibion-Gorodnichenko have done a great service by compiling this new survey on an ongoing basis.

Candia, Coibion, Gorodnichenko: “These results complement existing evidence on firms’ inflation expectations from other countries and confirm that inattention to inflation and monetary policy is pervasive among U.S. firms as well.”

https://www.nber.org/papers/w28836

Well, not exactly. If you don’t go to the right place, you probably won’t get the answers you’re looking for. CEOs are often not the right people to ask about inflation and monetary policy. Finance managers, along with staff economists, are the ones who make it their business to follow these things. And finance managers are the ones who drive budgeting and financial planning processes that include pricing plans. But I guess you would have had to have worked in business to know these things.

While Coibion and Gorodnichenko did do a great service in advancing this neglected area, their confidence in their own results cannot be that great, given the quality of the responses.

Here is the full abstract of their NBER paper:

‘Introducing a new survey of U.S. firms’ inflation expectations, we document key stylized facts involving what U.S. firms know and expect about inflation and monetary policy. The resulting time series of firms’ inflation expectations displays unique dynamics, distinct from those of households and professional forecasters. By any typical definition of “anchored” expectations, the inflation expectations of U.S. managers appear far from anchored, much like those of households. And like households, U.S. managers are largely uninformed about recent aggregate inflation dynamics or monetary policy. These results complement existing evidence on firms’ inflation expectations from other countries and confirm that inattention to inflation and monetary policy is pervasive among U.S. firms as well.’

It seems JohnH cannot be bothered to quote even their abstract. Did he read their paper? I doubt it. But of course these economists cannot be all that smart according to JohnH who seems to know everything. GEESH!

pgl: As far as I can tell, even if read the abstract, JohnH would not – or choose not – to understand it.

“A separate point Is that what pgl can’t seem to grasp is that business pricing decisions are informed by their inflation expectations but are entirely separate and distinct.”

What I do grasp is that you flat out lied about what Rudd wrote. In fact this assertion of yours is directly the opposite of what he is trying to saying. You are the most shameless person ever. READ the paper before you insult the author by making up your own stupid spin.

OK. I explain yet again. It is business firms that set most prices.

The people who set businesses’ inflation expectations are generally staff economists who offer an informed opinion as to the course of inflation.

The people in businesses who actually set prices are line managers who are informed by staff economists of inflation expectations and take them into account when they are setting their prices. However, many factors besides expected inflation go into the line managers’ decisions.

Needless to say, there is a big difference between economy-wide expectation and firm-specific implementation.

I am glad to know that somebody is finally consulting businesses on their inflation expectations. The information is most likely much better than that coming from consumers, who have been asked about inflation for ages and who have no reason to have the vaguest idea.

However, the quality of information to be gotten from line managers pricing plans would be infinitely better than the informed opinions of staff economists, who have no reason to be informed of the line managers’ decisions.

So I pose my question again: Given the indisputable fact that it is business that sets prices, why is it that there are no surveys of business pricing plans? The Wall Street Journal article shows that the data can be gathered by survey and that it is valuable. Food prices are going up. Kraft for example is going to raise prices 5%.

Ask a broad cross section of American businesses as to their pricing plans (which have already been set in their 2022 budgets) and you will get a pretty good idea of what inflation will look like in 2022. Why must forecasters rely on expectations, not planned action?

“The November Conference Board Salary Increase Budget Survey portends a 3.9% jump in wage costs for firms in 2022, compared to 3% reported in April. This would mark the highest rate since 2008. Indeed, the swell in compensation expectations for next year reflects rising wages for new hires and inflation…

Growth in wages for new hires and accelerating inflation are the main causes of the jump in salary increase budgets. The November Salary Increase Budget Survey shows that almost half of respondents (46%) said that the increase in wages of new hires played a factor in salary increase budget estimates for 2022, and 39% said that increased inflation played a factor.”

https://www.conference-board.org/blog/labor-markets/2022-salary-increase-budgets

Why is there no comparable survey of budgeted pricing increases? Where is the interest?

It would be extremely revealing to compare planned wage increases to planned price increases… (Maybe business pricing decisions do exacerbate inflation after all!)

You provided a link to the NBER paper THE INFLATION EXPECTATIONS OF U.S. FIRMS: EVIDENCE FROM A NEW SURVEY by Bernardo Candia, Olivier Coibion, and Yuriy Gorodnichenko

Alas you misrepresented their abstract as a prelude to basically saying “how dare these idiots disagree with me”.

Now I might suggest you actually READ this interesting paper. It starts with a very good discussion of what expected inflation matters in macroeconomic models. It then spends a fair amount of time talking about previous research that you for some reason assumed did not exist.

They then note their contribution (SoFIE) and how firms are not exactly on top of things providing the most reliable expectations of inflation. Yea I get it – you have to believe just the opposite. But come on dude – read the damn paper. You might learn something.

JohnH

December 27, 2021 at 7:11 pm

You have ZERO evidence to support your little thesis. You misrepresented the Rudd paper. And now you question this paper too. Ah yes – you know more than every other person on the planet in your own little mind. PLEASE!

Apparently pgl read but failed to understand the Rudd article. I’d say that he raised a lot of serious questions about the role and appropriateness of using expectations in forecasts of inflation.

The quote from the abstract was an accurate summary of the article

Regarding current practice, Rudd rcites Galbraith’s satiric observation that “It is far, far better and much safer to have a firm anchor in nonsense than to put out on the troubled seas of thought.”

John Kenneth Galbraith (1958)

Instead of using expectations to forecast inflation, economists would be better off surveying a broad range of price setters (businesses) as to their pricing plans, which are grounded in each individual company’s budgets and financial plans.

JohnH: I read the Rudd paper. My interpretation was *not* that the expectations data from surveys was necessarily wrong, but that the *empirical* link between the expectations-as-measured and the Phillips curve relationship was not particularly robust.

Your last point is sheer conjecture.

JohnH

December 28, 2021 at 9:44 am

Apparently pgl read but failed to understand the Rudd article.

This is rich from someone who did not even bother to READ the paper before he totally misrepresented what Rudd wrote. It seems our host actually read the paper and had an interpretation similar to mine.

I would ask you to stop lying about what your links says but then again asking you to be honest is a silly request as you just do not do that.

JohnH,

Your quoting John Kenneth Galbraith reminds me of yet another argument for operating here anonymously under a fake (or maybe in your case, incomplete) name as supposedly was recommended by some econoblogs when they started, although, frankly tro 2slugbaits, I never saw that anywhere, and it has been specifically discouraged by the hosts here.

So I used to operate on the econ lists before there econoblogs, and pretty much everybody there used their real names. When I was on Maxspeak and then on its successor, Econospeak, nearly everybody did also, the exceptions being pgl and Sandwichman (whose real name is widely known). On those blogs have been people like Dean Baker, Jason Furman, Max Sawicky, Peter Dorman, Kevnin Quinn, and others, all operating under their real names, and many of them not tenured academics.

Anyway, back in the day of the Post Keynesian econ list, where quite a few of those people operated, I once upon a time defended John Kenneth Galbraith. An actual economics journal editor, whom I shall not name, decided that this showed that I was a “communist,” and actually wrote to my dean and others above me trying to have me fired over this. They thought this was pretty silly, quite aside from my having tenure then. But I have had others trying to get me fired on grounds that might indeed have overcome even the tenure protection, as anybody who reads my unredacted account I linked to elsewhere on “Secrets from the Crypt: Dealing with True, Uncertain, and False Accusations of Plagiarism.”

Oh, so, JohnH, should we infer from your remarks that you are also like me a “communist”? Good thing you are not providing your full name so your “clients” do not stop doing business with you!

Johnny, Johnny, Johnny, we’ve talked about this. You don’t know enough about the practice of economics to say anything useful about it. At your level of knowledge, you should be asking questions, not climbing on soapboxes.

There are quarterly surveys of firms pricing intentions. This is widely known among those who follow the data. If you are unaware of the availability of the data, that’s just more evidence of your lack of knowledge. If you were aware, it’s baffling that you would assume people smarter and more experienced than you would not be aware. Almost as if you don’t care whether you are telling the truth. Either way, you are simply begging question after question (in the formql sense – look it up) when you climb on your soapbox.

So, here’s a little peek into one of the revolutions in economic research in the era of cheap computing power and easy access to data. Once upon a time, data analysis was expensive and (before Menzie’s time) often involved rooms full of grad students using primitive mechanical tools to do simple OLS calculations. Back then, a researcher would not have dreamed of brute-force comparisons of hundreds of data series. Beyond expensive. Impossible for the average researcher. Now, we got tools, baby! We got data! The idea that some simple relationship between various data series remains unexplored is just silly. Of course, the relationship between business pricing plans and consumer inflation has been explored! By hundreds of analysts (at least) each time the data are released! That’s how things work in an era of cheap computing power and easy access to data.

Wanna know a secret? Business pricing plans tend to be concurrent with consumer pricing changes. Not leading.

As to “Wouldn’t that information be extremely useful in making inflation forecasts?”, the answer is “no”. Stuffing business pricing plans into consume price forecasting models isn’t very useful.

You might want to reassess your place in the Dunning-Kruger scheme of things before your next comment.

macroduck,

Unlikely our JohnH understands your reference to “the Dunning-Kruger scheme of things.” Really need to keep things as simple as possible with him.

JohnH did not even understand the two papers he linked to in this discussion. But did that stop him from grossly misrepresenting what these two papers said? Of course not.

OK, macroduck. Care to provide a link?

You’re the guy who is cock-sure about what economists know and what data they ignore. You must have vast knowledge of data sources and the literature. Look it up yourself.

Next time, ask for information before you shoot your mouth off.

A random thought as I listen to discussions of how the 500 million COVID-19 tests will be allocated. That amount might be enough if only half of the population asks for tests and limits their use to test to only 3 per person. To which I have to say – are you effing kidding me?

I get they might be handed out for free, which almost insures we will have excess demand unless the supply is massively increased. Now just imagine a market based price rationing system takes hold. The price of this singular commodity is likely going to rise quite a bit.

Not that I am advocating using prices to ration something that has such positive externalities. But the Biden White House is telling us we get only 500 million tests. Not to repeat myself but are you effing kidding me?

OK I do get the previous President would “solve” this issue by trying to slow the testing down. He was THAT STUPID.

pgl,

It does look that not getting on the testing bandwagon big time the minute it became clear how transmissable omicron was may be Biden’s biggest mistake so far in managing the pandemic. I had a heck of a time getting a self-test kit to find out I was negative after my wife came down with it (and still has it).

Life’s little economic ironies. Higher cost-of-living (and cost-of-doing-business) states like NY, NJ and CA have lower rates of inflation than in the Southern “smile” states. Smile states are growing because labor costs are lower and governments are less interested in labor and environmental protections. Labor protections include mask and vaccine mandates.

Smile state inflation results from keeping costs down. Reap what you sow.

Just a speculation…

States which are well practiced at governance have greater capacity to take action when the need arises. If you don’t practice, you don’t get good.

The government is best which dawdles least.

Off topic-

The National Retail Association predicted holiday sale would be up 8.5% to 10.5% y/y. Mastercard reports sales up 8.5%. Different measures, so wouldn’t want to lean on it too hard, but that’s the low end of the range.

I’m hearing stories that the post Christmas drive to sell inventories may bring prices down. If so, time to go SHOPPING. I just got a great online deal on some much needed new running shoes!

Summers is making me so sick with his “I told you so” BS. To me, inflation should largely be “organic”. It should be caused by true demand/supply issues. Some of this is being caused by Chinese shippers, American suppliers and wholesalers, trucking companies that refuse to pay the true equilibrium wage, taking advantage (price gauging) of a relatively short term situation, and I may be the last hold out due to stubbornness, but I still have not given up on the fact a decent segment of this is transitive. There are “costs” being input into final prices which are not in fact true costs. Inelasticity of demand from a dumb/uneducated American consumer is not “inflation” to me, Although I am sure some here (maybe even yourself) will tell me I’m making up my own definitions as I go along.

Excuse me, price gouging, one of these days I’m gonna get that spelling straight in my head. I want to say it’s a “typo” but the problem is in my brain, not the keyboard (this time).

I think Summers has the wrong inflation model in his head. Every problem is a nail sort of thing. He is a policy pundit, so policy must matter.

If the common element in inflation is reduced from what it once was, the policy is less effective than it once was and lecturing policy makers about policy error is more about egos and less about outcomes than it once was.

I will freely acknowledge that Summers is way smarter than I am, but that doesn’t mean he’s right. Or wrong. Which of our commenter buddies reminded us of “not even wrong” recently? If we are living under a new inflation regime, one in which central bank policy is not powerful in determining inflation outomes, then Summers is not even wrong in lecturing the Fed about policy.

macroduck,

I think he is still sore at Janet Yellen getting selected to be Fed Chair over him.

I also agree on your points about him overstating the importance of policy in a situation where increasingly many things going on are not under the control of policymakers, especially compared to the past.

Yeah, he is plenty smart, but both of the times I met him in person and argued with him, it was a draw, with him even backing down a bit.

Summers may be a smart fellow but on issues such as macroeconomics or labor economics, Janet Yellen is just about as smart as it gets.

@ macroduck

If nothing else, the graphs are interesting. Doesn’t really support my argument on transitive inflation, but it’s still great reading:

https://blogs.imf.org/2021/12/03/addressing-inflation-pressures-amid-an-enduring-pandemic/

https://www.nytimes.com/2021/12/27/business/beef-prices-cattle-ranchers.html

December 27, 2021

Record Beef Prices, but Ranchers Aren’t Cashing In

“You’re feeding America and going broke doing it”: After years of consolidation, four companies dominate the meatpacking industry, while many ranchers are barely hanging on.

By Peter S. Goodman

Photographs by Erin Schaff

SHEPHERD, Montana — Judging from the prices at supermarkets and restaurants, this would appear to be a lucrative moment for cattle ranchers like Steve Charter.

America is consuming more beef than ever, while prices have climbed by one-fifth over the past year — a primary driver for the growing alarm over inflation.

But somewhere between American dinner plates and his 8,000-acre ranch on the high plains of Montana, Mr. Charter’s share of the $66 billion beef cattle industry has gone missing.

A third-generation cattle rancher, Mr. Charter, 69, is accustomed to working seven days a week, 365 days a year — in winter temperatures descending to minus 40, and in summer swelter reaching 110 degrees.

On a recent morning, he rumbled up a snow-crusted dirt road in his feed truck, delivering a mixture of grains to his herd of mother cows and calves. They roam a landscape that seems unbounded — grassland dotted by sagebrush, the horizons stretching beyond distant buttes.

Mr. Charter has long imagined his six grandchildren continuing his way of life. But with no profits in five years, he is pondering the fate that has befallen more than half a million other American ranchers in recent decades: selling off his herd….

https://fred.stlouisfed.org/graph/?g=Gbm8

January 15, 2018

Global price of Beef and Poultry, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=Kiiz

January 15, 2018

Global price of Beef and Poultry, 2007-2021

(Percent change)

“ The Biden administration and members of Congress are pressing to diminish the dominance of the meatpackers as inflation concerns intensify.

The Federal Trade Commission last month opened an inquiry into how anticompetitive practices by major companies have contributed to supply chain problems.

“The meat price increases we are seeing are not just the natural consequences of supply and demand,” senior White House economists recently declared in a blog post. “They are also the result of corporate decisions to take advantage of their market power in an uncompetitive market, to the detriment of consumers, farmers and ranchers, and our economy.” ibid.

Senior White House economists are the only economists mentioned in the article…another data point suggesting that economists are MIA when it comes to pointing out that monopolistic behavior is contributing to inflation. Surely, if the culprit was a tariff, economists would be beating down the door to be heard.

“Senior White House economists are the only economists mentioned in the article…another data point suggesting that economists are MIA when it comes to pointing out that monopolistic behavior is contributing to inflation.”

You do know that the Federal Trade Commission has some excellent economists with serious expertise on the role of market power and the pricing of goods. Of course no one at the FTC nor the White House would agree with your little theory about inflation.

That some NYTimes article did not mention other economists does not mean no other economist has done very excellent work on the role of market power. Even if there is some lying troll abusing your name that keeps making that absurd lie.

“After years of consolidation, four companies dominate the meatpacking industry”

Did this author tell us who these four firms are? It would be nice if he documented these allegations by presenting some actual evidence as in perhaps their profit margins.

Controlling meatpackers: Tyson Foods, Cargill, National Beef Packing Company and JBS. National Beef and JBS are Brazilian companies.

These data left me wondering why, in comparing the Northeast to the Midwest, food and housing jump out as major differences.

• https://www.bls.gov/regions/mid-atlantic/news-release/ConsumerPriceIndex_Northeast.htm

• https://www.bls.gov/regions/mountain-plains/news-release/ConsumerPriceIndex_Midwest.htm

The Northeast is not a big producer of food, unlike the Midwest, yet the Northeast shows lower inflation rates almost a 2pp difference for food at home. A similar difference in housing prices might be explained by a hotter housing market in the Midwest.

I find it difficult to believe that food supplies are more limited in the Midwest than in the Northeast or that demand for food is pushing up prices more in the Midwest than the Northeast. Perhaps it is limited to imported foods which come into Northeastern ports and are affected by higher transportation costs to the Midwest due to the annual increase in fuel costs. But trying to find causation between COVID vaccination rates and inflation seems pretty tenuous at best. Especially with the very high rate of COVID cases in the Northeast versus the Midwest.

https://www.mayoclinic.org/coronavirus-covid-19/map

I’d be interested in an analysis of the details of the inflation differences.

You are lucky that you have not had to endure the low quality overpriced food in Manhattan grocery stores for the last 12 years like I have. Even with your higher one year price increases, I am sure you still pay less for basic groceries than the poorly serve residents of Manhattan.

BTW – I learned something during a mayorial race that featured the owner of two out of the three grocery stores chains – yes they actually allowed a merger turning the market into a duopoly. New Yorkers do not believe in competition even when it comes to groceries – alas.

“yet the Northeast shows lower inflation rates almost a 2pp difference for food at home.”

Almost? Try greater than 2% as in 7.1% minus 5.0%. You need to work on your reading skills.

BTW – the increase in the price of food away from home were not that different between the two regions. Then again – I have not eaten out in almost two years.

pgl, sorry for the tacky-tacky error. Should have said “about”. My sincerest apologies. That error totally negates the point I was attempting to make and invalidates the data comparison.

So touchy there. I would say that the difference being greater than 2% enhances your point. But I still bet that the actual price of groceries is still higher in NYC than your town even if that gap in absolute prices has closed a wee bit. Although I just good a great deal on chicken!

https://news.cgtn.com/news/2021-12-27/Japan-to-auction-600-000-barrels-of-national-reserve-oil-in-February-16kUztX1PLa/

December 27, 2021

Japan to auction 600,000 barrels of national reserve oil in February

Japan’s industry ministry said on Monday it will hold an auction on February 9 to sell about 100,000 kilolitres, or 628,980 barrels, of crude oil from its national reserve as part of a U.S.-led coordinated release of oil reserves aimed at cooling rising prices.

The supply, to be taken from its Shibushi tank in southwestern Japan, will become available to the winning bidder on March 20 or later, it said in a statement.

I think the inflation disparity was driven by frequency and magnitudes of lockdowns…. Everyone got money anyway so the States that locked down had less inflation (to compensate for lost income)…

At first glance, state personal income data (which include labor income and transfers) do not match up all that well with regional inflation data for 2020:

https://www.bea.gov/system/files/rpp1221b_0.png

State personal consumption data, again just at a glance, may be a somewhat better fit:

https://www.bea.gov/system/files/inline-images/rpp1221.png

It could be that 2021 data will tell a different story.

https://www.nytimes.com/2021/06/20/business/economy/new-york-city-economy-coronavirus.html

June 20, 2021

New York Faces Lasting Economic Toll Even as Pandemic Passes

The city’s prosperity is heavily dependent on patterns of work and travel that may be irreversibly altered.

By Nelson D. Schwartz, Patrick McGeehan and Nicole Hong

Photographs by Gabriela Bhaskar

https://www.nytimes.com/2021/11/27/us/austin-texas-unaffordable-city.html

November 27, 2021

How Austin Became One of the Least Affordable Cities in America

The capital of Texas has long been an attractive place to call home. But with an average of 180 new residents a day arriving, its popularity has created a brewing housing crisis that is reshaping the city.

By Edgar Sandoval

https://www.nytimes.com/2021/12/26/us/texas-newborns-birthrate.html

December 26, 2021

1,000 New People Arrive in Texas Every Day. Half Are Newborns.

A surge in births in Texas comes amid a declining birthrate nationwide.

By Edgar Sandoval

https://www.nytimes.com/2021/10/07/business/tesla-texas-headquarters.html

October 7, 2021

Tesla Will Move Its Headquarters to Austin, Texas, in Blow to California

Elon Musk announced the move at the company’s annual shareholder meeting, hosted at a factory Tesla is building near Austin.

By Niraj Chokshi

[ Tesla was of course immediately welcomed by Texas, while Amazon which had decided to build a headquarters in New York City a short while before was protested against by local political representatives and decided against New York City and 25,000 new jobs for New York. ]

Elon Musk must be loving the fact that Texas has no state income tax.

NYC is doing AOK without Amazon as other hi tech companies are moving here even without getting massive tax breaks.

https://fred.stlouisfed.org/graph/?g=Kjzo

January 15, 2018

Nonfarm employment in New York and Texas, 2017-2021

(Indexed to 2017)

[ New York employment is recovering relatively poorly, and that should be worrisome. Paul Krugman was unable to judge the importance of adding thousands of high tech industry jobs in New York, a matter that I found puzzling at the time of the Amazon decisions and still do. Amazon in New York would seemingly have drawn other high tech companies to the area, but the Amazon jobs were valuable as such. ]

https://www.nytimes.com/2019/02/14/opinion/amazon-new-york.html

February 14, 2019

New York Returns 25,000 Jobs to Amazon

As the company cancels its plans for a major Queens campus, anti-corporate activists got what they wanted at a great cost.

“You have to be tough to make it in New York City,” Mayor Bill de Blasio boasted, choosing to jeer at Amazon as it canceled its plans on Thursday to build a new headquarters in Queens, after some local officials angrily criticized its proposal.

What a strange thing for the mayor to take pride in. It’s certainly true that you have to be tough these days. But that’s because the subways don’t work, the streets are gridlocked, the housing is unaffordable, the shelters are overcrowded, and the schools are segregated and often inadequate. Now think how much tougher it’ll become for the typical citizen — not the ones who ride in chauffeured government cars — if New York gets a reputation for the smugness of its politicians and their hostility to business.

There were all sorts of problems with the deal New York cut to bring Amazon to the city, and Amazon is no paragon, but its abrupt withdrawal was a blow to New York, which stood to gain 25,000 jobs and an estimated $27 billion in tax revenue over the next two decades. This embarrassment to the city presents a painful lesson in how bumper-sticker slogans and the hubris of elected — and corporate — officials can create losers on all sides….

I’m not sure why this is important now, since you are quoting information from 2018 and 2019. It’s almost 2022 now. That aside, as a person from Seattle, I can say that Amazon is a mixed blessing. Yes, Seattle has grown tremendously, and a lot of the growth is attributable to Amazon. There are costs that go along with the growth. Housing is not affordable to most people any more. My wife and I would not be able to live here if we were looking to move here now. We are reasonably well off people. Those who do a lot of the non-tech work in Seattle cannot live here. I know well paid lawyers and doctors who cannot afford Seattle. There are other social and economic disruptions that come about when such a large, powerful entity moves into (or grows up as Amazon did) in an area. Amazon attempts to take what they want and leave problems for others to solve. It has caused fiscal and political problems for the city. Amazon has not been especially cooperative when it comes to solving any of the problems they have created.

For now, Amazon occupies an enormous percentage of the commercial real estate within Seattle. If they ever leave or go bust, it’s going to be like a Boeing bust, only worse. They know it and use that as leverage. NYC has enough going on that they didn’t need Amazon. Chances are that the people Amazon would have hired in NYC would not have been New Yorkers for the most part anyway. Sure, there may have been some jobs in delis and the like, but those aren’t the kind of high paying jobs that Amazon recruits everywhere for. And the people who work in delis would be priced out of their neighborhoods in fairly short order. New York may have dodged a bullet with that one.

Interesting comments from Larry Summers on inflation.

https://seekingalpha.com/news/3783480-anti-trust-as-a-tool-for-fighting-inflation-is-science-denial-says-larry-summers

https://twitter.com/LHSummers/status/1475230223985786889?s=20

Lawrence H. Summers @LHSummers

The emerging claim that antitrust can combat inflation reflects “science denial”. There are many areas like transitory inflation where serious economists differ. Antitrust as an anti-inflation strategy is not one of them.

5:21 PM · Dec 26, 2021

I hope the Admin is simply using inflation as a way of adding urgency to the promotion of competition. That is a possible reading of this important @nytimes @jimtankersley @arappeport article.

I strongly support much of the Admin’s competition agenda.

https://www.nytimes.com/2021/12/25/business/biden-inflation.html

As Prices Rise, Biden Turns to Antitrust Enforcers

A wide-ranging presidential order helped block a railroad merger and tackle supply-chain problems, and it is planting the seeds for bigger actions.

Lawrence H. Summers @LHSummers

However, as described, hipster Brandeisian antitrust, with which the Admin and its appointees flirt, is more likely to raise than lower prices.

To start, increases in prices and profit margins are what happens when competitive industries experience increases in demand. That is what calls forth increased supply. This is how a market system operates.

There is no basis in economics for expecting increases in demand to systematically larger price increases for monopolies or oligopolies than competitive industries. ,

Monopoly may lead to high prices but there is no reason to expect it to lead to rising prices unless it is increasing. There is no basis whatsoever thinking that monopoly power has increased during the past year in which inflation has greatly accelerated.

Rising demand, with capacity and labor constraints, are fully sufficient to account for what we observe in meat packing — Administration claims notwithstanding.

Breaking up meatpacking would in the short run lead to reduced supply which would further increases prices. In general, when government goes to war with industries it discourages investment and subsequent capacity.

The traditional approach to antitrust is based on consumer welfare. This means seeking the lowest possible prices for consumers. To the extent that alternative Brandeisian approaches embraced by some in the Administration are different that will mean HIGHER prices.

If, for example, Walmart had been stopped from expanding, or Amazon had been kept from entering new markets, prices would be higher not lower today.

Resisting bigness per se, even when it comes from efficiency or seeking to protect competitors from efficient rivals, is a prescription for higher not lower prices.

Inflation is basically a macroeconomic, not a microeconomic, phenomenon. Its primary root going forward is going to be labor shortage.

If the Admin wants to push some prices down, perhaps it can stop advising the already overeager antitrust authorities to pursue cases like meatpacking where they have little chance to win…

Kevin Drum had a short story on this. While the comment section had one Larry Summers hater, most of the comments noted that anti-trust is needed to promote competition even if it is not the cat’s meow for fighting inflation.

“Rising demand, with capacity and labor constraints, are fully sufficient to account for what we observe in meat packing — Administration claims notwithstanding. Breaking up meatpacking would in the short run lead to reduced supply which would further increases prices. In general, when government goes to war with industries it discourages investment and subsequent capacity.”

Whoa! ltr posted excepts from an article that made claims that Summers is dismissing here. It might be nice if we had a real expert on this sector first tell us who these firms are and then looked into their financials etc. to provide some actual market analysis as opposed to one political priors.

In none of his recent columns, which have gotten a lot of attention, has Summers mentinoed gasoline or energy prices at all, which are going down now. It has been housing and labor costs and how the meatpacking oligopoly cannot have anything to do with what is happening to food prices. On this latter matter, Larry is right that there is a limit to how much market power can bring about ongoing inflation, but it can certainly add to temporary boosts, and the meatpacking situation is one where our good friend, JohnH, may have a point.

On me and Larry, I note that I knew both of his much smarter Nobel Prize winning uncles, and he knows it. I published lengthy interviews with both of them, published one of Samuelson’s last papers (his final take on Hayek, which created a stir in some circles) in JEBO, and with Arrow writing a blurb for cover of one of my books praising it.

Larry Summers must be reading those absurd rants from JohnH and having quite the belly laugh!

Summers has a point here. The argument for antitrust action to lower inflation, as I understand it, is that firms in highly concetrated sectors have higher profit margins, which could be squeezed out by competition. Consumers would benefit from lower prices as profits are reduced.

Fine theory, but not supported by data, as far as I know. One proposed explanation for the lack of empirical support for lower industrial concentration leading to lower prices is that industies become more concentrated when some firms gain market share by lowering production costs.

On the other hand, there is evidence that productivity growh slows as industry concentration increases. On the assumption that productivity gains keep costs down, thereby reducing inflation, there is reason to suspect there are still some stones to turn over in understanding the link between industry concentration and prices.

I suspect Summers s either naive or disingenuous, though, in claiming no good can come of leaning on large food and fuel companies. Drug and insurance firms have slowed price increases in the face of political pressure. Food and fuel firms may do the same, given the flexibility provided by high profit margins.

I have read a lot of the literature under the heading Industrial Organization. Some very smart people writing some very smart things. And not a single paper by Lawrence Summers that I have at least read. Summers is bright but he needs to stay in his lane.

Kevin Drum asks “Do Monopolies Increase Inflation”:

https://jabberwocking.com/do-monopolies-increase-inflation/

His short discussion is not necessarily the final word but it is a LOT smarter than the serial babble we get here from JohnH.

will the concentration and disposition of the 500 million mailed out ‘at home tests’ be in the blue states as well? and will that link to state gdp and inflation obs….?

A disgusting suggestion. President Biden wants to fight this virus in all 50 states. The need is greatest in the states where people wear MAGA hats.

smiling!

biden’s fight! how is it going? seems to me his 2020 promises to beat the virus ran in to reality.

how is biden doing with strategy. tactics and logistics?

may be von clauswitz can help!

heck ova way to run a war on an rna virus.

appreciate your consistency!

Did Trump hire you as his little troll?

Professor Chinn,

“…each one percentage point increase in partial vaccination rates is associated with a 0.5 percentage point decrease in y/y inflation…”

If both independent and dependent variables are stated as percentages, to calculate the effect of a 1% increase in the independent variable, would we multiply 1 x .05 = .05 percent?

For the first model presented, is a one percentage point increase in partial vaccination rates associated with a 0.05% percentage point decrease in y/y inflation or with a 0.5% percentage point decrease as stated?

AS: Thanks! You are absolutely right – I dropped a “0”. I have fixed the text.

Kopits: “Month on month inflation running at a 9-12% inflation rate on an annualized basis…”

Criminy, Kopits. This isn’t that difficult. Here is the BLS report for monthly inflation for the last year. I annualized the monthly rates for you just so you won’t have to hurt your head.

https://www.bls.gov/news.release/pdf/cpi.pdf

Jan 3.7%

Feb 4.9%

Mar 7.4%

Apr 10.0%

May 7.4%

Jun 11.4%

Jul 6.2%

Aug 3.7%

Sep 4.9%

Oct 11.4%

Nov 10.0%

At no time has the annualized monthly rate been 12%. It’s a noisy series. Monthly annualized rates have been bouncing between 3.7% and 11.4%. You can’t even get basic math right.

And even including October and November, the year over year rate of inflation is “running” 6.8%.