The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 3.0% annual rate in the second quarter. I have some concerns, but it looks better than many economists had been anticipating.

Continue reading

Author Archives: James_Hamilton

Economy stumbles into 2025

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP fell at a 0.3% annual rate in the first quarter. One can make excuses for the number, but I’m not feeling optimistic.

U.S. economic growth continues

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.3% annual rate in the fourth quarter. That’s a little below the historical average rate of 3.1% since World War II, but about equal to the average 2.4% rate since 2009:Q3.

Continue reading

This plane has landed safely

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.8% annual rate in the third quarter. That’s close to the long-run historical average of 3.1%. With inflation coming down, I think we now can declare that the Fed has achieved the admirable but difficult objective of a “soft landing” — bringing inflation down without tipping the U.S. into recession.

Continue reading

Chatting about math with ChatGPT

I’m still trying to learn how to use ChatGPT to improve my productivity. One thing I’ve been experimenting with recently is to ask it to check my math. As it turns out, I’m still better at math than the algorithm. Here is a link to a recent discussion I had with ChatGPT. My entries are the short strongly indented statements. In this little conversation, ChatGPT made six separate math errors. Each time it confidently asserted something to be true when in fact it was provably false, and each time it would cheerfully admit its error when I pointed it out.

My recommendation is to keep ChatGPT on a short leash. Don’t ask it anything you can’t directly confirm yourself.

Still strong after all these years

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.8% annual rate in the first quarter. That’s close to the long-run historical average of 3.1%, and continues what has now become a fairly impressive record of an economy that continues to chug along despite constant predictions of its imminent demise.

Continue reading

Almost landed

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 1.6% annual rate in the first quarter. That’s a little lower than many analysts expected. But the year-over-year growth is still on track.

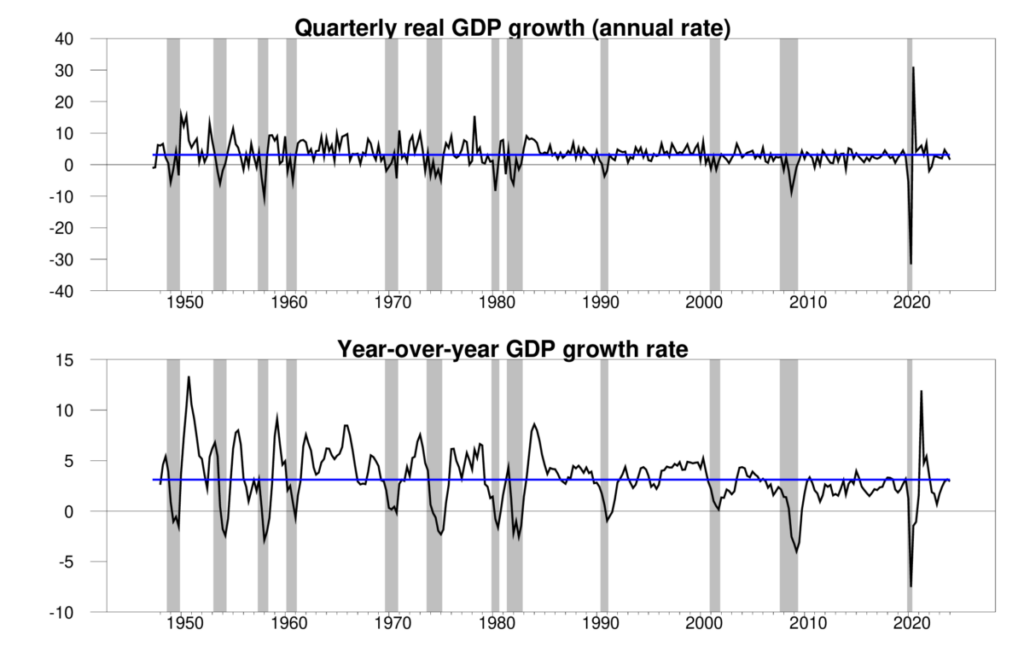

Top panel: quarterly real GDP growth at an annual rate, 1947:Q2-2024:Q1, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of real GDP from the previous quarter. Bottom panel: year-over-year growth rate. Calculated as 100 times the difference in the natural log of real GDP from the same quarter of the previous year.

Another solid GDP report

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 3.3% annual rate in the fourth quarter. That growth brings the level of GDP 3.1% above the value a year ago. Those numbers are right at the historical average GDP growth over the last 70 years of 3.1%, and well above the 2% average over the last 20 years. The year 2023 ended up far better than many people expected.

Continue reading

Strong GDP growth and consumer spending

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 4.9% annual rate in the third quarter. That’s well above the U.S. historical average growth rate of 3.1%.

Continue reading

Still chugging along

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.4% annual rate in the second quarter, not far from the historical average of 3.1%.

Continue reading