Torsten Slok provides this illuminating picture of discretionary spending (y/y), by category.

Diffusion – Geographic, Indicator

Mark Zandi states that a third of the country is in recession. Here’re some alternative ways of measuring the weakness in the economy, first by geography, second by indicator.

Hamburgers for Me, But Not for Thee (Trump Hamburger Edition)

I was contemplating a hamburger cookout over the Labor Day holiday. Prospects?

NABE Survey Result on Economic Data Quality: “Worried”

If You Can’t Get Somebody on Lack of Qualifications, Then Make Something Up: Economics Edition

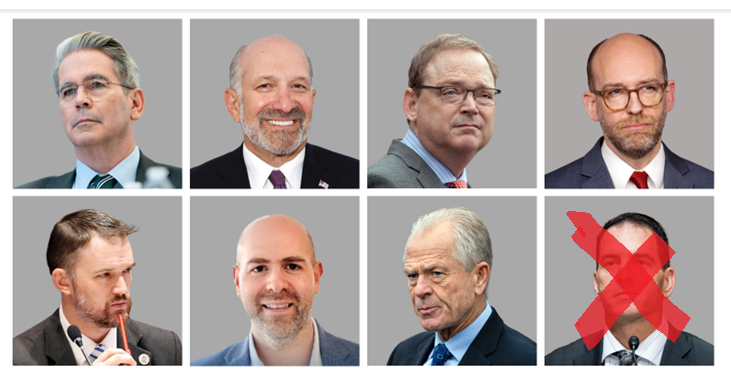

Back in 2022, a group of Republicans argued that Lisa D. Cook should not be appointed as a Fed governor because of her thin resume. How does that argument stand out in terms of whom the Trump administration has put in place in economic posts? In order to evaluate this, I first repost my 2022 Econbrowser post below:

Steve Cortez: “Antoni is … a serious, fact-driven economist with a record of rigorous analysis. “

From Daily Signal. Paragraph continues:

Final Sales to Domestic Purchasers – Nowcasts and Tracking

Goldman Sachs says +0.3% q/q AR in Q3:

Deputy Treasury Secretary Michael Faulkender Out

EJ Antoni Tries to Estimate Crowding Out using 2SLS

Or at least the response of interest rates to deficits, controlling for investment and global saving.

Continue reading

Guest Contribution: “Monthly Household Income Estimates at the White House”

Today we present a guest post written by Matías Scaglione of the data science and economic consulting firm Motio Research.