What else would one expect from expectations of expanded budget deficits, higher incipient inflation in the context of a Taylor rule reaction function, when the currency is a safe haven asset?

Author Archives: Menzie Chinn

Trade War and Recession?

Former Senator Toomey (Politico):

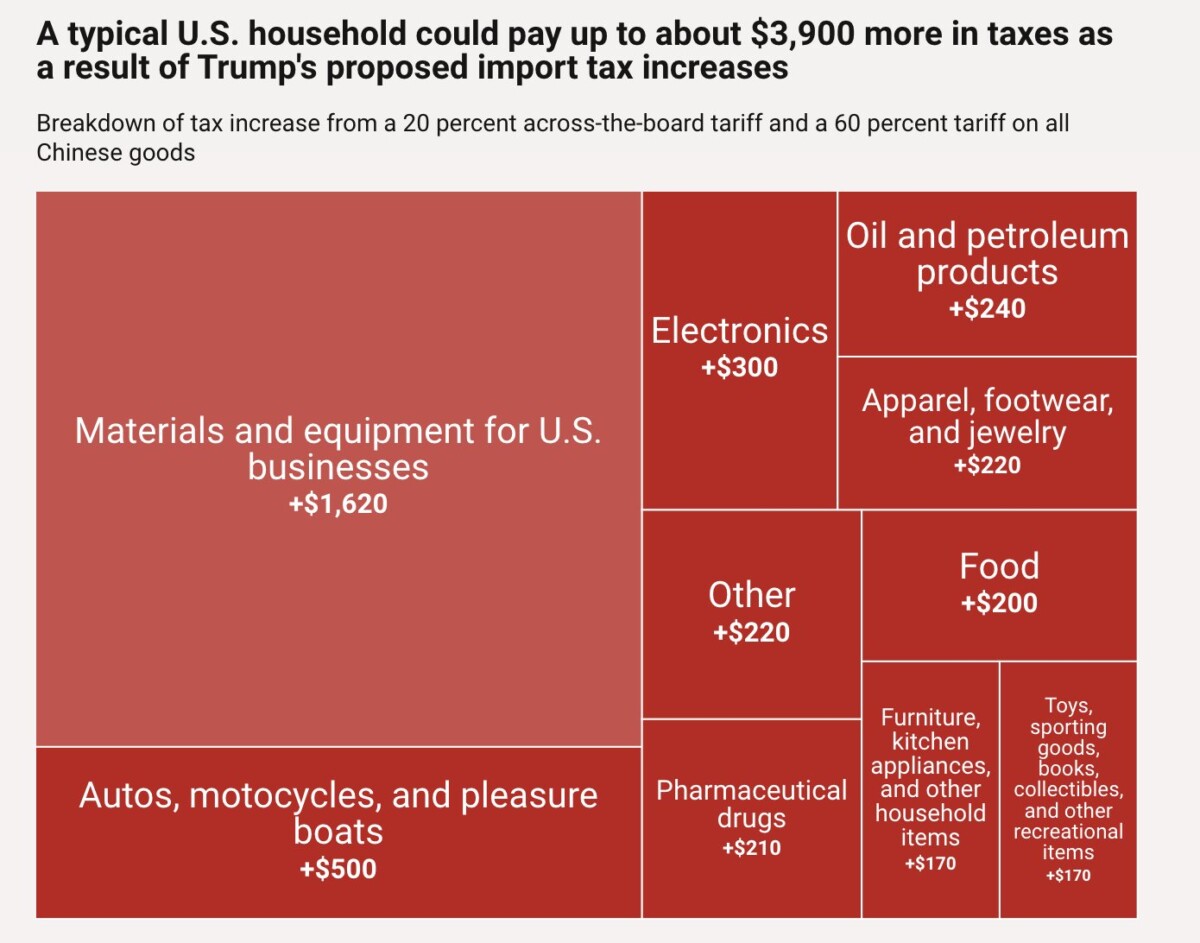

“We have a recession coming. That’s what the response would be from a full-blown trade war that [Trump] would precipitate,” Toomey said, referring to the president-elect’s trade proposals. Those include tariffs of up to 20 percent on all imports, tariffs of at least 60 percent on China and more radical positions such as swapping the income tax with tariffs.

Did the Trade Balance Improve with Tariffs? Did Imports Fall? Did Ag Exports Rise?

Answers: No. No. No.

Analyses on the Impacts of Trump’s Proposed Ultimate Solution

Given the results of the election, and Mr. Trump’s statement that deportations will start immediately, there will be a need for facts. I recommend EconoFact’s Immigration page as a start for your analysis.

The Recession Call Revisited

There was a noisy minority of analysts thinking we were in, or imminently in, recession (see a list here). It’ll be interesting to see how those views are revised. However, as I noted, while the data was not supportive of being in a recession as of October, three possibilities could reconcile observations with such views: (1) the model is wrong, (2) the recession is here, but we don’t know it, or (3) the recession is still to come.

“The Recession of 2025 Will Be Backdated” to 2022

Debt-to-GDP under Trump 1.0

A reminder, so when next you hear about fiscal restraint.

Inflation Breakevens, Term Spreads Up pre-FOMC

As of yesterday COB:

Everyday Price Inflation at 0.3% y/y?

Versus 2.4% for the CPI (in logs). Lots of people think the government’s statistics understates the true inflation rate. It used to be John Williams at ShadowStats. Now it’s EJ Antoni at Heritage Foundation (who touts the use of Primerica’s everyday price index). But the American Institute for Economic Research’s “Everyday Price Index” (EPI) says otherwise (over the past year and a half).