From CNBC:

I really believe it," Trump said in an interview with Fox News. "We're saying 3 (percent) but I say 4 over the next few years. And I say there's no reason we shouldn't be able to get at some point into the future to 5 and above.

From CNBC:

I really believe it," Trump said in an interview with Fox News. "We're saying 3 (percent) but I say 4 over the next few years. And I say there's no reason we shouldn't be able to get at some point into the future to 5 and above.

That was the title of a conference organized by Istituto Affari Internazionale (with support of the Italian Ministry of Foreign Affairs and International Cooperation and Banca d’Italia) that I attended a couple of weeks ago in Rome.

We all know that the CBO has been under assault over the recent scoring of the AHCA (14 million reduction in coverage by 2018, 26 million by 2026; relatively unchanged by recent amendments), with allegations that their previous projections have been “wrong”. I document in this post that CBO macro projections have been comparable to Blue Chip averages, in terms of accuracy (mean bias, RMSE’s). In terms of the issue at hand, here is a graph depicting various vintages of CBO projections of reduction in uninsured.

That’s the title of a new EconoFact memo written by me:

Nearly 70 percent of rural votes cast in the 2016 election went to Donald Trump. This phenomenon has been attributed in part to the declining fortunes of farmers. But rather than helping reverse this trend, several of the Trump administration’s policy proposals would negatively affect the fortunes of the agricultural sector by depressing the prices received by farmers, reducing the demand for American agricultural exports, and raising production costs. Moreover, that portion of the agriculture budget aimed at supporting farm prices and incomes is likely to be squeezed to accommodate the increase in defense spending.

A year ago, the Federal Reserve decided to raise its target for the fed funds rate by 25 basis points above the floor of 0-0.25% at which we’d been stuck for 7 years. FOMC members indicated at the time that they were expecting to end 2016 at 1.4%, or four rate hikes during the last year. We started this December at 0.41%, and the first hike of 2016 didn’t come until last week. Now FOMC members say they are expecting to end 2017 at 1.4%, or three more hikes from here during the next year. The January 2018 fed funds futures contract is currently priced at 1.23%, suggesting that the market is buying into two, not three hikes during 2017.

Continue reading

Mark Thoma comments on the impact of the likely dollar appreciation:

A stronger dollar will make imports cheaper for American consumers…The U.S. economy is now strengthening and approaching full employment, but it’s not quite there yet. So I expect the stronger dollar to have some employment effects, but I don’t expect them to be substantial…

In short: Rural areas will not like what they get from a combination of expansionary fiscal/counter-cyclical monetary policy.

At least Kansas makes Wisconsin look good.

That’s the title of an informal panel at the UW La Follette School of Public Affairs on Tuesday. Here are the slides that underpin my presentation.

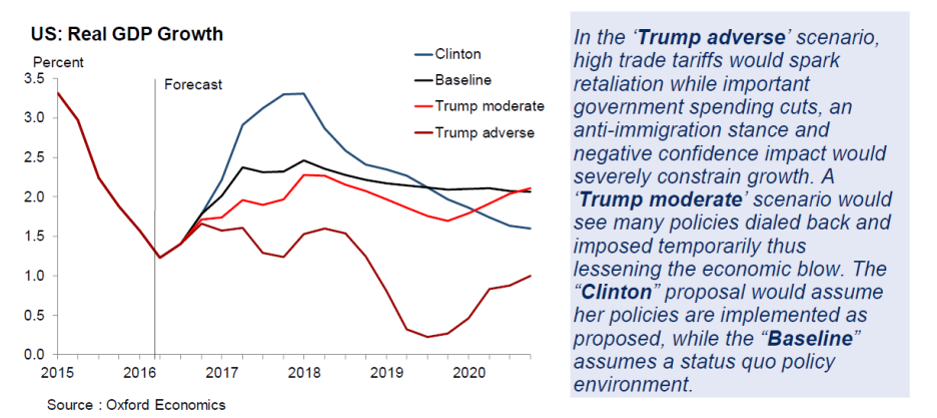

For now, let the following figure summarize the choices.

Source: “Trump vs Clinton: Polarization & uncertainty,” Research Briefing (Oxford Economics, 19 Sept. 2016) [not online].

The other panelists are Pam Herd, Greg Nemet, Rourke O’Brien, and Tim Smeeding.

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. This is an extended version of a column that appeared at Project Syndicate.