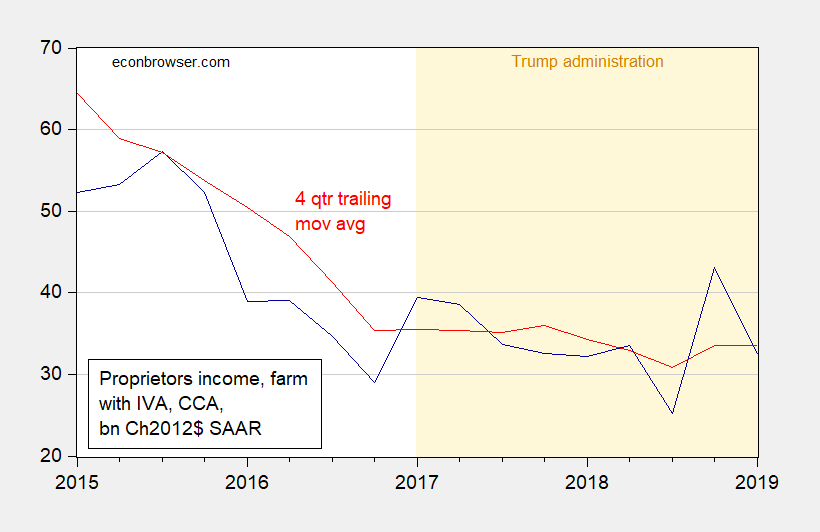

America needs all-tofu school lunches, subsidized tofu pizza, a Tofutti ice-cream substitute campaign… and more. I figure 205.4 pounds of tofu per American should do the trick. The situation facing American soybean farmers is dire, as shown below.

Category Archives: commodities

Winning: US Agriculture Edition

Of Chinese Swine, US Hog Exports, Soybean Prices, and News

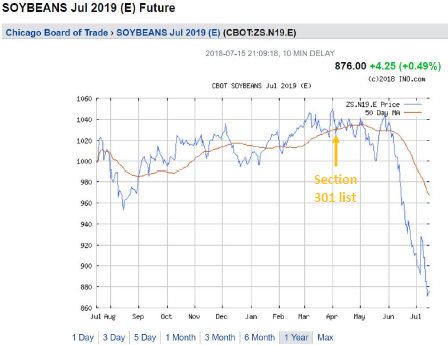

Soybean prices continue to plunge (July ’19 futures). Some have argued that decreased demand for soybeans, due to the ongoing African swine fever epidemic in China. The April 9th USDA FAS report contained information on both this, and soy market conditions. If decreased demand for soybeans was due to news about Chinese swine stocks, we would have expected rising US hog and declining soy prices. Yet hog prices have fallen for most of the time since then.

A Gold Standard Exchange Rate Regime for the 21st Century

The quasi-nomination of Stephen Moore and Herman Cain to the Federal Reserve Board has resurrected the issue of the gold standard. Jim Hamilton has repeatedly — and convincingly — critiqued the idea of a return to the classical gold standard, here, here, here, and here. But here I talk about what a gold standard for the 21st century would entail.

Soybean Prices on the Eve of the US-China Trade Deal

Why haven’t they risen?

Why Hasn’t the Incipient Trump-Xi Deal Shown Up in Soybean Futures?

(In honor of reader CoRev), soybean futures for May…

“[I]t’s a big IF that soybeans futures are LONG TERM predictors at all.”

AKA CoRev Memorial Post. The quote is from CoRev, and motivated a July 15 post that contained this graph:

Figure 1: Soybean futures for July 2019. Source: ino.com.

Why Haven’t Soybean Futures Recovered?

As Brad Setser noted last month, US, Brazilian and Argentine soybean prices have converged, suggesting the end of arbitrage profits.

When Will Trump Deliver on the Trade War: Soybeans

Stock market meltdown, government closure, coup d’etat at DoJ, announced exit from Syria, maybe-exit from Afghanistan, tanks on the Russia-Ukraine border, DPRK still developing nukes, and Mattis departs. But at least we’re winning the trade war, right?

Continue readingUS Gets China to Agree to What It Was Going to Do Anyway

From NYT:

In a significant concession, Mr. Trump will postpone a plan to raise tariffs on $200 billion worth of Chinese goods to 25 percent, from 10 percent, on Jan. 1. The Chinese agreed to an unspecified increase in their purchases of American industrial, energy and agricultural products, which Beijing hit with retaliatory tariffs after Mr. Trump targeted everything from steel to consumer electronics.