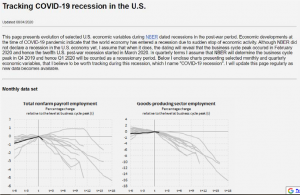

Paweł Skrzypczyński has taken on the task of tracking what he calls the Covid-19 recession as the data come out:

Category Archives: recession

Reader Comment from March 9th

Bruce Hall, on Stephen Moore’s “roaring back” comment, about a month ago:

The situation is a prepper’s dream: market dropping with prices probably following as competition for any sales heats up, assets in gold and cash, a big stock of freeze-dried food, and a self-contained dwelling.

But realistically, once the real scope of the problem is understood and amelioration actions are effected, things will begin to normalize. That may be six weeks or six months, but Moore is probably right although “roaring” may be overstating the case. The economy did not “roar” back to life after the last major downturn. There may be significant re-thinking about supply chains and markets because of the vulnerabilities exposed by Covid 19. You know … eggs in one basket ….

Wow, oil below $30 around midnight, but recovered to $34. Well, that will make that summer road trip that won’t happen less expensive.

My personal opinion (yes, opinion) is that this crisis is somewhat overblown and will fall into the Ebola, SARS, MERS, sky-is-falling category once more facts and protocols are in place. But fear is a powerful de-motivator.

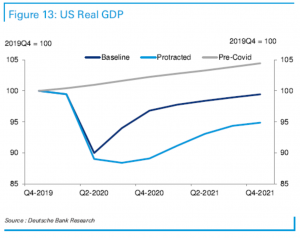

I think we can now safely say the the crisis was not “overblown”. Deutsche Bank’s March 30th forecast for the US, shows a persistent hit to the level of GDP.

Source: Deutsche Bank, 3/30/2020.

Source: Goldman Sachs, 3/31/2020.

Addendum, 4/10: For Bruce Hall, a review of the non-randomized trial on hydroxychloriquine-Azithromycin regimen, here (by a bunch of statisticians, so what do they know?).

Comparing GDP, Employment to 2007

For my macro lectures next week:

Ma, Rogers, Zhou: “Global Economic and Financial Effects of 21st Century Pandemics and Epidemics”

Addendum, A new paper by Chang Ma, John H. Rogers and Sili Zhou:

We provide perspective on the possible global economic and financial effects from COVID-19 by examining the handful of similar major health crises in the 21st century. We estimate the effects of these disease shock episodes on GDP growth, fiscal policy, expectations, financial markets, and corporate activity. Simple time-series models of GDP growth indicate that real GDP is 2.57 % lower on average across 210 countries in the year of the official declaration of the outbreak and is still 2.96 % below its pre-shock level five years later. The negative effect on GDP is felt less in countries with more aggressive first-year responses in government spending. Consensus forecast data suggests a pessimistic view on real GDP initially that lasts for two months, an effect that is larger for emerging market economies. Stock market responses indicate an immediate negative reaction. Finally, using firm-level data, we find a fall in corporate profitability and employment, and an increase in debt, the last of which is further reflected in higher sovereign CDS spreads.

Addendum, 4/1:

Impact on GDP growth expectations are illustrated in Figure 3:

One interesting (among many) policy relevant findings:

In countries with large responses of government expenditures, real GDP initially falls by 2.68% but the effect dies out in the second year. For the low government expenditure response countries, real GDP initially falls by 2.84%, an effect that is very persistent. Meanwhile, responses in government tax revenues do not make much of a difference.

Guest Contribution: “Macroeconomic nowcasting in times of Covid-19 crisis: On the usefulness of alternative data”

Today, we are pleased to present a guest contribution written by Laurent Ferrara (SKEMA Business School and QuantCube Technology), Alice Froidevaux (QuantCube Technology) and Thanh-Long Huynh (QuantCube Technology).

Coping with the COVID-19 economic shock

Every recession is different. The recession of 2020 will not be an exception to that rule.

Continue reading

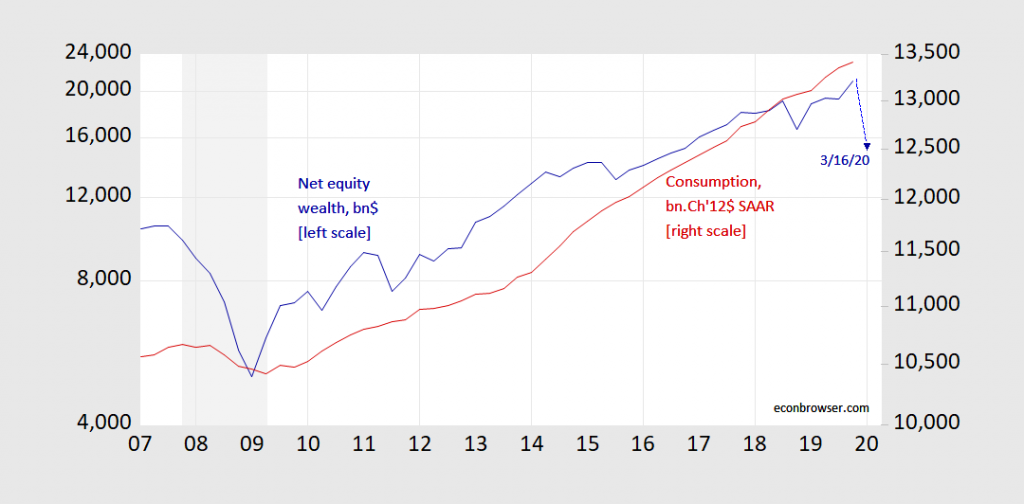

Equity Wealth and Consumption

Figure 1: Household equity wealth, in billions dollars (blue, left log scale), and estimated based on Russell 5000 (blue triangle at 2020Q1), and consumption, in billions Ch.2012$ SAAR (red, right log scale). Source: Fed Flow of Funds, via FRED, BEA 2019Q4 2nd release, and author’s calculations.

Note that scales are in logs. The picture looks a lot worse in levels.

On the other hand, equities net worth is only about 18% of total net worth in 2019Q4.

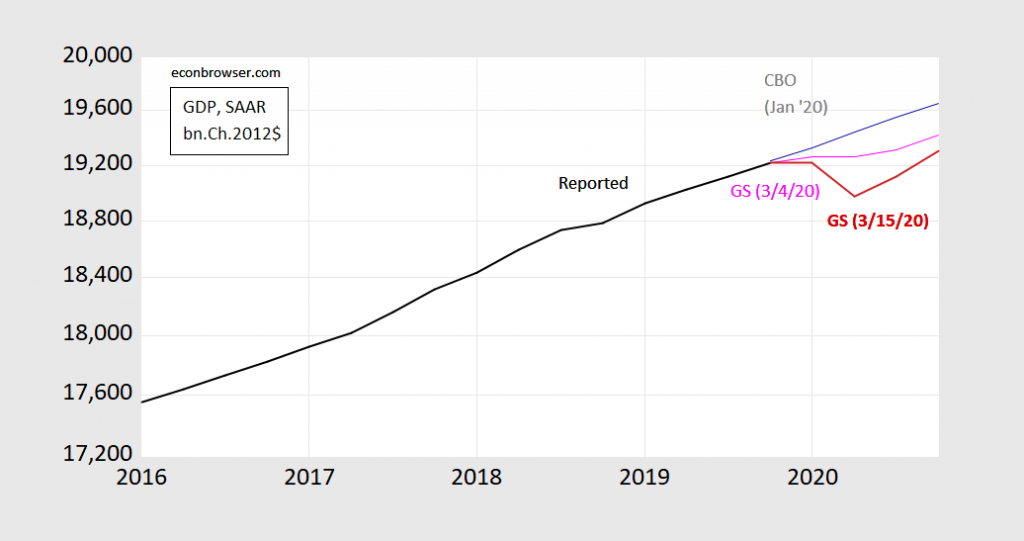

The Deterioration in the Economic Outlook

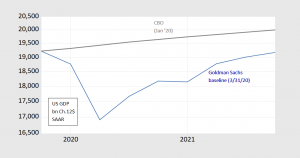

Goldman Sachs reported out their forecast. Don’t be deceived by the “snapback” in growth rates…the levels look grim.

Figure 1: GDP (black), CBO January 2020 forecast (gray), Goldman Sachs March 4 forecast (pink), Goldman Sachs March 15 forecast, all in bn.Ch.2012$, SAAR. Source: BEA 2019Q4 2nd release, CBO Budget and Economic Outlook (January 2020), Goldman Sachs, and author’s calculations.

Forecasts and Output Gaps in the Wake of Covid-19 (as of early March)

No major economics agency or group has forecasted a recession in their baseline. However, forecasts are definitely being marked down.

Business Cycle Indicators as of 3/1/2020

Business cycle indicators that NBER examines (along with others):