From the Wall Street Journal’s May survey:

Continue reading

Category Archives: recession

Who Is Predicting a “V” Shaped Recovery?

I was wondering about this question as I followed the discussion of how to categorize recoveries. I was reminded by crampell to check the WSJ survey (which requires me to somehow circumnaviate the paywall), and this is what I found.

The Intellectual and Moral Bankruptcy of Arthur Laffer and Stephen Moore

These two individuals have written an extraordinary document entitled “When and Where Will the Recovery Occur? A National and State by State Analysis of the Economic Response to the Coronavirus”. It is the pinnacle of economic hackery.

Guest Contribution: “How Severe Is the “Great Lockdown” Expected to Be?”

Today, we are pleased to present a guest contribution written by Enrique Martínez-García (Senior Reserach Economist and Policy Advisor, Federal Reserve Bank of Dallas). The views expressed here are those solely of the author and do not reflect those of the Federal Reserve Bank of Dallas or the Federal Reserve System.

Guest Contribution: “History Warns Us How to Avoid a W”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate May 1st.

Economy in a nose dive

The Bureau of Economic Analysis announced today that U.S. real GDP fell at a 4.8% annual rate in the first quarter of 2020. That’s a rate of decline that we only see historically during the worst quarter of a recession.

Continue reading

Negative oil prices

First negative interest rates, and now negative oil prices. Is the world coming to an end?

Continue reading

Guest Contribution: “Business cycle dynamics after the Great Recession: An Extended Markov-Switching Dynamic Factor Model “

Today, we’re pleased to present a guest contribution written by Catherine Doz (Paris School of Economics), Laurent Ferrara (SKEMA Business School and International Institute of Forecasters) and Pierre-Alain Pionnier. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affilliated with.

Guest Contribution: “Will the Recovery be J-Shaped?”

Today, we are pleased to present a guest contribution written by David Papell and Ruxandra Prodan, both of the Department of Economics at the University of Houston.

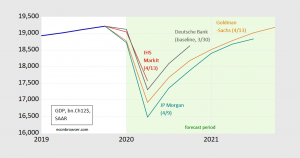

Some Forecasts

It’s been interesting to me to see how various economic groups assess the outlook. Here are a select few:

While rapid growth is projected for the end of the year, it’s of interest to note that output will still be below the pre-Covid19 trajectory.

It must be an unenviable task to forecast output in these times. Thinking about it a bit, on top of the usual challenges, these forecasts have to be conditioned on big question marks (so known unknowns as well and unknown unknowns).

- Scientific unknowns about degree of contagiousness, whether there’s seasonality, the ease of reinfection

- Political unknowns such as commitment to developing an infrastructure to test, track the epidemic, so that the economy can be restarted without large increments to fatalities.

- Unknowns regarding how the health infrastructure has been degraded by the scattershot administrative response, thereby constraining the readiness for restart

- Unknowns regarding administrative capacity of a Federal government that has many policy level positions still vacant.

Update, 4/21:

A Vox article on the difficulties of forecasting, even w/o a pandemic, here.