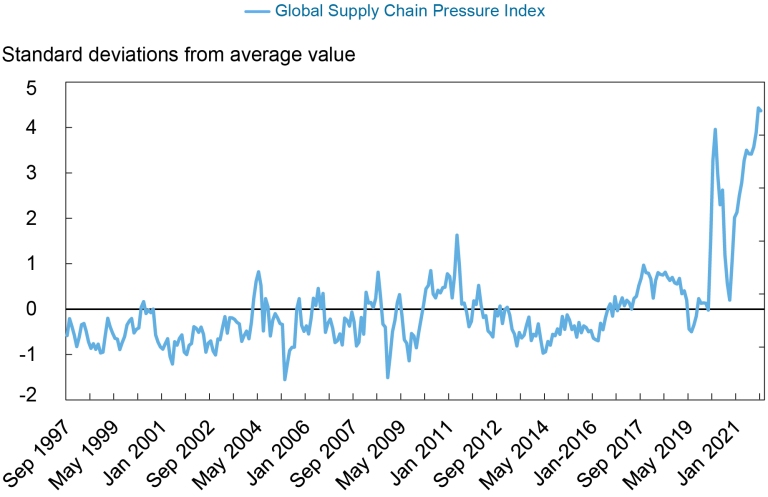

From the NY Fed, a new measure (Benigno, di Giovanni, Groen and Noble):

Farm Income – 2021

Net income up, government support down.

Business Cycle Indicators, at Year’s Start 2022

Monthly GDP for November is in; next big indicator is December nonfarm payroll on Friday. Here are some key indicators followed by the NBER BCDC.

Latest Statistics on Covid-19 Hospitalizations, Fatality Rates, and Speculation

From NYT, today.

Year in Review, 2021: Cleaning Up What Trump Wrought

Last year’s recap was subtitled “Hanging on for dear life (and rational policymaking)”. This year, at least we’ve ended the self-inflicted economic uncertainty (and officially sanctioned economic mendacity) of the previous four years.

China, Omicron, and US Inflation

When assessing the course of US inflation, it’s helpful to have a model; the one I use is the AD-AS model described in this post. The cost of imported inputs can be interpreted as a cost-push shock (rather than an overheated economy caused by high aggregate demand relative to low potential GDP). In this context, China — as a major supplier of inputs and commodities to the US — looms large. And hence, developments there loom large. The preliminary findings that the Chinese vaccines are not particularly effective against the omicron variant, combined with the Chinese authorities’ zero tolerance for covid infections, means that the disruptions to imports from China are likely to continue for some time.

Wages and Prices in Wisconsin

How are wages moving in Wisconsin, relative to the cost of living (as measured by the CPI)? It’s hard to tell.

Gasoline Prices Moving Downward

As of Monday, 12/27, from EIA via FRED:

Regional Inflation Rates

A recent article (N. Brophy, Appleton Post-Crescent) outlined some of the causes and implications of heightened inflation. The article lays out some of Wisconsin-specific effects. The discussion is somewhat constrained since BLS only reports limited region-specific CPI data, and none limited to Wisconsin, so the author makes some inferences linked to housing prices, energy and wage costs. Nonetheless, there are some interesting regional differences.

Guest Contribution: “History Advises Biden to Match Signals with Actions”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared at Project Syndicate.