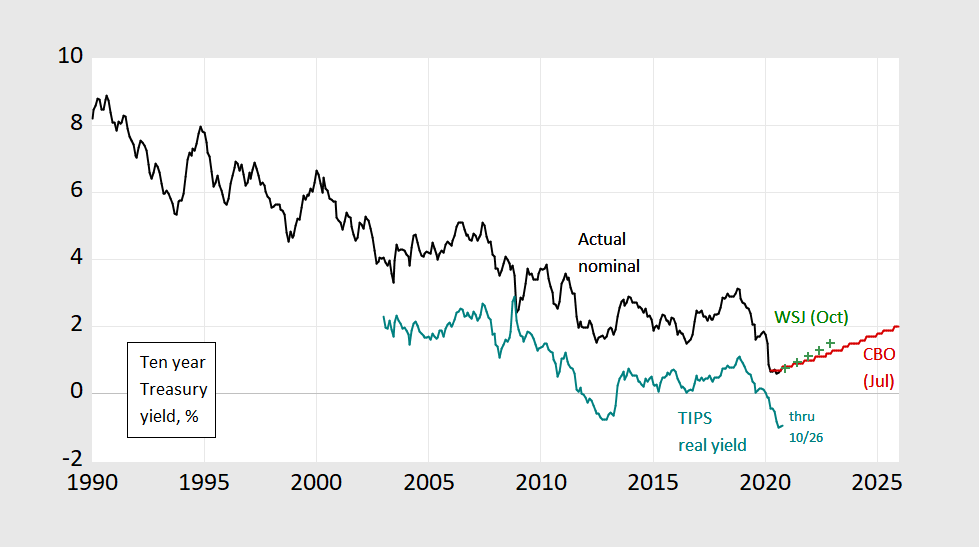

Remember Δbt = (r-g)bt-1 + deft , where b is debt/GDP, r is the real interest rate, g is the GDP growth rate, and def is the primary budget deficit/GDP ratio. What’s r?

Figure 1: Ten year constant maturity Treasury yield (black), WSJ October survey mean forecast (green +), CBO July projection (red), and ten year TIPS (teal), all in %. October 2020 is data through 10/26. Source: Federal Reserve via FRED, WSJ, and CBO.