So the IEEPA tariffs are gone. Now a hodge podge of indefinitely-lived tariffs lives on, with uncertainty elevated.

Confidence and Sentiment: February 2026

With the release of the Conference Board’s Confidence Index, and the SF Fed’s News Sentiment Index, we have the following picture:

Guest Contribution: “Understanding Bond-Stock Price Comovements”

Today, we’re fortunate to have Willem Thorbecke, Senior Fellow at Japan’s Research Institute of Economy, Trade and Industry (RIETI) as a guest contributor. The views expressed represent those of the author himself, and do not necessarily represent those of RIETI, or any other institutions the author is affiliated with.

Cautionary Notes to Avoid Rookie Economist Errors, Revised Edition:

As I’m teaching econometrics, I’m adding in handling-of-data issues. Examples from the last three years.

Business Cycle Indicators: GDP, Personal Income, Mfg & Trade Industry Sales, Consumption

NBER Business Cycle Dating Committee (BCDC) key variables:

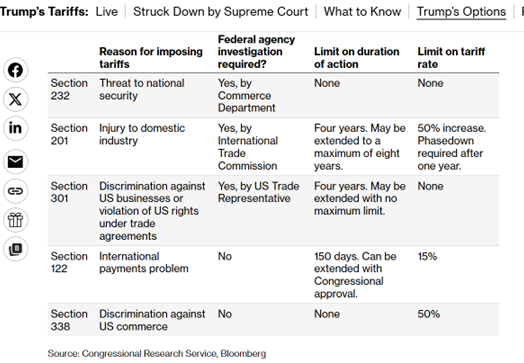

Section 122 Implementation in Context

On the Q4 Advance Release: GDP vs. “Core GDP” and Residential Investment

Yesterday, Jim moved the Econbrowser Little Econ Watcher’s countenance to neutral 😐, based primarily on Q3 growth, using the methodology outlined in this post. Remember, there will be two revisions for Q4 growth (before the annual revision, and succeeding revisions). What are some other readings from the Q4 release?

Where’s the Balance of Payments Emergency?

Section 122, invoked to place 10% tariffs, was written primarily to address balance payments issues under fixed exchange rates. By balance of payments accouting:

CA + FA +ORT ≡ 0, ORT is official reserves transactions, ORT > 0 implies decumulation.

So CA + FA < 0 requires total reserves to be decreasing. Is that the case?

GDP continues to grow

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 1.4% annual rate in the fourth quarter. That is a bit below the historical average growth of 3.1% and also below some analysts’ expectations for the Q4 numbers.

Continue reading

On the Eve of the 2025Q4 Advance Release

Jim will have examination of the GDP numbers tomorrow, but here is the picture as of today, in the wake of the international trade figures, industrial production, housing starts, yesterday and today.