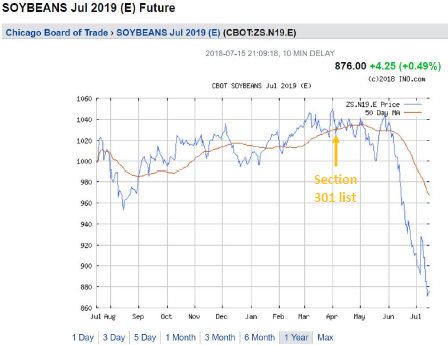

AKA CoRev Memorial Post. The quote is from CoRev, and motivated a July 15 post that contained this graph:

Figure 1: Soybean futures for July 2019. Source: ino.com.

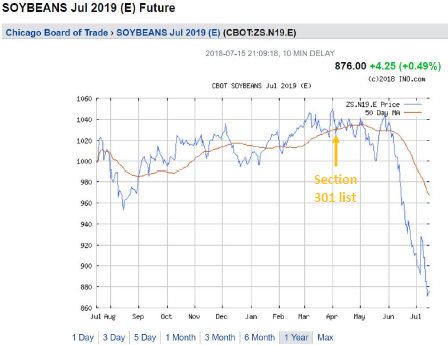

AKA CoRev Memorial Post. The quote is from CoRev, and motivated a July 15 post that contained this graph:

Figure 1: Soybean futures for July 2019. Source: ino.com.

From being appointed to the Fed. Here is a non-exhaustive recounting of Moore’s reign of error.

It doesn’t get much more real than this, when the Fed has to take into account the implications of global climate change. Glenn D. Rudebusch, senior policy advisor and executive vice president at the Federal Reserve Bank of San Francisco, lays out the issues in this letter.

I have no idea if they’re a particularly good predictor of recessions, but January sales have fallen 40% relative to a year previous…

Central Bank of Ireland – ECB and IM-TCD

Workshop on:

International Capital Flows and Exchange Rates

CALL FOR PAPERS

Venue: Trinity College Dublin, Ireland

Date: September 6th, 2019

Whether due to Brownback or other factors, Kansas is doing very well.

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate on March 21st.

As Brad Setser noted last month, US, Brazilian and Argentine soybean prices have converged, suggesting the end of arbitrage profits.

After a hiatus of nearly 4 years, the Wisconsin Department of Revenue has resumed publication of the Wisconsin Economic Outlook, as of yesterday.

Not much…Wisconsin manufacturing employment up to February; January revised down…