As suggested here. Maybe. It might depend on the measure of economic activity.

“West Coast Workshop in International Finance 2017”

Taking place today, this is the fifth in the series, with topics this year on exchange rates and monetary policy, macroprudential policy, credit and business cycles (sponsored by UC Santa Cruz Economics, Santa Clara Economics, and Federal Reserve Bank of San Francisco, organization chaired by Helen Popper at SCU and Grace Weishi Gu at UCSC).

The website is here with links to papers, conference agenda here.

Wisconsin Economic Activity Flat… And Projected to Remain Flat

That’s what the Philadelphia Fed’s leading indices, released today, indicate. In contrast, Minnesota is projected to power ahead.

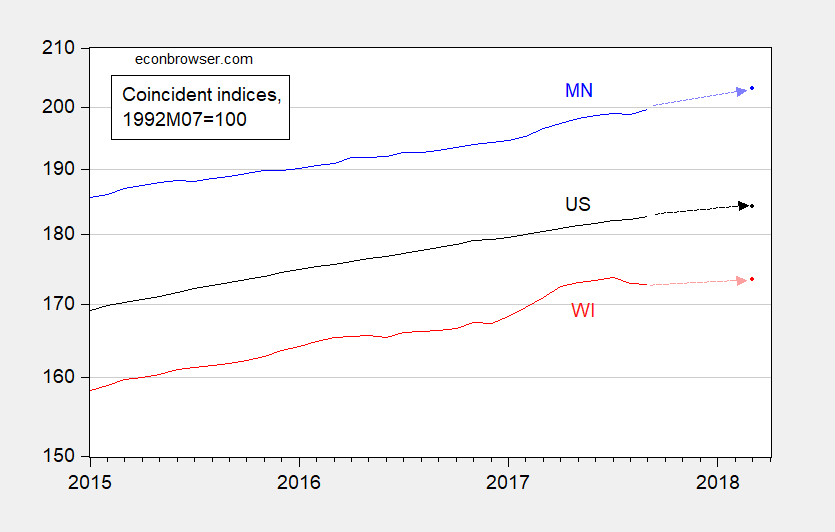

Figure 1: Coincident index for Minnesota (blue), Wisconsin (red), and US (black), 1992M07=100, all on log scale; March 2018 values are implied by leading indices. Source: Philadelphia Fed, author’s calculations.

The implied level of economic activity in March 2018 will not exceed the level estimated for July 2017.

Governor Scott Walker has described the Wisconsin economy as “on fire”.

Premature Triumphalism and Wisconsin Manufacturing

Some analyses have pointed to the surge in Wisconsin manufacturing employment as evidence that certain policy configurations lead to improved performance [1]

No Second Thoughts: Sustained 3.5% Growth Is Unlikely

Reader Arthurian writes in the wake of the 3% growth rate (SAAR) reported for 2017Q3:

Back in January Menzie Chinn said he thought growth in the 3.5-4% range was “unlikely”. I wonder if he is having second thoughts now.

I’m going to show two pictures deploying at most undergraduate statistics to show why I — like most numerically literate people — still think sustained 3.5% growth is unlikely.

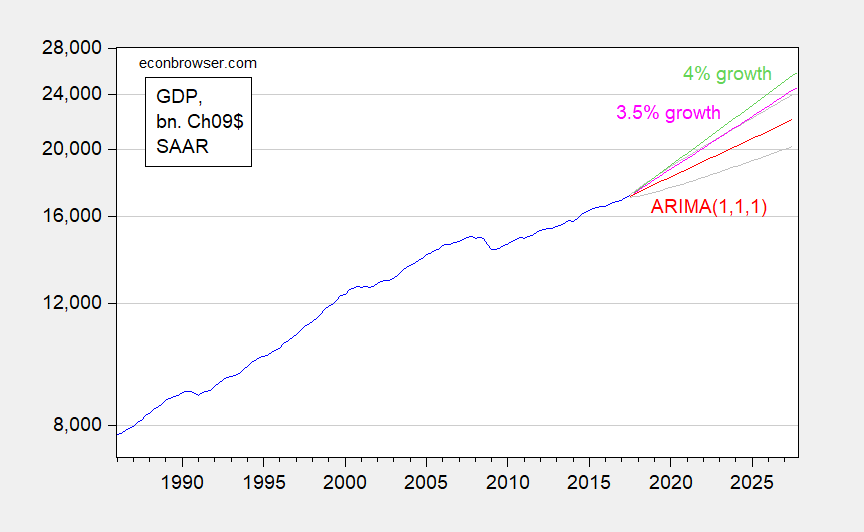

First, consider what a naive statistical model — an ARIMA(1,1,1) estimated over the 1986-2017Q3 period — says, as compared to a 3.5% or 4% growth rate.

Figure 1: Reported GDP (blue), ARIMA(1,1,1) dynamic forecast (red) and 64% prediction interval (gray lines), implied path for 3.5% sustained growth (pink) and for 4% (light green), all billions Ch.2009$ SAAR. Source: BEA 2017Q3 advance release, author’s calculations.

Note that by estimating the regression starting in 1986 when the trend growth rate was relatively high, I am slanting the results toward projecting faster growth. Even then, the 3.5% growth rate is at the uppermost edge of the 64% prediction interval. 4% growth is even more laughable.

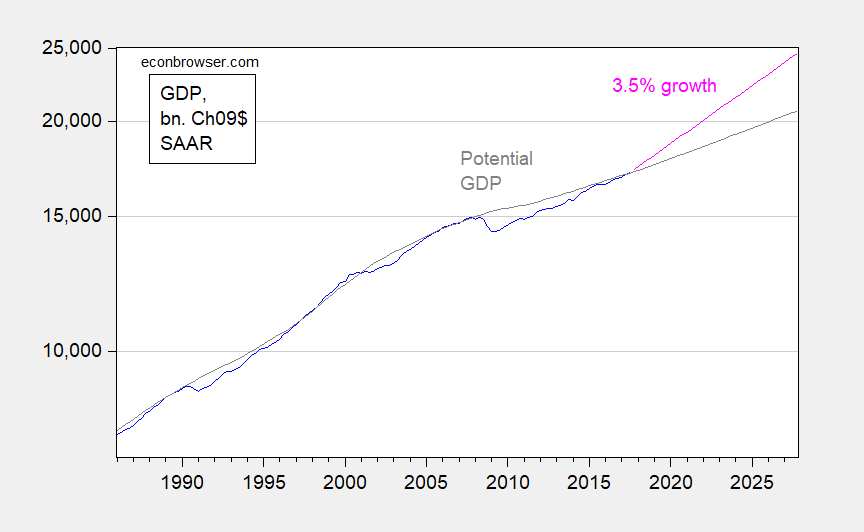

Second, now consider what sustained 3.5% growth implies for the output gap. For that calculation, one needs an estimate of potential GDP; for want of a better measure, I use CBO’s estimate. This is shown in Figure 2.

Figure 2: Reported GDP (blue), implied path for 3.5% sustained growth (pink) and potential GDP (gray), all billions Ch.2009$ SAAR. Source: BEA 2017Q3 advance release, CBO (June 2017), author’s calculations.

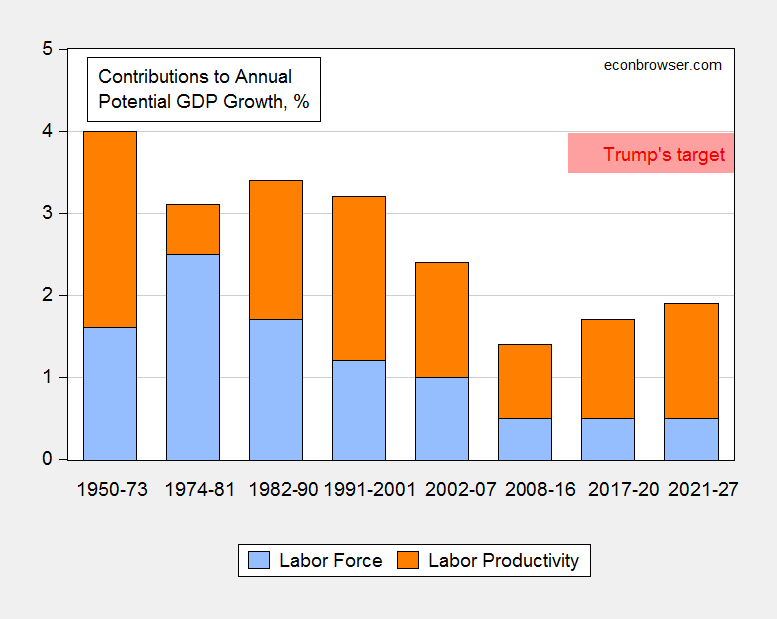

Assuming sustained 3.5% growth, the output gap by end-2019 would be 4.2%, 5.9% by end-2020. Of course, CBO could be terribly misguided about the trajectory of potential GDP. But in order to believe potential GDP can grow at 3.5%, I really do believe that it can only be done by adherence to Spaceology. Refer to Figure 3, reproduced from my January post, and look at what the orange bar — labor productivity — has to do in order to hit 3.5% potential growth.

Figure 3: Contributions to annual growth in potential GDP growth, from labor force augmentation (blue bar), and from labor productivity growth (orange bar). DJT’s target of 3.5-4% shown as pink range. Source: CBO, Budget and Economic Outlook, January 24, 2017, Table 2-3; and Trump-Pence website

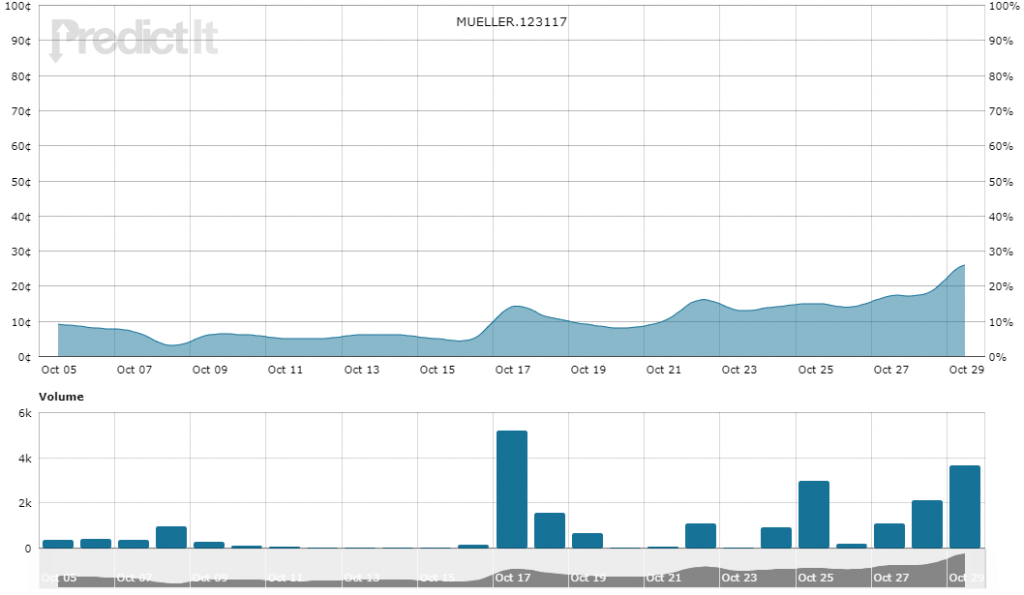

Prediction Markets on Firing of Special Counselor Mueller

From PredictIt tonight, “Will Robert Mueller be replaced as Special Counsel by Dec. 31?”:

Guest Contribution: “The Choice of Candidates for Next Fed Chair”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

Steady economic growth continues

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 3.0% annual rate in the third quarter. That is close to the long-term historical average of 3.1%, and better than the 2.1% we’ve seen on average since the Great Recession ended in 2009.

Continue reading

So Much For Fiscal Probity

The budget will allow Republicans to pass a tax overhaul that adds up to $1.5 trillion to the deficit through a process known as reconciliation, which only requires 51 votes to pass in the Senate.

Day 279: China Still Not Yet Declared a Currency Manipulator

Not that I’m complaining. But seriously, it’s far past the “day one” of the new Administration when Donald Trump promised China would be declared a currency manipulator.