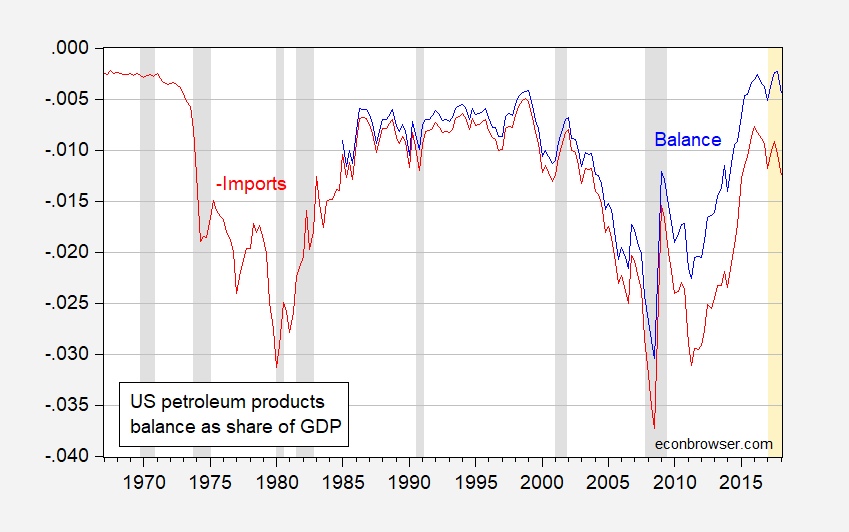

As oil prices start heading up, the usual questions arise regarding the macro implications. One view is that with the revolution in tight oil production, the US will experience less of a negative impact than before. This conclusion relies on a set of assumptions, possibly including the US being substantially less dependent on oil imports. Is this true?

Figure 1: US petroleum trade balance (blue), and negative of US petroleum imports (red). NBER defined recession dates shaded gray. Source: BEA, 2018Q1 advance release, NBER, author’s calculations.