The ironies abound

Guest Contribution: “Stagnant incomes of white workers do not explain Trump”

Today we are pleased to present a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99.

2016 Econbrowser NCAA tournament challenge winner

Congratulations to Jackiegee, winner of the 2016 Econbrowser NCAA tournament challenge. None of our entrants correctly picked the tournament winner to be Villanova, but Jackie (like a number of others of you) thought it would be UNC, and came within half a second of being right! For fans of Michigan State, West Virginia, and others, better luck next year!

Wisconsin’s Dependence on Exports

On the eve of the primary votes in Wisconsin, where protectionists are set to make some inroads, it’s of interest to consider the state’s reliance on exports — including those to China (a target of both Senator Sanders and Mr. Trump) and Mexico [1].

Productivity gains in U.S. shale oil

Horizontal fracturing of tight hydrocarbon-bearing formations was responsible for a phenomenal resurgence in U.S. oil production, which rose more than 4 million barrels per day from 2010 levels before peaking in April of last year.

Continue reading

What Is “Solid Economic Reasoning”?

Writing in The Nation, Robert Pollin asserts:

All of [Bernie Sanders’s] major proposals are grounded in solid economic reasoning and evidence.

US-China Trade Policies: the Nuclear — and Near-nuclear — Options

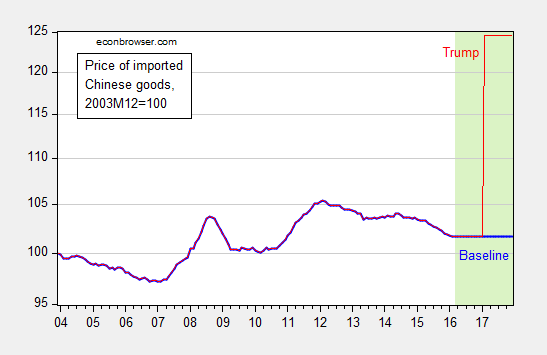

Substantial attention has been devoted to the disasterous effects of implementing a Donald Trump agenda of imposing 45% tariffs on imports of goods from China. To gain some perspective, consider the implications for prices of goods imported from China if such a tariff were imposed (and a large country assumption used, so that only half of the tariff increase manifested in increased prices).

Figure 1: Price of Chinese commodity imports, 2003M12=100, with 2016M03 values at 2016M02 values (bold blue), and a 22.5% higher price level as of 2017M02 assuming the half of incidence falls on the US (red). Light green shaded area denotes projection period. Vertical axis is logarithmic. Source: BLS, and author’s calculations.

Obviously, drop the large country assumption, and the resulting price increase can be up to 45%.

Uber efficiency

Ride-sharing services like Uber and Lyft are using a vastly more efficient technology for matching people who want a ride with people who want to drive them than was available when the taxi radio dispatch systems were set up in the 1940s.

Continue reading

Wisconsin Employment Still Lags (Quelle Surprise!)

BLS just released state level data. Wisconsin employment nonfarm payroll employment is up, but remains below what is expected given the historical relationship between US and Wisconsin employment — by 63.2 thousand…

Guest Contribution: “Inequality: Diagnoses and Prescriptions”

Today we are pleased to present a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99. This is an extended version of one published in Project Syndicate.