From a paper by Carlos Vegh, (John Hopkins University), Daniel Riera-Crichton (Bates College) and Guillermo Vuletin (Brookings Institution) presented at the USC-JIMF conference “Financial Crisis in the Aftermath of Global Crisis” (described here):

Is the Fed near its target?

The BLS reported on Friday that the U.S. unemployment rate fell all the way to 6.3% in April. That marks significant progress in terms of the bull’s eye of Fed accountability proposed by Federal Reserve Bank of Chicago President Charles Evans which Econbrowser discussed 2 months ago. The unemployment rate has dropped steadily over the last 4 years with no increase so far in the inflation rate.

Continue reading

Deployment of Forces: Ukraine

From WaPo based on a Royal United Services Institute paper:

Messages from the April Employment and 2014Q1 Advance GDP Release

April nonfarm payroll employment surprises. The most recent trends in the labor market diverge from those of GDP.

U.S. growth stalls

The Bureau of Economic Analysis announced today that U.S. real GDP only grew at a 0.1% annual rate in the first quarter. Some of the reasons for an economic stall appear to be temporary, but it’s a very disappointing start to the year nonetheless.

Wisconsin Growth Forecasted to Decline; Kansas Flat

The Philadelphia Fed has just released leading indices for the states. Wisconsin growth is forecasted to decelerate from March growth rates, while Kansas forecasted growth is near zero since the beginning of the year.

Oil and gasoline prices: many still missing the big picture

Gasoline prices in the United States have risen sharply recently, leading some newspapers to round up the usual suspects.

“Risk Aversion, Global Asset Prices, and Fed Tightening Signals”

In the IMF analysis of capital flows highlighted in yesterday’s post, the VIX is used to proxy for risk. This variable has a lot of explanatory power [1] [2], but there is more to be investigated. Jan Groen and Richard Peck at the NY Fed examine the nature of risk in international financial markets, in a Risk Aversion, Global Asset Prices, and Fed Tightening Signals :

The global sell-off last May of emerging market equities and currencies of countries with high interest rates (“carry-trade” currencies) has been attributed to changes in the outlook for U.S. monetary policy, since the sell-off took place immediately following Chairman Bernanke’s May 22 comments concerning the future of the Fed’s asset purchase programs. In this post, we look back at global asset market developments over the past summer, and measure how changes in global risk aversion affected the values of carry-trade currencies and emerging market equities between May and September of last year. We find that the initial signal of a possible change in U.S. monetary policy coincided with an increase in global risk aversion, which put downward pressure on global asset prices.

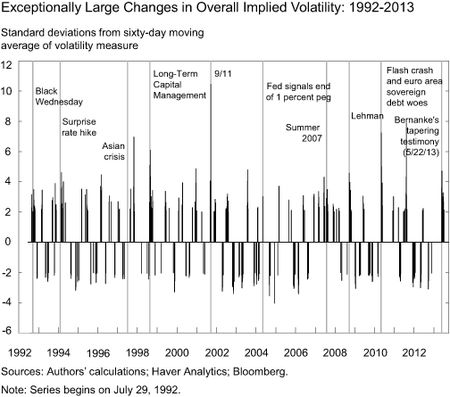

Implied volatility measures across different assets reflect, among other factors, market participants’ views on risk. Therefore, we conjecture that shifts in their risk aversion coincide with exceptionally large changes in implied volatility measures. An “exceptionally large” change in this case is defined as when overall implied volatility is at least two standard deviations above or below its mean over the previous sixty days. (“Overall implied volatility” is constructed as the average of the VIX index for U.S. equities, the Merrill Lynch Option Volatility Estimate [MOVE] Index for U.S. Treasury bonds, and the J.P. Morgan Global FX Volatility Index.) The chart below depicts changes in overall implied volatility for daily data from 1992 to September 2013, with labels for some key events that caused market turmoil. Exceptional volatility changes often occur in conjunction with these events, suggesting that these volatility changes are positively correlated with changes in (unobserved) risk aversion.

After examining the impact on the US dollar, carry trade returns and emerging market equity indices, the authors conclude:

Measuring changes to global risk aversion is a difficult exercise. The model used here suggests that substantial changes in risk aversion coincided with Chairman Bernanke’s May 22 testimony, resulting in substantial downward pressure on global asset prices in the two months after the May 22 testimony.

More in the post.

Josh Barro on the Demographic Characteristics of Anti-Government Groups

I have been puzzling over the following remark by Cliven Bundy, who has objected to the granting of government subsidies while arguing for no-cost use of government lands. As quoted in Barro/NYT:

“Taper Tantrum or Tedium”

“How Will the Normalization of U.S. Monetary Policy Affect Latin America and the Caribbean?”