That’s the point of a Bloomberg article:

Anyway, that Jeep plant? It didn’t move to China. And it’s actually doing quite well. No, scratch that: It’s going gangbusters. Demand for Jeeps is so high that Chrysler workers are clocking 60 hours a week and still can’t keep up.

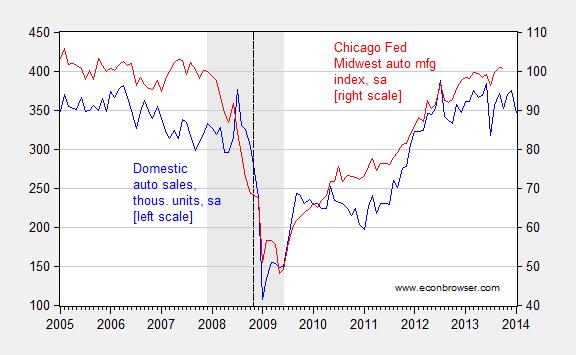

Figure 1 illustrates the context.

Figure 1: Auto and motor vehicle sales, thousands of units (blue, left scale), and Chicago Fed motor vehicle manufacturing index, 2007=100 (red, right scale), both seasonally adjusted. NBER defined recession dates shaded gray. Vertical dashed line at “Let Detroit Go Bankrupt”. Source: FRED.

Update, 3/16, 6PM Pacific: Reader Patrick R. Sullivan writes:

Looking at Figure 1, I’d say that sales of cars are pathetic. Only back to the level of 2005. And that after years of far below normal sales figures, which should have resulted in pent-up demand. This is nothing to brag about for this economy.

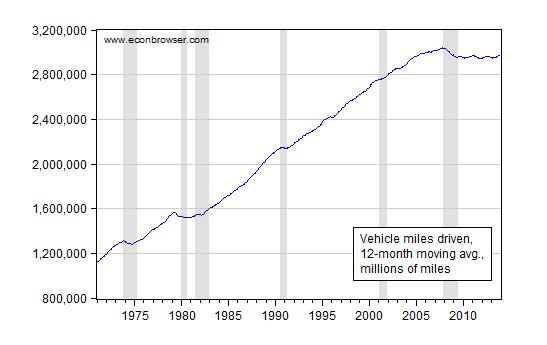

I think it is useful when thinking about production trends to consider the end-use of the product. One interesting point is that vehicle miles driven has declined, and is essentially flat, despite the fact that GDP has exceeded pre-recession peaks. This is shown in Figure 2.

Figure 2: Vehicle miles driven, 12 month moving average, in millions. NBER defined recession dates shaded gray. Source: Federal Highway Administration via FRED.