Several months ago, I discussed the indicators of financial stress developed by the IMF in two posts [1] [2]. The working paper documenting and extending the results in the World Economic Outlook has just been released.

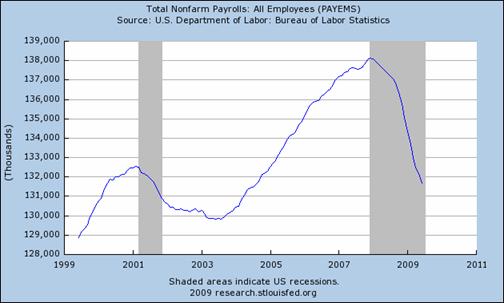

Back where we started

BLS reported that the total number of Americans employed in June on nonfarm payrolls came to 131.7 million workers on a seasonally adjusted basis. That’s below the June 2000 figure of 131.8 million with which we started the decade.

|

The Informational Content of the OECD Leading Indicators

Sunday’s NYT had a great interactive graphics by Amanda Cox detailing the dynamics of recessions and recoveries. One interesting graph pertained to the OECD Leading Indicators:

Off-balance-sheet federal liabilities

Just how much has the U.S. government promised to pay?

Waxman-Markey and the Great Depression II?

“With the passage of Cap and Trade there is a good chance that unemployment will be worse than 1933 by the end of 2010.”

So writes an Econbrowser reader. Well, anything can happen, but that is not the outcome I predict. Nor the CBO, EPA, and other informed analysts.

Back to the Stimulus Debate: W, Timing, the States, and Baselines

A “W” Recession?

Martin Feldstein has recently raised the possibility that we might experience a relapse into recession (a beautiful symmetrical W), with the next dip in 2010. In my view, this means (1) we should have opted for a bigger and better composed stimulus package, and (2) the timing of expenditures in the stimulus package might not be as problematic as many commentators have indicated. From Bloomberg:

No rebound for autos

Autos are worth watching as one sector where economic growth could resume first. But despite what others are saying, I don’t believe that it’s happening yet.

A V-shaped recession?

As James Morley has pointed out, often a sharp economic downturn is followed by an equally sharp economic recovery. One reason for that is the liquidation of inventories that accompanies any recession and restocking that takes place in recovery. What should we expect this time?

The Newest Data on Foreign Exchange Reserves

The IMF has released its estimates for 2009Q1 reserves (COFER data). Below I update and extend my recent post on the dollar as a reserve currency.

New Papers on International Finance: Crises, Puzzles, and Exchange Rates

Summertime is conference season, especially for those of us who don’t live close to a major airport hub. The first conference I attended was the NBER’s International Seminar on Macroeconomics, co-organized by Lucrezia Reichlin and Ken West. The conference was broken up into several sections: Financial Crises, International Economic Puzzles, Exchange Rates and Financial Development. Lot’s of interesting papers, and plenty of stimulating discussion. I can’t do justice to the proceedings, but I can provide the summaries of the papers.