As of today, measured economic policy uncertainty hit 468.

Continue reading

Monthly Archives: November 2016

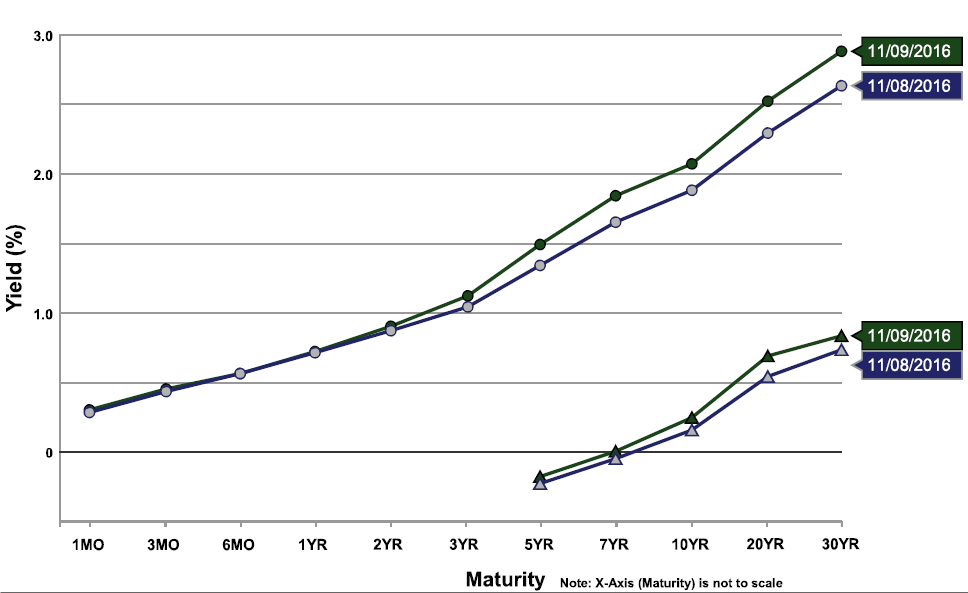

At Long Last, the Feared (Portfolio) Crowding Out Has Materialized

The implication of a (massive) revision to the expected path of government debt relative to baseline is an increase in the slope of the yield curve. Some portion comes from the expectations hypothesis of the term structure, some from an increase in the risk premium. [lecture notes on portfolio crowding out] [lecture notes on expectations hypothesis of term structure]

Figure 1: Yield curve as of 8 November (blue), and 9 November (green). Source: US Treasury.

Today, and Eight Years Ago

Here are graphs of employment, industrial production, personal income ex.-transfers, manufacturing and trade sales, and real GDP (five indicators that the NBER Business Cycle Dating Committee has focused on in the past) depicting the state of the macroeconomy, given what we know today, and compared to eight years ago.

New data sources for economic research

One of the exciting implications for economists of the digitization of everything is the ability to study economic relations and behavior at a level of detail far beyond anything that could have been attempted a decade ago. I’ve earlier called attention here to new measures of inflation obtained from millions of prices posted on the web, new insights into pricing behavior coming from scanner data on individual store transactions, and understanding of consumer behavior based on debit and credit transactions of 25 million Americans. Here I discuss another new study based on smart-phone apps.

Continue reading

Guest Contribution: “Economists Sign Letter Opposing Trump”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers.

Wisconsin Growth Prospects

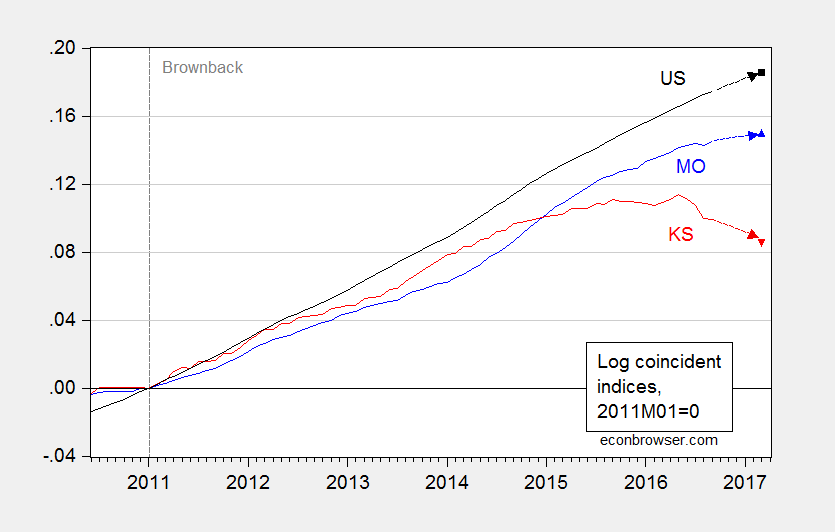

At least Kansas makes Wisconsin look good.

Guest Contribution: “Battling Unemployment: A Clear Win for the ‘Cycs'”

Today we are fortunate to have a guest contribution written by Zidong An (American University) and Prakash Loungani (IMF).

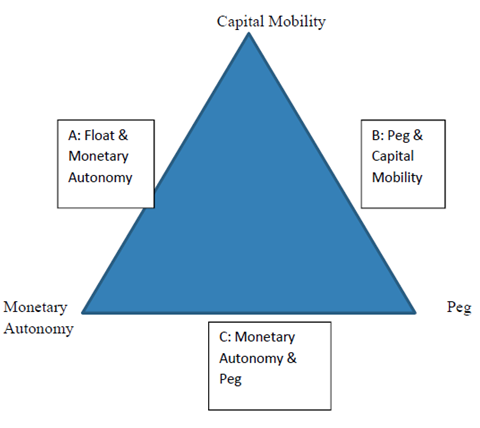

The Trilemma, Nuanced

I’ve just finished up the Mundell-Fleming model in my int’l finance course, and ended the section with a discussion of the “International Trilemma”, also known as “the Impossible Trinity”, which states that a given country can at any given time fully achieve only two out of three objectives of exchange rate stability, monetary autonomy, and financial integration (full capital mobility) at a time.

With a Program of Sufficiently Regressive Tax and Spending Cuts, America Can Be Like Kansas

Figure 1: Log coincident index for Missouri (blue), Kansas (red), and US (black), all 2011M01=0. March 2017 observation implied from leading indices. Source: Philadelphia Fed and author’s calculations.

Update: More on Governor Brownback’s information program, here.