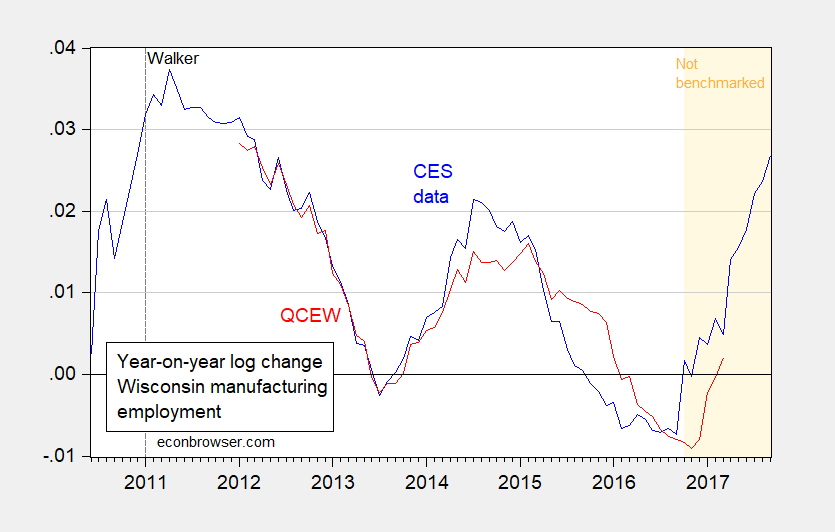

The Wisconsin Department of Workforce Development (DWD) today released new employment data for October. Manufacturing employment surged in the establishment data, but the contemporaneously released additional three months of data from the Quarterly Census of Employment and Wages (QCEW) (through June) suggests slower manufacturing growth.

Category Archives: employment

Quarterly Census Data on Wisconsin Manufacturing: More on Premature Triumphalism

Recall the Walker Administration termed the Quarterly Census of Employment and Wages (QCEW) the “gold standard” of employment measures. I thought it useful to compare the QCEW figures on manufacturing against the establishment survey. Here is the twelve month growth rate under the two measures (the QCEW data is not seasonally adjusted).

Figure 1: 12 month log difference in Wisconsin manufacturing payroll employment from establishment survey (CES) (blue), and from Quarterly Census of Employment and Wages (QCEW) (red). Light brown shaded area denotes period where CES data has not been benchmarked using QCEW data. Source: BLS, DWD and author’s calculations.

One for the Annals of Selective Data Reporting: Wisconsin Edition

Around midmonth I often check the Wisconsin Department of Workforce Development to see their reporting of state employment statistics in advance of the BLS release (tomorrow, for the September figures). Oddly, today, the DWD released statistics for September, without any detailed tables, in an abbreviated press release (compare with last month’s release to see what I’m saying). In order to figure out the revised August numbers (and actual level of September preliminary numbers) one had to go back to earlier releases and add and subtract.

The Association between China-based Job Displacement and Drug Overdose Deaths

A recent White House internal memo has suggested a causal relationship between the decline in manufacturing jobs and a host of social ills, including the opioid epidemic. Here is a graphical/geographic comparison of two variables that are related to these factors.

Two Pictures from the September Employment Situation

Consensus (Bloomberg) had been for +100,000 (range 0 to 140,000); print was -33,000.

Wisconsin Employment Continues Downward in August

And is over 12,000 below April peak. Private nonfarm payroll employment is also declining, with previous months’ data revised down.

Wisconsin Employment below April Levels, Minnesota Surges

State agencies have released data on July employment. Below is Wisconsin, compared to Minnesota and the Nation.

Beware the State Level Household Employment Series: Wisconsin Edition

Steve Kopits obsesses on the household survey based employment series for Wisconsin, despite our previous exchange on why reliance on this series for Kansas is a problem. But just to make matters concrete, lets look at a few vintages of the household series.

Are we in a new inflation regime?

Federal Reserve Bank of Chicago President Charles Evans got some attention recently with the following statement:

In a world of global competition and new technology, I think competition is coming from new places. New partners are choosing to merge and sort of changing the marketplace and [bringing] more competitive pressures on price margins…If that’s the case, and I think that’s just speculative at this point, then it means that we need even more accommodation to get inflation up.

Pangloss in Wisconsin

In search of a “supply side success” after the end of the Kansas experiment, conservative observers turn to Wisconsin. The Manhattan Institute’s Mr. Riedl declares victory:

Wisconsin’s job growth over the past six years has been extraordinarily strong.

When last we met Mr. Riedl, he was explaining why fiscal policy could have no impact on GDP because, well, because. That does not augur well for his abilities an economic analysis, and indeed we can easily poke holes into the argument that Wisconsin’s doing just great!