From IEA (correction – all sources are International Energy Agency):

Category Archives: energy

What Is CoRev Smoking this Holiday Season?

Innumerate CoRev writes:

“[I am] Just smiling at the idiocy and cognitive dissonance of the renewables zealots. …EV purchases dropping…coal use rising”

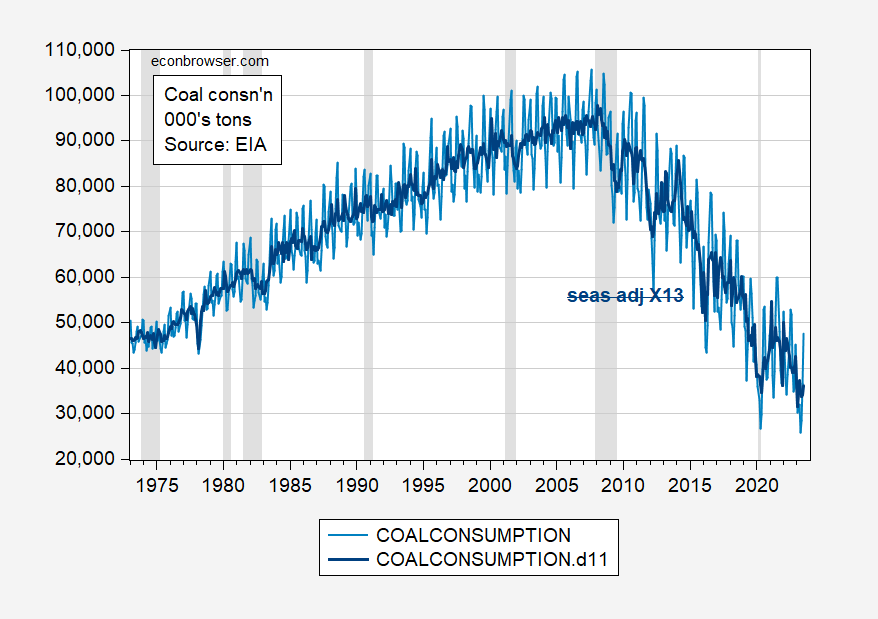

Like innumerable things CoRev writes, this seemed wrong, so I looked up US DoE EIA data, and downloaded this:

Figure 1: US coal consumption (light blue), seasonally adjusted by author (dark blue), all in thousands of tons. NBER defined peak-to-trough recession dates shaded gray. Source: EIA, NBER, and author’s calculations.

Coal consumption looks like it’s declining to me, unless one is looking at a very short horizon.

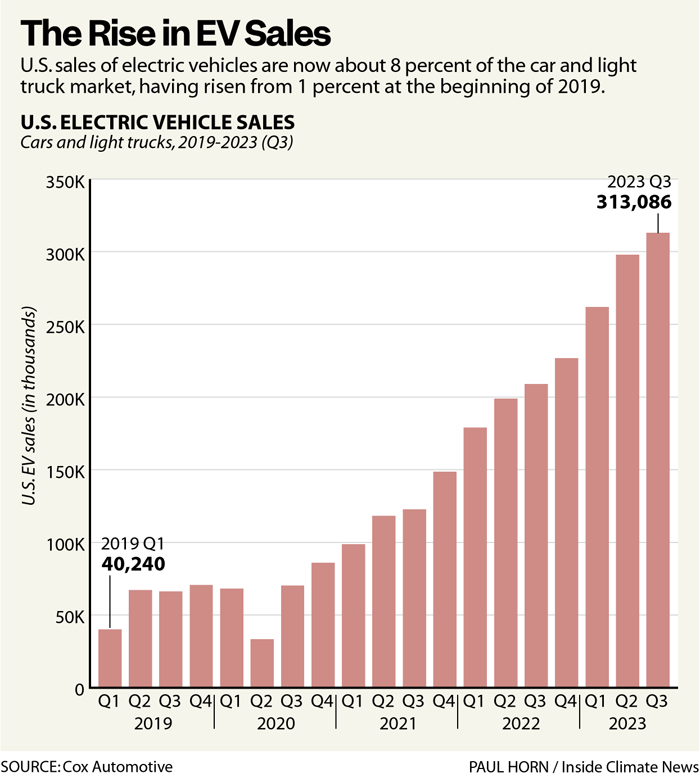

As for EV sales, they look like they’re rising to me:

Source: Gearino, InsideClimate, Oct 26, 2023.

Now, it may be that CoRev has access to super-secret alternative series that tell a different story than the EIA series (or it may be a plot by the Deep State’s statistical minions). And he might also know that Cox Automotive has been infiltrated by said Deep State agents, so those numbers are not to be believed. I am afraid I don’t have time to investigate these possibilities.

I leave it to readers to dissect CoRev’s other errors in his comment. My main point – do not take as given assertions by (1) individuals who have no idea how to conduct time series analysis (let alone apparently read a graph), and (2) those who go about accusing others of manipulating data without understanding where the data are coming from. For a compendium of CoRev-related cautionary tales I give my policy analysis/stats students, see here (or if you just want to laugh and laugh and laugh).

Under Pressure

Urals and Brent, as of today:

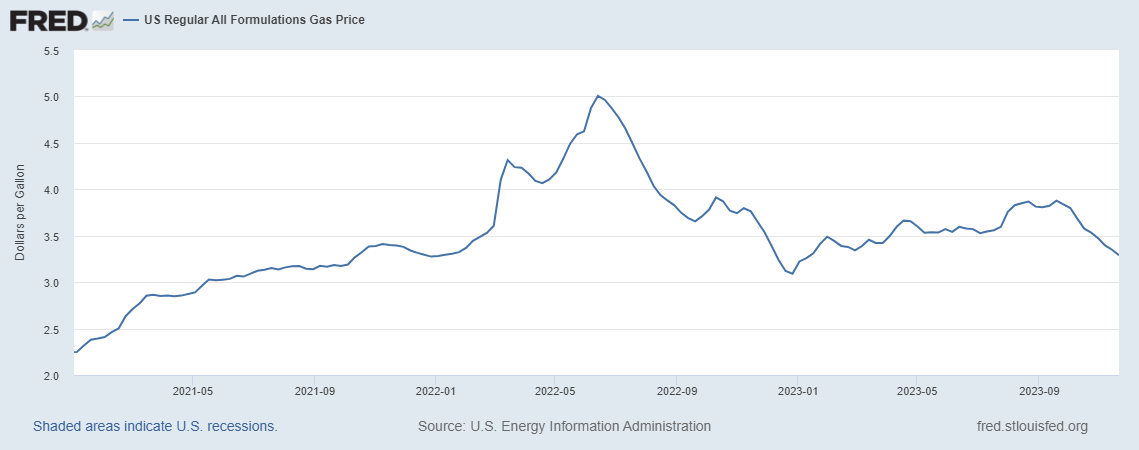

Gasoline Prices, Weekly thru Nov 20

EIA Short Term Energy Outlook Forecast for Oil, and the Impact of Sanctions

As reported yesterday:

Urals vs. Brent, pre- and post-Cap

The $60 price cap on Russian crude oil was effective 5 December 2022. Here’s a figure of Urals vs. Brent over the past 5 years.

EIA Short Term Energy Outlook Oil Price Forecast

Peak price 2023Q4 at $87.7/bbl (WTI), $92.7/bbl (Brent). WTI forecast below:

Urals Discount to Brent $16.3

From TradingEconomics, accessed just now:

Guest Contribution: “How Political Tensions and Geopolitical Risks Impact Oil Prices”

Today we are pleased to present a guest contribution by Jamel Saadaoui (University of Strasbourg). This post is based on the paper coauthored with Valérie Mignon (University of Paris Nanterre).

FERC/NERC Report On Texas 2021

Clearly, electricity generators and natural gas providers were the problem in reduced supply during the winter crisis of 2021, according to the FERC/NERC report.