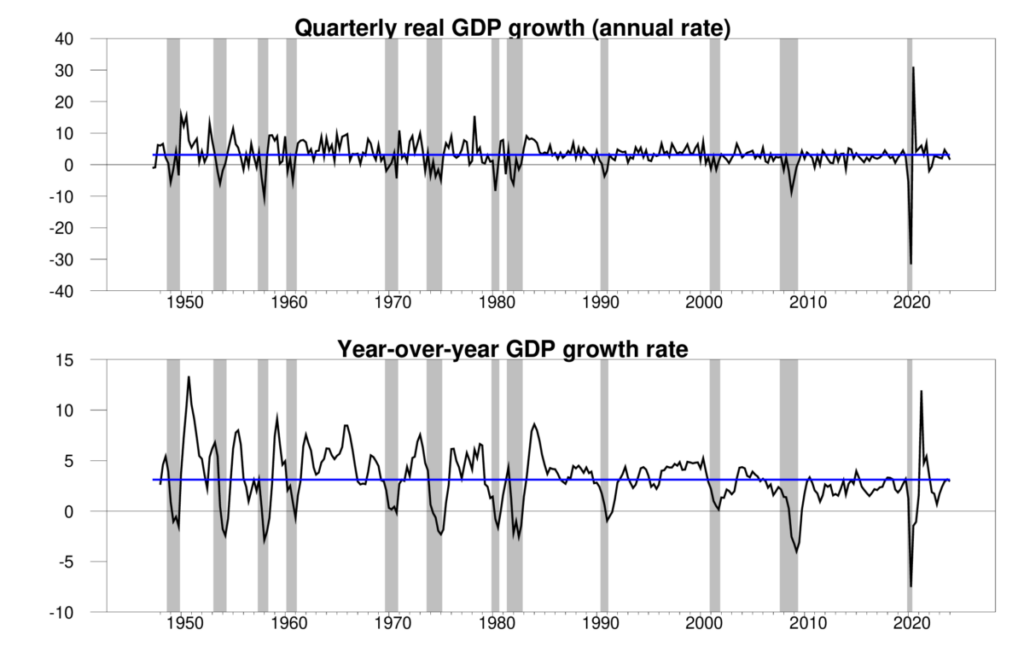

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 1.6% annual rate in the first quarter. That’s a little lower than many analysts expected. But the year-over-year growth is still on track.

Top panel: quarterly real GDP growth at an annual rate, 1947:Q2-2024:Q1, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of real GDP from the previous quarter. Bottom panel: year-over-year growth rate. Calculated as 100 times the difference in the natural log of real GDP from the same quarter of the previous year.