From EIA, and BEA NIPA:

Stagflation Fears? March NBER Business Cycle Indicators and Instantaneous Inflation

That’s a term that is invoked in a CNN article today. I think of stagflation as weak growth combined with high inflation. A little context:

GDP, Nowcasts, and Est’d GDO, GDP+, and Final Sales

Following up on Jim’s post yesterday, thoughts on measurement error and prospects. Note that GDP surprised on the downside, at 1.6 ppts q/q AR vs. consensus 2.5 ppts. On the other hand, GDP+ grows faster, as does final sales to private domestic purchasers.

Almost landed

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 1.6% annual rate in the first quarter. That’s a little lower than many analysts expected. But the year-over-year growth is still on track.

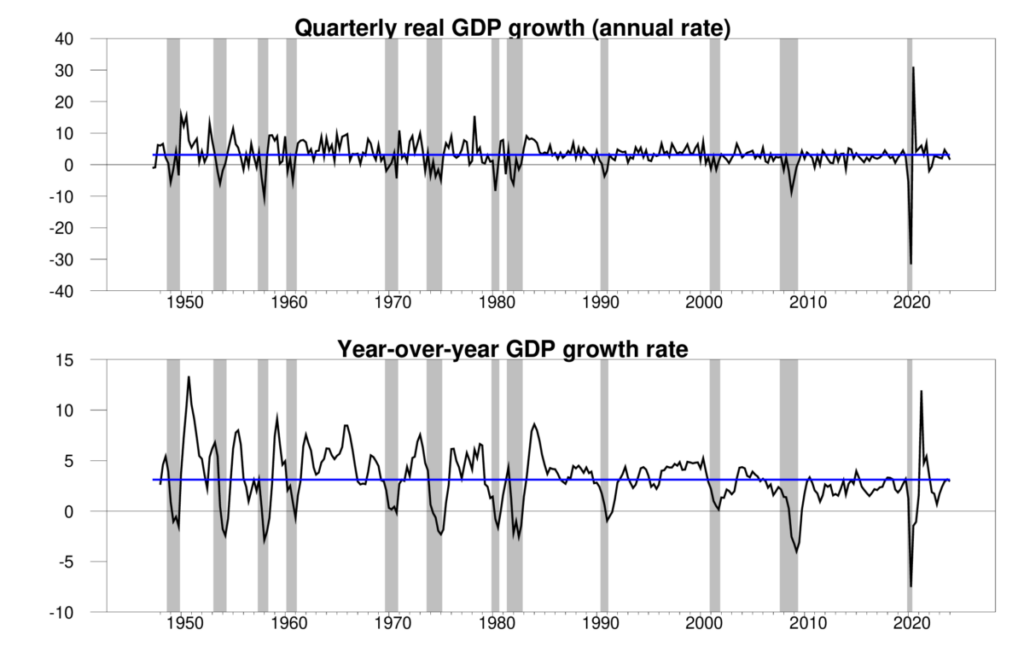

Top panel: quarterly real GDP growth at an annual rate, 1947:Q2-2024:Q1, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of real GDP from the previous quarter. Bottom panel: year-over-year growth rate. Calculated as 100 times the difference in the natural log of real GDP from the same quarter of the previous year.

First Tranche of Weapons to Ukraine; Seizing Russian Assets?

From Bloomberg: Upon signing the foreign assistance bill, this is what’s heading to Ukraine first tranche ($1bn):

Wisconsin Economic Activity thru March

Continues to rise, according the the Phildaelphia Fed’s coincident index, just out. The divergence with GDP continues to persist.

Chinese GDP in Q1

Official is 5.3% y/y (consensus 4.8%), vs BOFIT 4.3%.

Stephen Moore: “If you liked what Trump did on the economy the first time, you’ll like what he does the second time”

The Value of the Chinese Yuan: Down 15% since 2022M03

There’s been a lot of discussion of overcapacity in Chinese production, and the resulting pressures in US and other markets. Here’s a picture of the Chinese real exchange rates.

Have Wisconsin Inflation Adjusted Total Wages and Salaries Risen since 2021Q1?

Yes, using either Chained CPI, or East North Central CPI: