The challenges of global climate change are with us, even if Russia’s aggression in central Europe is threatening to send the world economy into recession, and populations into starvation.

Corporate Profits, pre-tax, w/o IVA and CCAdj

10 seconds on FRED allows one to see a time series. 20 seconds in a stats package (or even Excel) allows one to see ahead of time if one is going to write something stupid.

Oil Prices, Price Surprises, and Forwards, Breakevens, and Term Spreads

First, what are current one month and 1 month forward 2 months doing?

Guest Contribution: “Why has the Nobel Prize sometimes been given to economists with opposing viewpoints?.”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. This was his response to a question posed in a symposium of views in The International Economy:

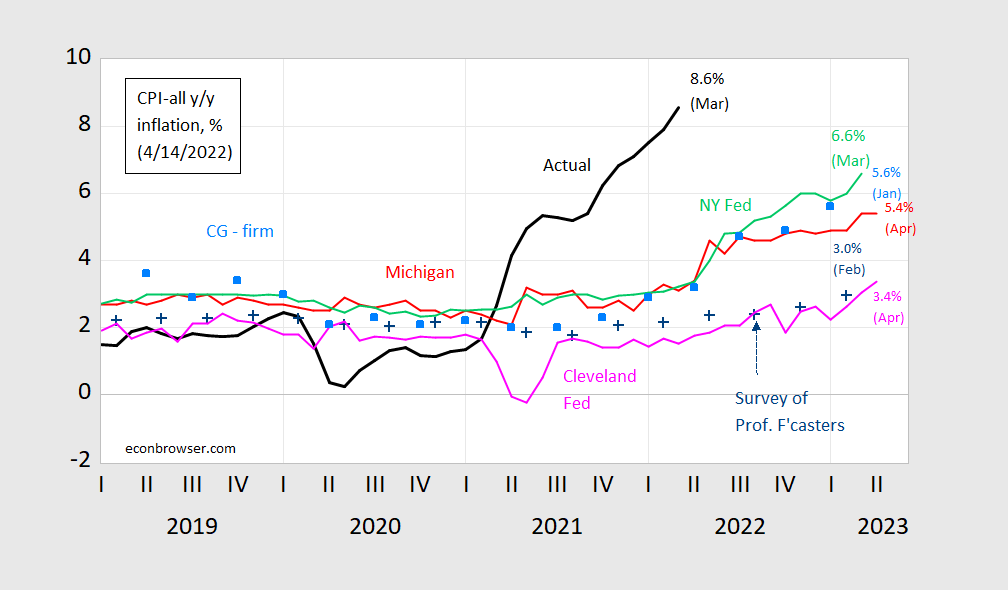

One Year Ahead Inflation Forecasts

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

In terms of accuracy and bias, a new study by Bennett and Owyang (forthcoming) is very relevant.

Real Wages

Reader JohnH confidently asserts:

Will the True PPI Stand Up?

Links: Oil Shocks, China Lockdowns, Spring Meetings, Economic Report of the President, and Ukraine Reconstruction

Some links relevant to current events, in no particular order:

PPI Inflation in March, with Implications for April CPI

Month-on-month PPI inflation surprised on the upside, 1.4% vs. Bloomberg consensus 1.1%, while core PPI was up 1% vs. 0.5% consensus.

Financial Market Responses to the March CPI Release

10yr-2yr spread continues to rise, 5 year inflation breakeven (unadjusted) shrinks, as does implied 2 month interest rate 1 month forward.