From Inomics:

Business Cycle Indicators as of May 4th

Monthly GDP figures were released by IHS-Markit yesterday, showing a rebound in March. In the context of key macro indicators followed by the NBER Business Cycle Dating Committee:

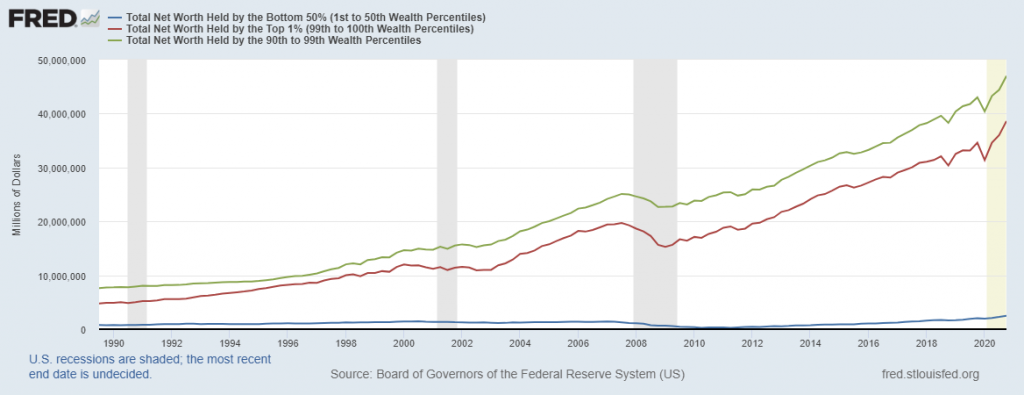

Net Worth for Bottom 50% and Above

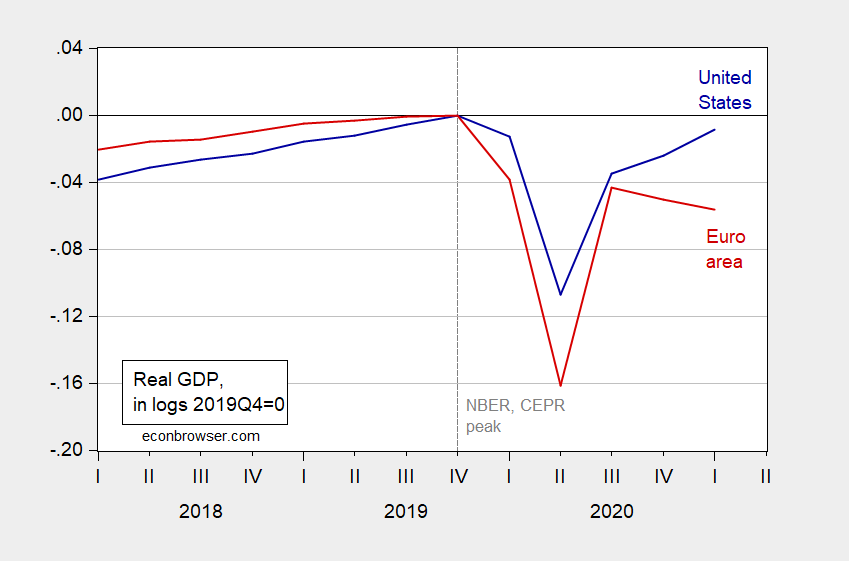

Diverging Fortunes: US and Euro Area GDP

Euro area GDP continues to drop in Q1, while the US recovery accelerates.

Figure 1: US real GDP (blue), Euro Area 19 real GDP (red), both in logs, 2019Q4=0. Source: BEA, European Union, and author’s calculations.

The US recovery has benefited from a tremendous amount of fiscal stimulus and — finally — a reasonable pandemic response (including an effective vaccination rollout).

The Composition of Consumption

While aggregate consumption has surpassed peak levels, it hasn’t returned to trend. Furthermore, the composition has changed drastically.

Economy looks strong

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 6.4% annual rate in the first quarter, well above the 3.1% average growth that the U.S. experienced over 1947-2019.

Nowcasts, Economic Indicators, Expectations

On the eve of the advance GDP release for Q1.

Five Year Inflation Breakevens

Accounting for term and liquidity premia can change the story.

Guest Contribution: “What Three Economists Taught Us About Currency Arrangements”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared at Project Syndicate.

Donald Trump’s “eighth wonder of the world” shrinks from $10 billion to $674 million

Article from Reuters, “Foxconn mostly abandons $10 billion Wisconsin project touted by Trump”:

Under a deal with the state of Wisconsin announced on Tuesday, Foxconn will reduce its planned investment to $672 million from $10 billion and cut the number of new jobs to 1,454 from 13,000.

The Foxconn-Wisconsin deal was first announced to great fanfare at the White House in July 2017, with Trump boasting of it as an example of how his “America first” agenda could revive U.S. tech manufacturing.

My discussion in 2017, citing Legislative Fiscal Bureau assessment, here. Formal modeling of possible economic impacts from CROWE in 2017, and critical assessment by Mercatus of the package here.

And, all of us are wondering – where is Scott Walker?