Today, students in my Master’s level Public Affairs course in macroeconomics had the good fortune to receive a guest lecture from Steven Kamin, resident scholar at AEI, formerly Director of the International Finance Division of the Federal Reserve Board (sponsored by UW’s International Division). In his lecture, he covered the centrality of the dollar in the global financial system, monetary “spillovers” of Fed policy to other economies with special reference to the pandemic response, the macro challenges posed by the most recent fiscal relief package, and implications for emerging market economies. The entire lecture is here.

Company Price Change Announcements and Future Inflation

Goldman Sachs (Walker, “Company Pricing Announcements and the Inflation Outlook”) points out that changes company statements regarding price changes is contemporaneously correlated with PCE inflation, but not predictive. This puts in a different perspective media discussion of impending inflation.

Another Minimum Wage Proposal

There’s a rumored plan by Senators Romney and Sinema to raise the minimum wage to $11. Assuming the phase is four years (as in the proposed Cotton plan to raise to $10) starting in June 2021, the trajectory of the real minimum wage looks like:

Retail Sales: Implications for Consumption

Retail sales jumped 9.8% m/m, exceed Bloomberg consensus of 5.9%. Sales ex-food services rose 9.4% in nominal terms, 8.7% if deflated by the CPI-all.

Business Cycle Indicators as of Mid-April

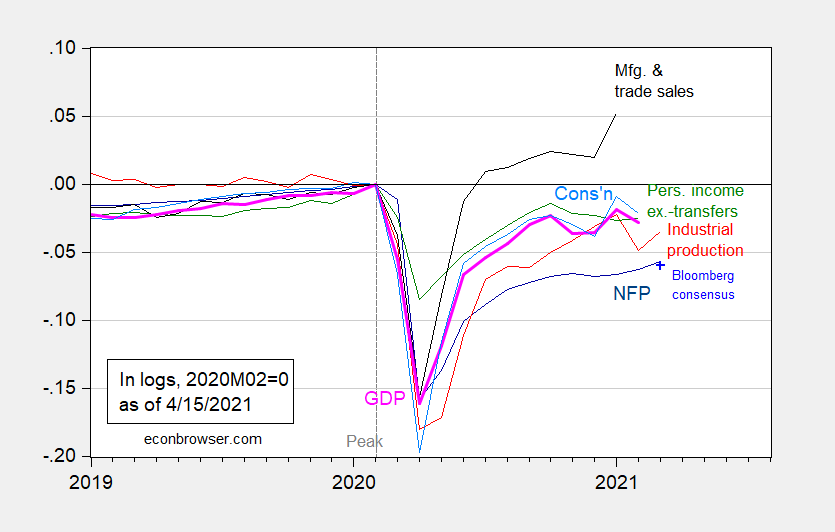

Industrial production figures were released today, showing a rebound in March. In the context of key macro indicators followed by the NBER Business Cycle Dating Committee:

Figure 1: Nonfarm payroll employment from March release (dark blue), Bloomberg consensus as of 4/1 for March nonfarm payroll employment (light blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (4/1/2021 release), NBER, and author’s calculations.

Industrial production was whipsawed by weather in February, so it makes sense to look at manufacturing production as well. Seasonally adjusted industrial production rose 1.4% vs. 2.8% for manufacturing production (18.7% vs. 39.1% annualized). Industrial production is 3.4% below levels at NBER peak (2020M02), while manufacturing is 1.7% below. Incidentally, neither has re-attained the local maxima in January 2021.

Atlanta Fed GDPNow (4/15) is for 8.3% in Q1; IHS Markit nowcast (4/15) is 6.0% (both figures SAAR).

Wisconsin Employment: Employment Drop Revised Away

Wisconsin nonfarm payroll employment has stabilized at a level down 4.9% relative to NBER peak in 2020M02, vs. 5.5% for the nation overall (according to figures released by DWD today). In addition, the downward decline in February of 1.9% (annualized) has been largely revised away — it’s now 0.3% decline (annualized).

CPI Surprise

The CPI came in slightly above Bloomberg consensus (2.6% vs 2.5%), and above the WSJ April survey consensus (shown below).

The WSJ April Survey: Accelerating Growth Prospects

The survey results are out, and once again, the outlook improves.

When (US) Corporate Tax Rate Reductions Last Bloomed

Under the Tax Cuts and Jobs Act, no enormous surge in capital investment appeared, above and beyond what could be explained by aggregate demand changes. From the conclusion to U.S. Investment Since the Tax Cuts and Jobs Act of 2017, by Emanuel Kopp, Daniel Leigh, Susanna Mursula, and Suchanan Tambunlertchai.

The Trade Balance: Macro Dominates Tariffs

Like I said four years ago. By Trump’s own criterion, the trade war was lost. My view – that was a stupid criterion in any case.