I keep on getting missives from the IIMR. Here’s today’s, from a Tim Congdon:

Downward Revision in GDP and Consumption Outlook

Goldman Sachs observes, over the weekend:

The US has experienced a dramatic resurgence of Covid over the last two weeks, with confirmed daily new cases surpassing 50,000. In response, officials have paused or reversed reopening in states containing more than half the population.

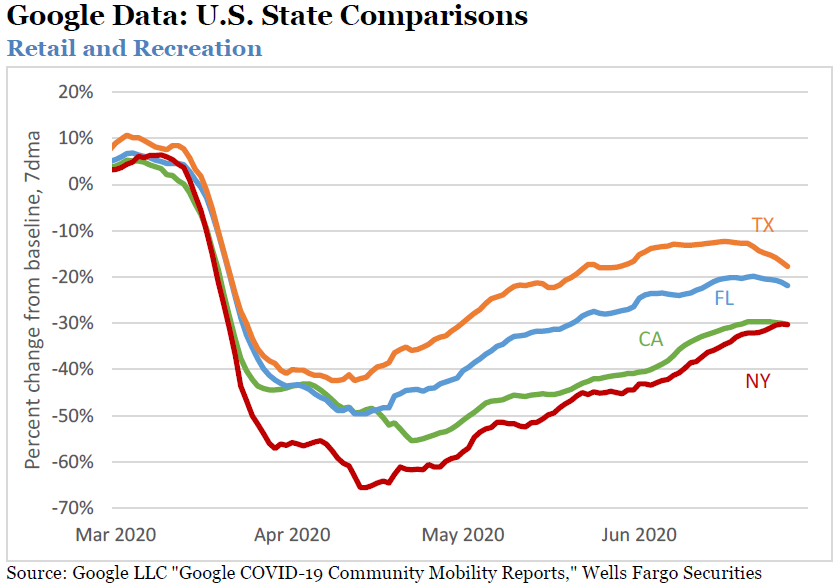

A combination of tighter state restrictions and voluntary social distancing is already having a noticeable impact on economic activity. States with the most severe deterioration in the Covid situation saw declines in consumer and workplace activity at the end of June that will likely continue into July, and activity flattened in other states.

The healthy rebound in consumer services spending seen since mid-April now appears likely to stall in July and August as authorities impose further restrictions to contain virus spread. The ongoing recovery in manufacturing and construction should be largely unaffected, however.

…

An Employment W – What Would It Take?

Some idle speculation as we head into more closures: What if hospitality and leisure and retail employment dropped back to May levels, and the rest of nonfarm payroll employment increased by 2 million (it increased by 1.972 million in June). Then what would overall employment look like?

Even Before the Recession, Employment Was Slowing

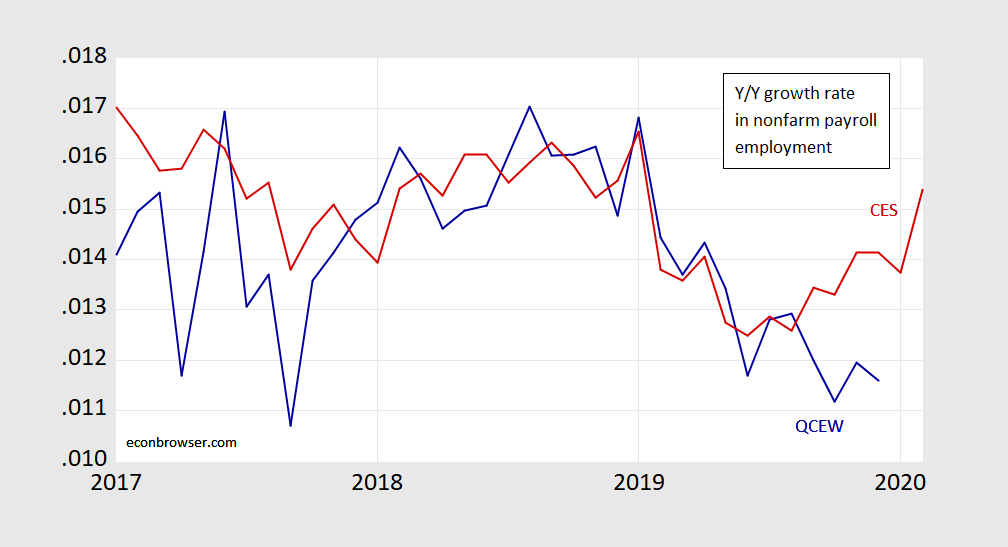

Quarterly Census of Employment and Wages data show the divergence from the establishment survey measurment of total employment in the months before the peak.

Figure 1: Year-on-year growth rate in nonfarm payroll employment from establishment survey (red), from Quarterly Census of Employment and Wages (blue), both calculated as 12 month log differences. Source: BLS, author’s calculations.

NBER identified peak is 2020M02.

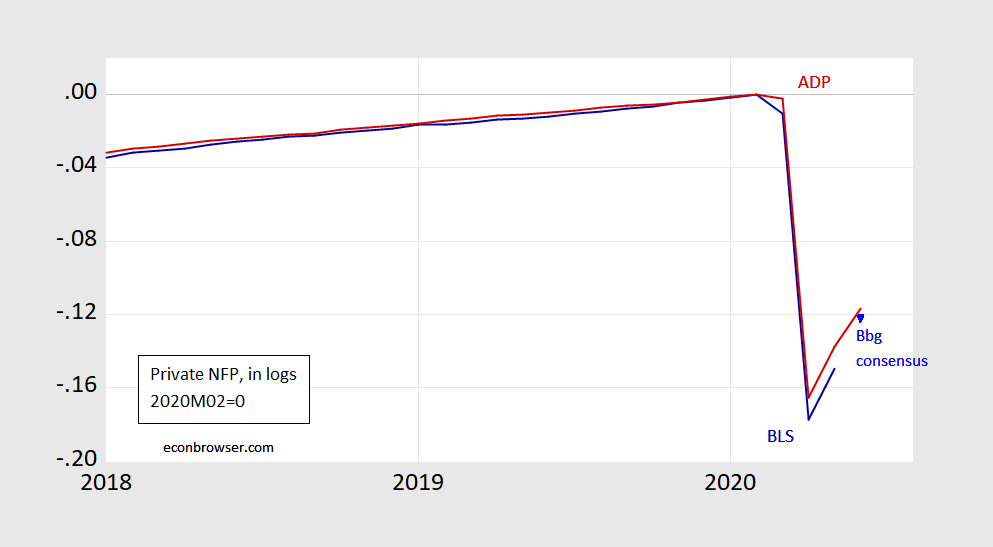

Business Cycle Indicators as of July 2

Nonfarm payroll employment continues to rise in June (although it remained over 10% below peak, in log terms). Here is a graph of some key variables tracked by the NBER’s Business Cycle Dating Committee.

Excess Deaths, March-May 2020

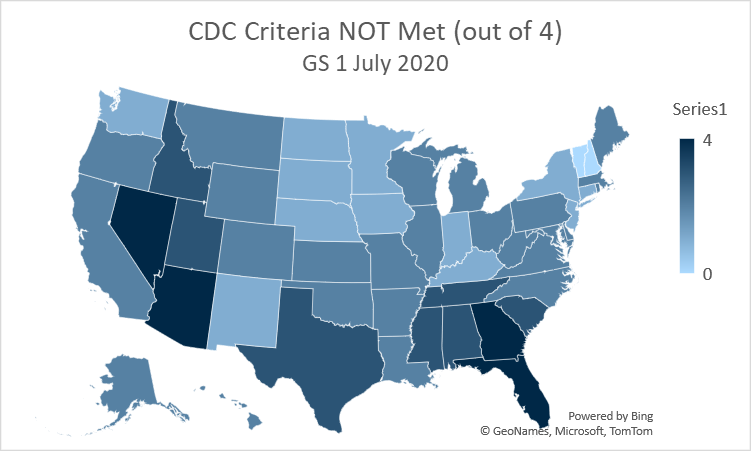

CDC Criteria Not Met (out of 4), by State

CDC has defined 4 criteria for relaxing restrictions (called “gating criteria). Only two states now meet all the criteria, a lot meet 0 or only 1 — 11 states.

Source: Goldman-Sachs, 7/1/2020.

Florida meets none; Texas meets 1, but is just teetering on slipping into none.

Declining Mobility in TX, FL

Continued Recovery in June (II)

Continued Recovery in June?

The New York Fed’s Weekly Economic Index suggests yes.