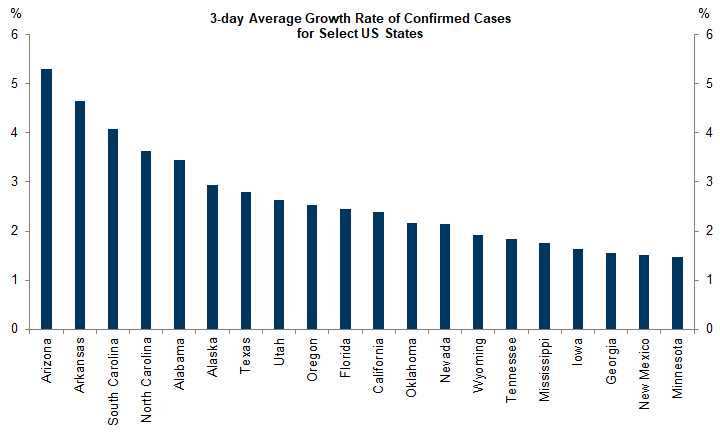

From Goldman-Sachs today:

Source: Goldman-Sachs, “Global Economics Comment: Tracking Coronavirus,” June 13, 2020.

Guest Contribution: “The cost of Coronavirus Uncertainty in Europe: the High Returns to Clear Policy Plans “

Today, we’re fortunate to have Giovanni Pellegrino (Aarhus University), Federico Ravenna (Danmarks Nationalbank, University of Copenhagen, HEC Montreal, CEPR) and Gabriel Zullig (Danmarks Nationalbank, University of Copenhagen) as guest contributors. The views expressed represent those of the authors, and do not necessarily represent those of Danmarks Nationalbank , or any other institutions the authors are affiliated with.

Guest Contribution: “How the Coronavirus Crisis is Affecting Japanese and American Businesses: Evidence from the Stock Market”

Today, we’re fortunate to have Willem Thorbecke, Senior Fellow at Japan’s Research Institute of Economy, Trade and Industry (RIETI) as a guest contributor. The views expressed represent those of the author himself, and do not necessarily represent those of RIETI, or any other institutions the author is affiliated with.

Guest Contribution: “How Has COVID-19 Already Impacted Small Businesses”

Today, we’re pleased to present a guest contribution by Rob Fairlie (UC Santa Cruz).

Guest Contribution: “A Severe US Recession”

Today, we’re pleased to present a guest contribution written by Laurent Ferrara (SKEMA Business School and International Institute of Forecasters) .

Assessing Covid-19 Trends in Wisconsin

The Golden Rule: Understand…your…data

Interpreting the unemployment numbers

The Bureau of Labor Statistics announced Friday that 2.5 million more Americans were working in May than in April. That’s the biggest monthly increase since 1946, both in terms of the number of workers and as a percentage of the workforce. The unemployment rate dropped from 14.7% in April to 13.3% in May, the biggest monthly drop since 1950. All this is very good news. But there are also indications that we are in a deeper hole than the headline numbers suggest. Here I explain why I believe the true unemployment rate in May was a number more like 19.8%.

Continue reading

Guest Contribution: “Global financial markets and oil price shocks in real time”

Today, we are pleased to present a guest contribution written by Fabrizio Venditti (European Central Bank) and Giovanni Veronese (Banca d’Italia). The views expressed in this paper belong to the authors and are not necessarily shared by the Banca d’Italia and the European Central Bank.

Guest Contribution: “Uncovered Interest Rate Parity Redux: Non-Uniform Effects”

Today, we’re pleased to present a guest contribution written by Yin-Wong Cheung and Wenhao Wang (City University of Hong Kong).

Forward Looking Economic Activity, Pre-Covid19

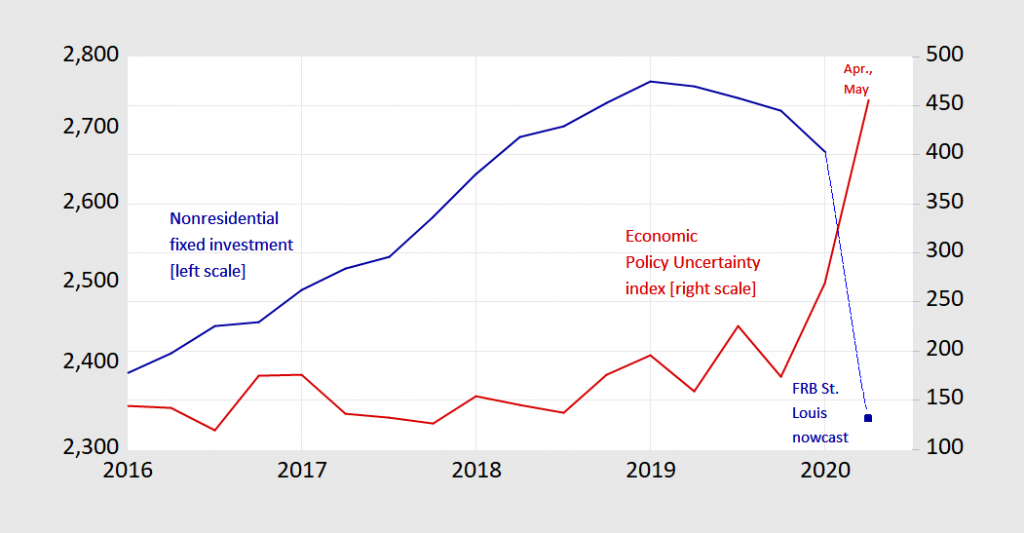

The economy is collapsing. That’s not news. What is interesting is that nonresidential fixed investment has been falling since 2019Q1.

Figure 1: Nonfarm fixed investment in billions Ch.2012$ SAAR (blue, left log scale), and Economic Policy Uncertainty index (red, right scale). 2020Q2 investment is St. Louis Fed nowcast as of 6/1; 2020Q2 EPU is for first two months, as of 6/1. Source: BEA 2020Q1 2nd release, St. Louis Fed FRED, policyuncertainty.com and author’s calculations.