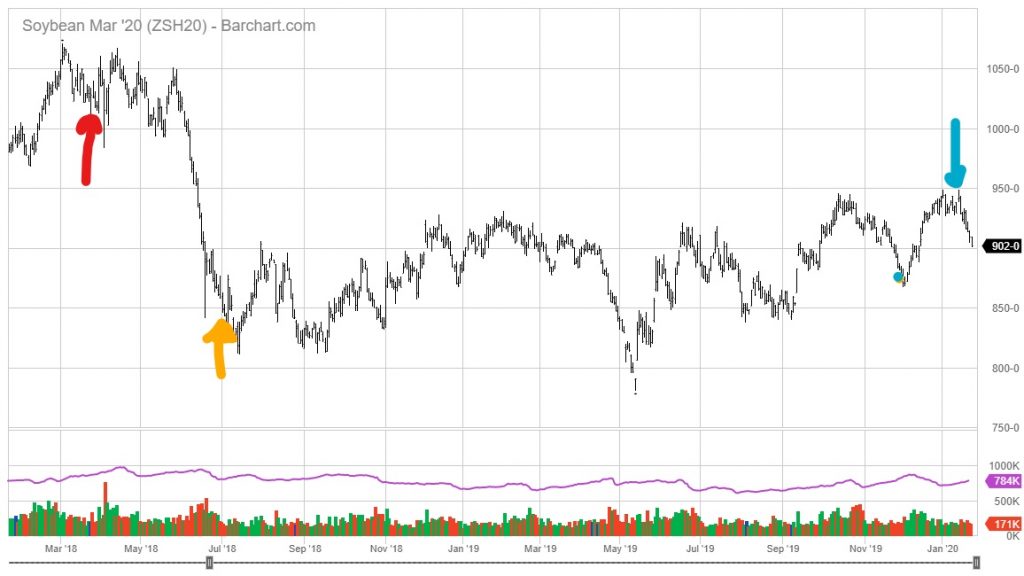

Reader Ed Hanson insists I plot soybean prices from 2014 onward, instead of 2016, to show how factors other than tariffs affect soybean prices. I am happy to accommodate his request. I wonder why soybean prices suddenly deviate from grains overall, starting in March 2018.

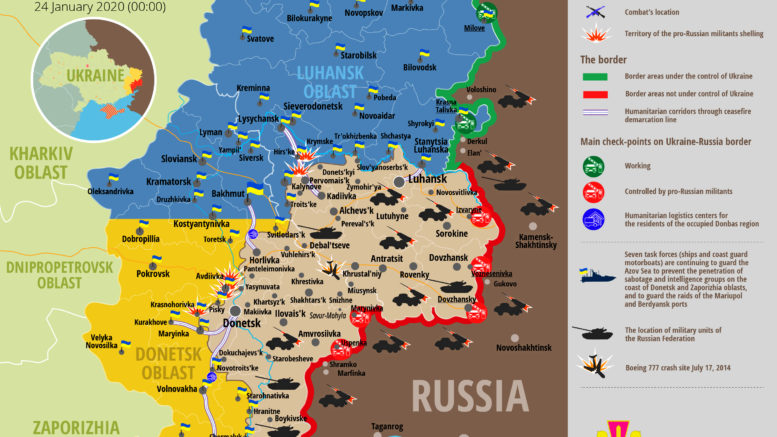

Disposition of Forces in Donbass Region, Ukraine

As of 24 January, according to the Information Analysis Center:

Source: Information Analysis Center.

Discussion of presence of Russian T-72-B3 tanks in Ukraine, here.

Have All Agricultural Commodity Prices Behaved As Did Soybean Prices?

That’s what reader sammy asserts, trying to support the proposition that Chinese retaliatory tariffs on imports of US soybeans had no impact on US soybean prices.

… chart of soybean prices there are a number of other commodity price charts, such as copper, wheat, coffee etc. They are unaffected by the tariff war yet are remarkably similar to the soybean chart.

What a Trump Trade Victory Looks Like: Soybeans

Back in July 2018, reader CoRev wrote:

…no one has denied the impact of tariffs on FUTURES prices. Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

Back on March 23rd, when Mr. Trump announced intent to launch Section 301 actions, nearest month soybean futures closed at 1028. Latest today is 902. Indeed, prices have been falling since Mr. Trump signed the much heralded (by some) Phase 1 deal. This is shown in Figure 1 below.

Figure 1: Front month soybean futures (black). Trump announces intent of Section 301 action against China (red), Section 301 tariffs and Chinese retaliation in effect (orange arrow), and Phase 1 deal signed (blue arrow). Source: barchart.com.

Front month futures prices are now 14% lower now, while the CPI is 2.2% higher (both in log terms). You can do the math. The “blip” is not over.

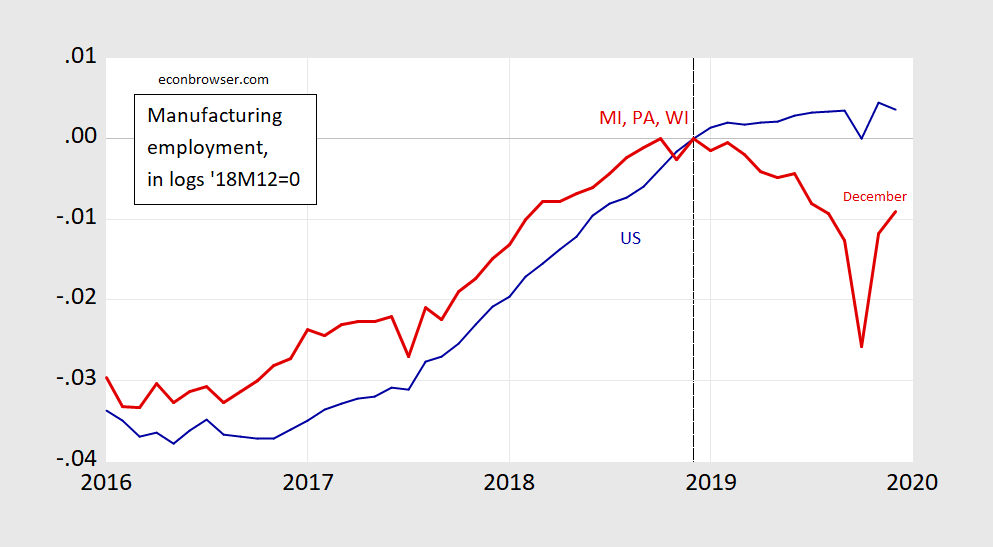

Manufacturing Employment Lags in Three Midwest States

Figure 1: Manufacturing employment in US (blue), and aggregate of Michigan, Pennsylvania, and Wisconsin (red), both in logs, 2018M12=0. December data preliminary. GM strike in October. Source: BLS, author’s calculations.

Michigan, Pennsylvania and Wisconsin aggregate manufacturing employment 1% below peak. In contrast, nationwide manufacturing employment (total, including managerial) has been flat from September 2019.

Spot the Incipient Recession

Most accounts these days suggest the risk of recession has abated, given the strength of various indicators, and the un-inversion of the yield curve. This made me wonder what two key indicators look like in real time on the eve of a recession. Take a look at these two graphs, to see which one denotes data just before a recession.

Guest Contribution: “Carbon Prices, not Monetary Policies, Are the Tools to Fight Climate Change”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate January 17th.

Judy Shelton to the Fed?

From the White House:

A “Critique” of Confidence Intervals

Steven Kopits opines on statistics:

I don’t like confidence intervals for two reasons:

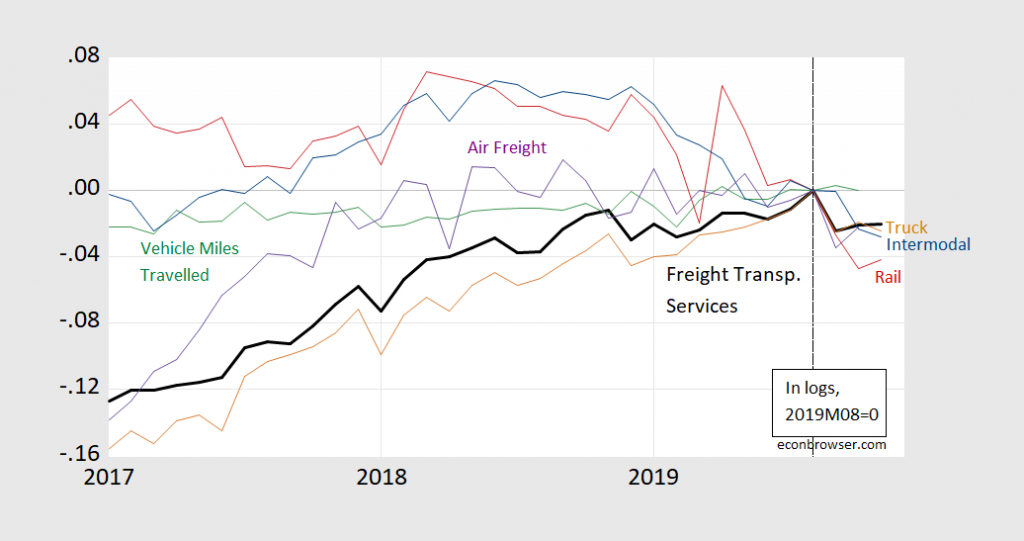

Planes, Trains, and Automobiles – and Trucks

Figure 1: Freight Transportation Services Index (bold black), Truck Tonnage Index (tan), Vehicle Miles Traveled (green), Rail Freight Carloads (red), Rail Freight Intermodal Traffic (blue), Air Revenue Ton Miles of Freight and Miles (purple), all in logs, 2019M08=0. Source: BTS via FRED, and author’s calculations.

All series are below peak.