A tweet:

I am fine with govt. helping people pay bills. But the idea that the spending will actually increase GDP is the Keynesian argument that I find very misguided.

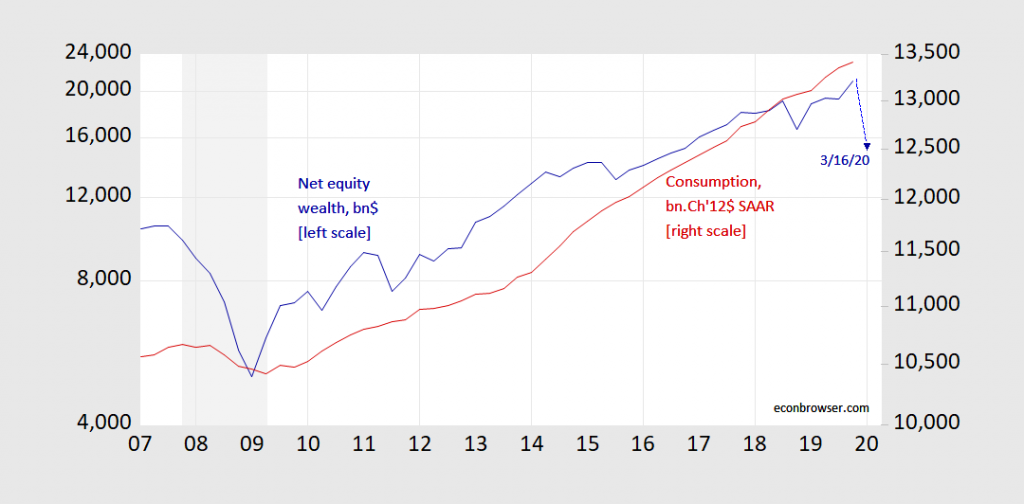

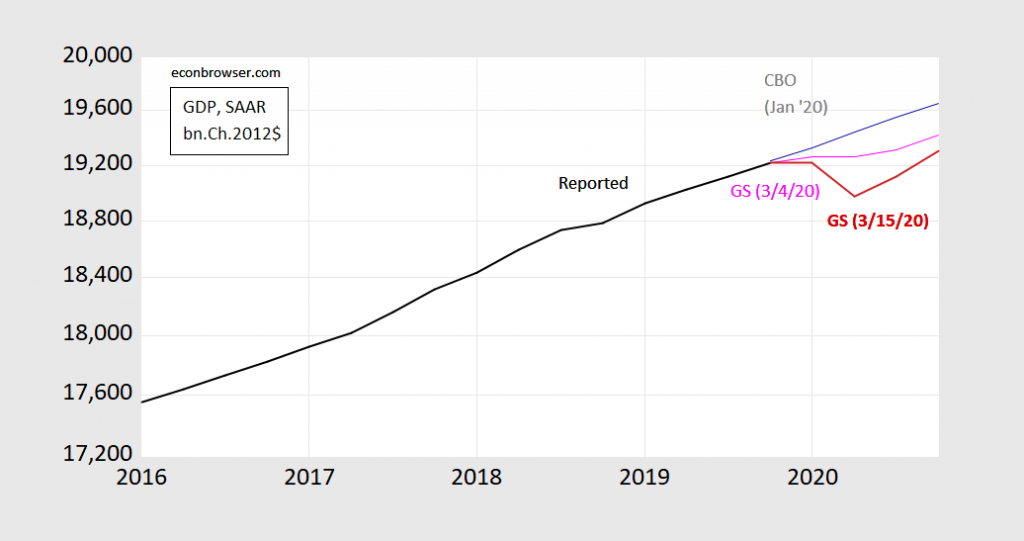

So, here it is useful to have a model discipline one’s arguments (textbook I’m using this semester, here, includes Classical as well as New Keynesian models). Fiscal stimulus, particularly some that have proposed, involves transfers (SNAP, unemployment insurance payments). Helping people pay bills presumably makes aggregate demand higher (by virtue of enabling greater consumption) than it otherwise would be. If there is slack in the economy (which is likely if lots of people can’t pay their bills), then higher aggregate demand will lead to higher output.

If higher demand results in higher production, that means that income necessarily is higher than it otherwise would be, and likely disposable income. That would then mean consumption should be higher; but that would mean higher aggregate demand, and hence higher output, and higher income, leading to a repeat cycle – albeit at a lower rate.

In other words, we have the Keynesian multiplier process. In the presence of slack in the economy, output will rise. Of course, assume that output falls entirely because of reduced production capacity (not a single person reduces consumption because they aren’t being paid), then increased transfers won’t do anything.

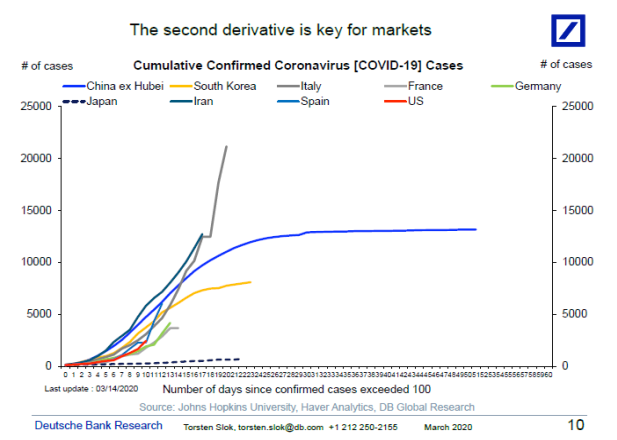

How likely is that condition?

The capacity for some people to engage in internally inconsistent reasoning and writing is breathtaking.

More on multiplier estimates here.