Q/q Chinese growth in 2018Q3 is estimated at 1.6% (not annualized), after downwardly revised 1.7% rate in Q2. Y/y growth was 6.5%. [1] [2]

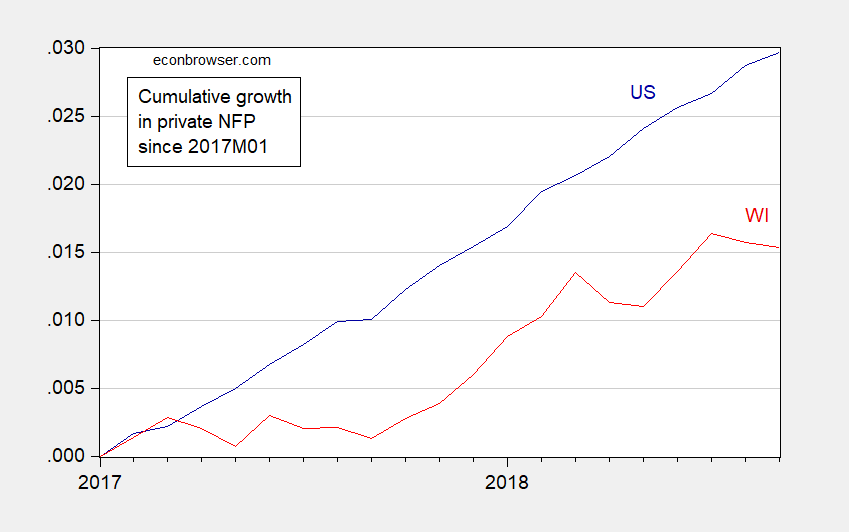

Private Nonfarm Payroll Employment Growth in US and Wisconsin (Not Pretty!)

Wisconsin Labor Force, Civilian, Total and Private Nonfarm Payroll Employment All Decline

August total NFP and private NFP also revised downward.

Continue reading

Guest Contribution: “The role of debt dynamics in US household consumption”

Today, we are pleased to present a guest contribution written by Vincent Grossmann-Wirth and Clément Marsilli (Banque de France) summarizing their chapter in the book International Macroeconomics in the wake of the Global Financial Crisis edited by L. Ferrara, I. Hernando and D. Marconi. The views expressed here are those solely of the authors and do not reflect those of their respective institutions.

The Fed: Drumpffeind

So sayeth Donald Trump today. From FoxBusiness:

“My biggest threat is the Fed,” Trump said on Tuesday during an interview with FOX Business’ Trish Regan. “Because the Fed is raising rates too fast, and it’s too independent,” he complained.

Ashok Mody at UW: “EuroTragedy: A Drama in Nine Acts”

The effectiveness of large-scale asset purchases

That’s the topic of a piece I put up at VoxEU, which draws on my comments at a recent conference at the Brookings Institution.

N. Dakota “orphan soybeans” at 236 million bushels

That’s from WaPo. In 2017, the US exported 1.2 billion bushels to China: North Dakota’s orphan soybeans today are nearly 1/5 of total sales to China in 2017…

Continue reading

Guest Contribution: “The New NAFTA”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

Trump: “I think the Fed has gone crazy”

Implicitly, Trump is saying John Taylor is crazy, since the original Taylor rule would imply even faster rises in the Fed funds rate (I am inferring from Professor Taylor’s discussion of neutral rates. Below I plot the implied Fed funds rate, assuming no interest rate smoothing, the Laubach-Williams one-sided estimate of the real natural rate, and a target variable of 4 quarter PCE inflation.