A few years ago, most economic models presumed that interest rates were subject to a lower bound of zero. Why lend a dollar to someone who only promises to pay you back 99 cents, when you could just hold on to the dollar yourself? But we now have several years of experience from Sweden, Denmark, Switzerland, Japan, and the European Central Bank in which the central bank successfully induced negative interest rates in hopes of stimulating a greater level of spending on goods and services. We have enough data now to take a look at how much that seems to have accomplished, and update my earlier discussion of this topic.

Continue reading

Stephen Moore: “When It Comes To Electric Power, Coal Is No. 1”

That’s a title of a July 28 piece in IBD. He writes:

According to the Energy Information Administration, which tracks energy use in production on a monthly basis, the single largest source of electric power for the first half of 2017 was…coal.

Stephen Moore’s Analysis of Income Taxes and Employment Growth

Further Documentation on “Stephen Moore Is a Liar”

Or statistical incompetent, just for the record for the new year.

The Year in Review, 2017: Fighting against Normalization of Lying

Last year’s recap was subtitled “Triumph of the Blowhards”. So far, my plea for the return of rational policy analysis (let alone facts) has failed to occur. But the struggle for sanity must continue.

Quartets: Music by Laura Schwendinger

That’s a new CD of my wife Laura‘s music, just released by Albany Records.

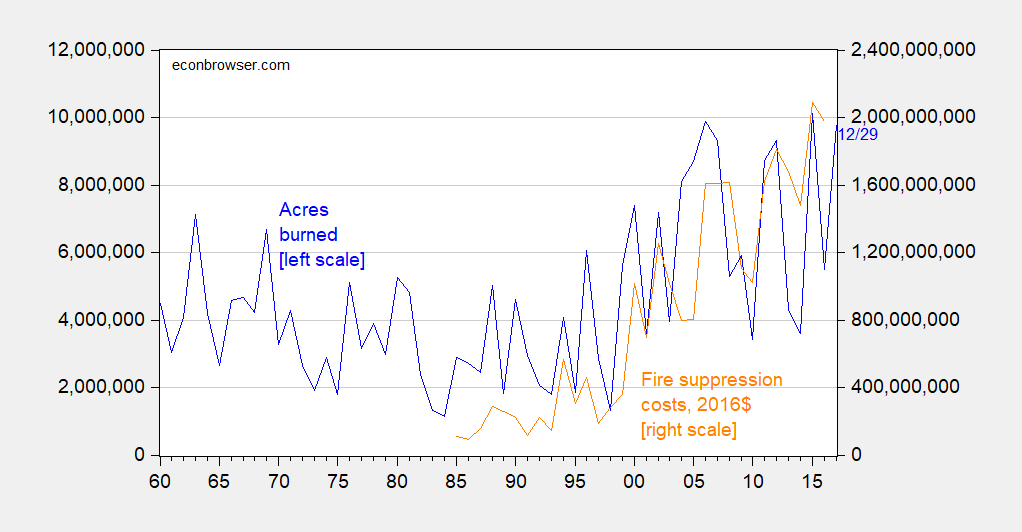

Acres Burned, through 29 December

Figure 1: Acres burned (blue, left scale) and total Federal firefighting expenditure in 2016 dollars (orange, right scale). 2017 observation is for acres burned through 29 December. Source: NIFC1, NFIC2, and author’s calculations.

But remember: “Global warming is a total, and very expensive, hoax!”!!!

Wisconsin in Recession?

I doubt it, but it’s more likely than an ongoing recession in California. Wisconsin year-on-year GDP growth lags, personal income and wages/salaries growth are both bouncing around zero.

California in Recession?

That’s what Ironman asks at Political Calculations, and he answers his question thusly:

Going by these [household survey based labor market] measures, it would appear that recession has arrived in California, which is partially borne out by state level GDP data from the U.S. Bureau of Economic Analysis.

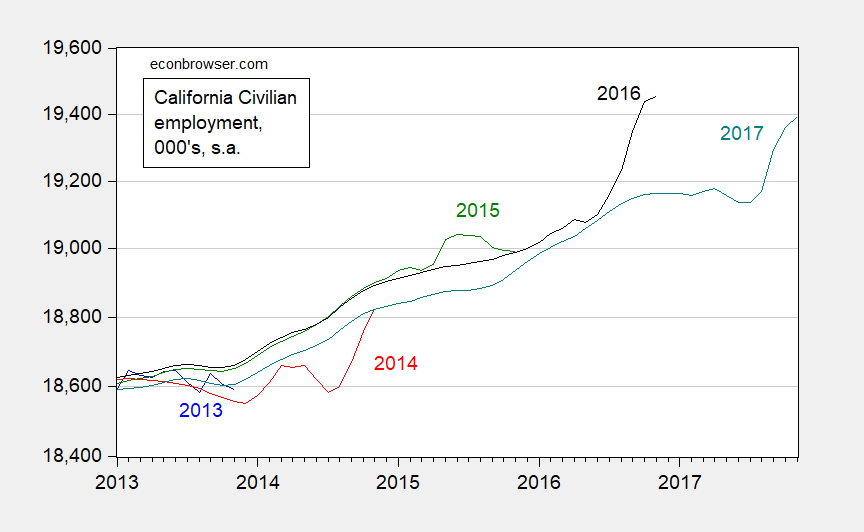

Beware the State Level Household Employment Series: California Edition

Some analysts continue to infer short term trends solely based on household labor market series compiled at the state level. Here are two pictures showing why focusing on the household over establishment could be misguided.

Here are various vintages of the November release for California household/civilian employment series.

Figure 1: Civilian employment from household survey in California, from November 2013 release (blue), November 2014 release (red), November 2015 release (green), November 2016 (black), and November 2017 (teal), all seasonally adjusted. Source: BLS via ALFRED and FRED.