Last year’s recap was subtitled “Triumph of the Blowhards”. So far, my plea for the return of rational policy analysis (let alone facts) has failed to occur. But the struggle for sanity must continue.

January. Don’t reason from accounting identities. From More on the Trade Deficit and Economic Growth:

In an EconoFact post from Saturday, Michael Klein and I noted that usually for the US, the trade deficit grows during times of robust economic growth.

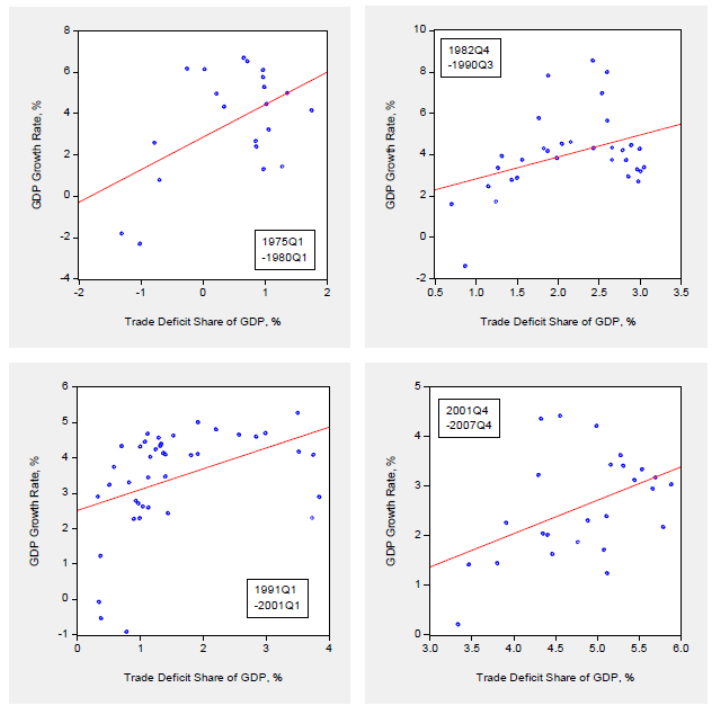

Here I provide an additional way of looking at the relationship between growth and trade deficits — namely scatterplots for the periods from recession trough to peak.

Figure 1: Annualized q/q real GDP growth, % against nominal trade deficit as share of nominal GDP, % for recession trough-to-peak samples. Source: GDP 2016Q3 3rd release, NBER, and author’s calculations.

Notice the clear correlation — as growth accelerates, trade deficits widen.

To understand how thinking in accounting terms can lead to misleading inferences, consider the statement in a Washington Post opinion piece, Peter Navarro and Wilbur Ross wrote:Net exports are currently running at a negative $500 billion annually, a direct subtraction from growth.

While this is true in terms of accounting, it’s a misleading statement. Consider a firm with revenues of $3 million, and labor and materials costs of $1 million, and hence profits are $2 million. The $1 million in costs are a direct subtraction from $3 million in revenues, but if no labor and materials were purchased and costs $0 million, profits would not be $3 million, but zero.

February. The President feels unappreciated because he doesn’t credit for something that happens almost all the time. From The Media Fails to Report the Sun Rose Today:

President Trump is upset that the media missed this economic event:

“The media has not reported that the National Debt in my first month went down by $12 billion vs a $200 billion increase in Obama first mo”

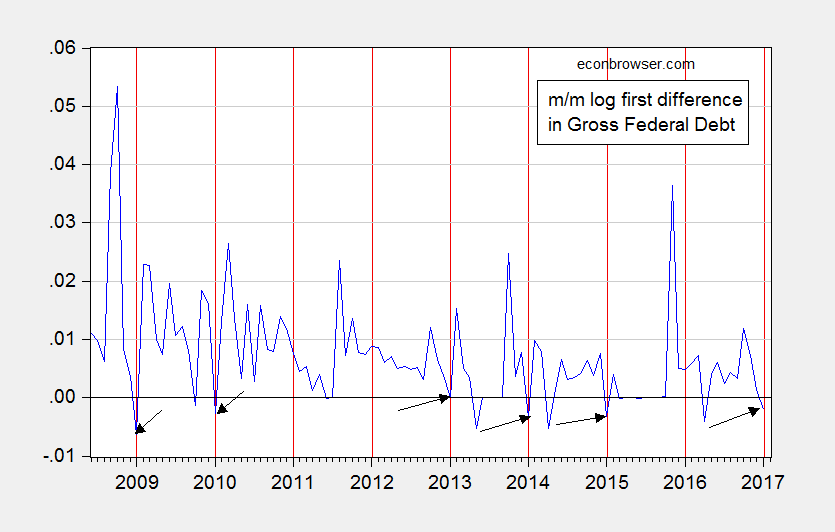

I do not have the stats for Inauguration + 1 month data, but here is end-of-month data through January 2017 for total Federal debt.

Figure 1: Log first difference of monthly total Federal debt (blue), and red lines at January. Arrows at non-positive January entries. Source: Dallas Fed, and author’s calculations.

Notice that a reduction in debt in January happens more often than not. A regression of this series on a constant and a January dummy over the period 1947M01-2017M01 yields a January coefficient of -0.0036, t-stat of 5.6 (HAC robust standard errors). In words, gross Federal debt drops on average 4.3% (annualized) in January relative to average growth. . . .

March. Forecasting critiques from the least qualified. From Nowcasting with OMB Director Mick Mulvaney:

Since Mr. Mulvaney has been criticizing the numbers produced by the BLS [1], and scoring by CBO [2], I thought it of interest to see Mr. Mulvaney’s record on predictions. To make things easy on Mr. Mulvaney, I thought it would be more fair to evaluate his “nowcasting” abilities.

In July 2016, Mr. Mulvaney gave a speech to the John Birch Society in which he observed:

the Fed’s actions have “effectively devalued the dollar” and harmed economic growth.

It is difficult to assess the economic growth assessment without a counterfactual. However, we can easily observe what has happened to the dollar, as of July 2016, when Mr. Mulvaney provided his nowcast. . . .

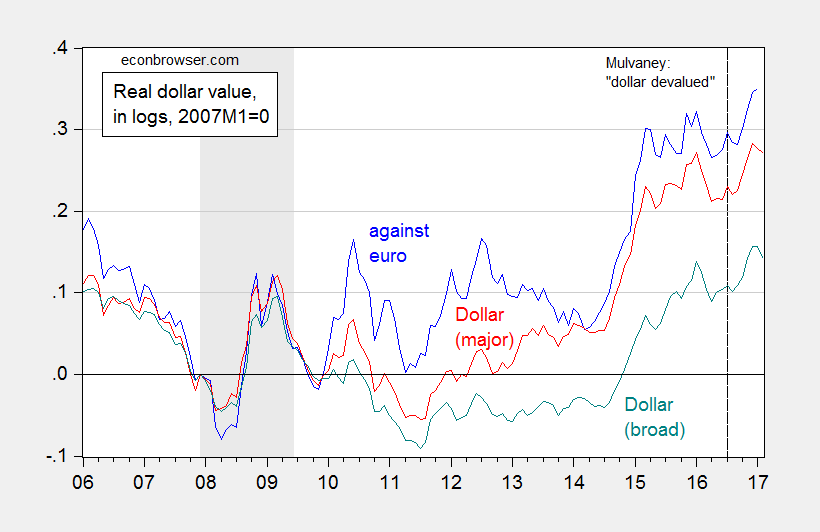

[H]ere is the picture in inflation adjusted (“real”) terms:Figure 2: Log real EUR/USD exchange rate (blue), value of USD against basket of major currencies (red), and against broad basket of currencies (teal), all normalized to 2007M12=0 (up is stronger dollar). Adjustment using CPI’s. NBER defined recession dates shaded gray. Dashed line at time of Mulvaney’s statement on dollar devalued. Source: Federal Reserve Board via FRED, NBER, and author’s calculations.

Note that at the time of Mr. Mulvaney’s “dollar devalued” statement, the dollar was actually fairly strong, as compared against the previous decade. So, if Mr. Mulvaney is not even aware of how the dollar fares at a given instant, in a world of readily available data, how are we to take his assessments of data validity (e.g., from BLS), or scoring (from CBO)?

On a separate note, is this statement a Freudian slip of some sort on the part of Mr. Mulvaney?

“I don’t believe the facts are correct”

You can’t make up this stuff.

April. Take ALEC predictions, invert them, and you have actual economic performance. From State Employment Trends: Some Selected States and ALEC Rankings :

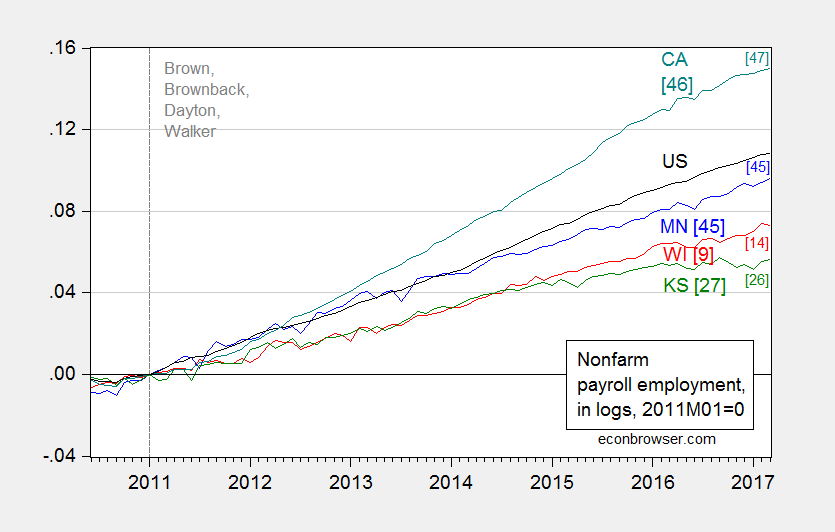

Since 2011 — when Scott Walker and Sam Brownback came into power — California has powered far ahead of Wisconsin and Kansas. The newly released Rich States, Poor States, 2017 allows us to look at how four states, both low and high ranked by Arthur Laffer et al., fared, employmentwise.

Figure 1: Log nonfarm payroll employment for Wisconsin (red), Minnesota (blue), California (teal), Kansas (green) and the US (black), all seasonally adjusted, 2011M01=0. ALEC-Laffer State Economic Outlook rankings for 2016 and 2017. Vertical dashed line at beginning of terms for indicated governors. Source: BLS, Rich States, Poor States and author’s calculations.

Wisconsin was ranked 9th in RSPS 2016, and had what at best was lackluster employment growth over the subsequent year. California has been consistently ranked very low by ALEC, and yet has outperformed.

For formal statistical analyses relating ALEC rankings to economic outcomes, see this post.

May. One instance of “alternative statistics”. From Stephen Moore Is a Liar:

Or a statistical incompetent. Or both.

(I know, in the grand scheme of lying, this is small bore.)

I just heard Stephen Moore of Heritage Foundation saying we had a trillion dollar budget deficit, in a debate on CNN about the Paris Accord (1:42PM CST).The FY 2017 budget deficit is $603 billion, according to the just released budget (see Table S-1). Add his serial lying to the statistical atrocity that is the ALEC-Laffer-Moore-Williams index, and all I can say is Mr. Moore should not be paid as a “CNN economic analyst”.

Update, 7:14 PM Pacific: I’d forgotten this tabulation of errors by Mr. Moore. The man has no shame.

Bonus: Rick Stryker writes that facts don’t matter.

In a similar fashion, does Moore’s mistake matter for the argument he was making? Moore’s point was that the Paris Accord obligated nations to spend 100 billion annually on climate “research” by 2020. So far, about 10 billion has been collected, with the US pledging 3 billion of the total. If those proportions hold, that means the US would be contributing 30 billion per year. And it won’t stop there. Moore knows that the number will climb, with the US contributing enormous amounts of money annually to a new international climate boondoggle organization, which will spend enormous amounts of US taxpayer money on useless studies, fly climate bureaucrats around to conferences (probably first class), agitate for new regulations, etc.

If we have that kind of money to throw around, why aren’t we spending it on Americans to serve their needs, especially when we have to borrow large sums every year? Whether that large sum is 600 billion or a trillion doesn’t really matter. We shouldn’t be doing it. I agree with Moore.

This is the quote of the year; it highlights the intellectual and moral rot at the heart of the Trump era.

June. From Pangloss in Wisconsin:

In search of a “supply side success” after the end of the Kansas experiment, conservative observers turn to Wisconsin. The Manhattan Institute’s Mr. Riedl declares victory:

Wisconsin’s job growth over the past six years has been extraordinarily strong.

When last we met Mr. Riedl, he was explaining why fiscal policy could have no impact on GDP because, well, because. That does not augur well for his abilities an economic analysis, and indeed we can easily poke holes into the argument that Wisconsin’s doing just great!

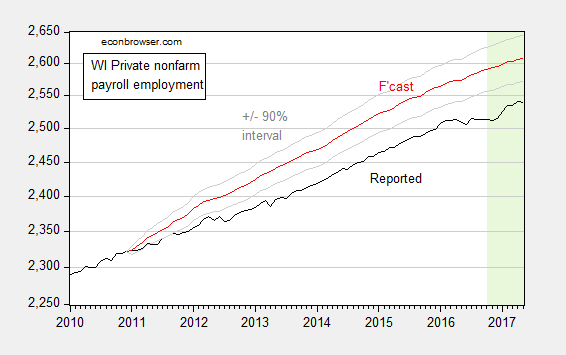

… let’s compare what Wisconsin private nonfarm employment looks like against a counterfactual based upon the historical correlation between US and Wisconsin log employment (nUS and n respectively). To do this, let’s estimate an error correction model over the 1994M01-2010M12 period (so up until just before the Walker administrations):(1) Δnt = -0.0036 – 0.036×nt-1 + 0.027×nUSt-1 – 0.178×ΔnUSt + one lag of first differences + ut

Adj-R2 = 0.65, SER = 0.0015, DW = 2.02, Obs.=204, sample 1994M01-2010M12. Bold face denotes significance at the 10% MSL, using HAC robust standard errors.

I then use this equation to dynamically forecast using ex post observations on national employment (this is sometimes termed an ex post historical simulation). I plot this forecast plus the 90% forecast interval against reported employment in Figure 2.

Figure 2: Wisconsin private nonfarm payroll employment, May release (black), and out-of-sample forecast (red), in 000’s, s.a. 90% forecast interval (gray). On log scale. Light green shading denotes data not yet benchmarked to QCEW data. Source: BLS and author’s calculations. See text.

Regression output is here. The methodology roughly follows that in Chinn (JPAM, 1991).

The results indicate that Wisconsin private employment has been lagging what one would have expected given historical correlations with US employment.To paraphrase the President, again: “Sad”. …

July. When incoherence meets ignorance. Mr. Trump on Economics and Accounting:

“For many, many years, the United States has suffered through massive trade deficits. That’s why we have $20 trillion in debt. So we’ll be changing that.”

This statement was made during the meeting with the South Korean President on June 30th [1]

Observations

- The United States has experienced large trade deficits for years, starting with the Presidency of Ronald Reagan.

- Gross Federal debt at the end of 2017Q1 was $19.8 trillion.

- The US trade deficit is the excess of exports over imports. It is measured in a variety of ways. On a national income and product accounts (NIPA) basis, net exports is -$562.8 billion (Seasonally Adjusted at Annual Rates, SAAR) in 2017Q1.

- The gross national debt is the cumulated Federal budget balance, including interest accrued, and includes debt held by other agencies of the Federal government (e.g., Social Security trust funds).

- Net Federal government saving on a NIPA basis was -660.3 billion (SAAR) in 2017Q1.

- The budget balance and the trade balance (net exports) are:Budget balance ≡ taxes – government transfers – government spending

Trade balance ≡ exports – imports

- These two accounting identities are pertain to different sectors – one is the (Federal) government sector, the other the aggregate economy with respect to the rest-of-the-world.

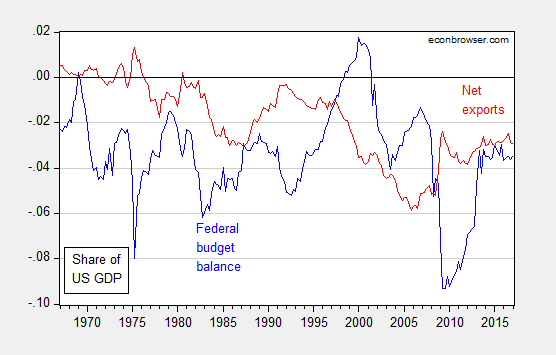

The fact that the two deficits are unrelated in accounting terms does not mean that they are not somehow economically related. However, a causal mechanism has to be laid out in order to make the argument they are. Take a look at Figure 1.

Figure 1: Share of Federal government net saving (blue), and net exports (red), as share of nominal GDP. Source: BEA, 2017Q1 3rd release.

It’s clear the correlation, even with a lag, does not always fit in with President Trump’s story. And the correlation changes over time. To the extent they are related, I would say the causality more likely goes from budget balance to trade balance, rather than the reverse. For instance, higher government spending leads to a budget deficit, and at the same time higher imports due to higher consumption of imported goods, and less exports and higher imports due to an appreciated currency (Figure 2).

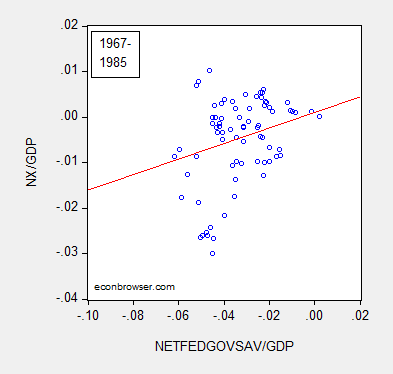

Figure 2: Share of Federal government net saving vs. net exports, as share of nominal GDP, 1967-85. Source: BEA, 2017Q1 3rd release.

Or, a positive shock to investment leads to higher income, a boom in tax revenues, so the budget balance improves. But higher economic activity draws in more imports (for consumption, investment purposes).

Figure 3: Share of Federal government net saving vs. net exports, as share of nominal GDP, 1986-07. Source: BEA, 2017Q1 3rd release.

Or something else, like the US growing faster than the rest-of-the-world.

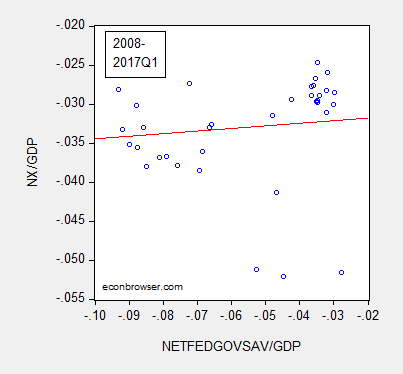

Figure 4: Share of Federal government net saving vs. net exports, as share of nominal GDP, 2008-2017Q1. Source: BEA, 2017Q1 3rd release.

It could be that Mr. Trump meant to point to US net indebtedness with respect to the rest-of-the-world, as summarized by the US Net International Investment Position. However, this is not quite correct, as the NIIP (which includes equities and direct investment) does not match up with the cumulated current account deficit. External debt kind of does, but even that is not exact (and it’s not clear why cumulated current account balances should equal only the net position in debt).

So, I am forced to conclude (and here I’m going out on a limb(!)), Mr. Trump is (not for the first time) confused.

August. The strangest definition of dead weight loss ever – it’s like the person writing didn’t understand basic microeconomics. From What’s the Dead Weight Loss of a Consumption Tax When Externalities Are Present?:

Or, Ironman at Political Calculations mangles Econ 101. Again.

Political Calculates takes on the issue of the Philadelphia soda tax issue, asking specifically “Who is really paying Philadelphia’s controversial soda tax? And how much, if at all, has it affected the economy of the City of Philadelphia?”

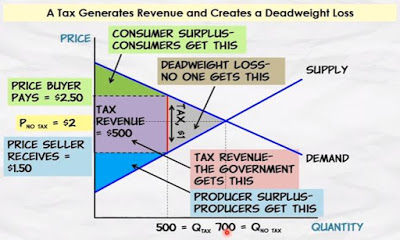

A little online tool to calculate tax incidence and dead weight loss (DWL) is provided, motivated by the following graph:

Source: Political Calculations.

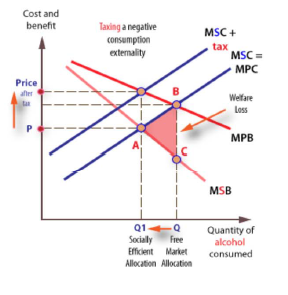

Now, the funny thing is that the graph is appropriate when no externalities exist. But the reason for imposing the tax is to internalize the negative externalities associated with consuming sugary drinks. That means that, contrary to the graph provided by Political Calculations, the marginal social benefit and marginal private benefit (i.e., demand) curves do not overlap.

If the marginal social benefit of consuming a soda is less than that of private benefit, then one obtains the following graph (substitute “soda” for “alcohol” in the figure below).

Source: EconomicsOnline.

The imposed tax is assumed to fully internalize the externality. The tax incidence calculations are correct, but the dead weight loss calculation offered by Political Calculations is wrong in this context. In fact, in this case, the DWL is exactly zero. Only by assuming away the externality is the DWL calculation correct.

It might be that Political Calculations believes there are no negative externalities associated with soda consumption; if so, he should mention it, given that’s a key reason the tax is there.

As an aside, Political Calculations provides an odd definition of DWL:

If a deadweight loss exists, it represents the amount of economic activity that has been directly lost because of the imposition of the tax, which tells us the degree to which the city’s economy may have shrunk as a result.

I don’t think I’ve ever seen such a definition of DWL. I think of DWL (in Political Calculation’s context) as the cumulation of excess social benefit over social cost, for all the foregone units of consumption arising from the tax; in his graph, he thinks it’s for units 501 to 700. So, it’s a welfare loss, expressed in dollar terms, under various assumptions regarding the nature of utility functions.

This discussion exercise illustrates the adage that a (very) little knowledge is a dangerous thing. At a minimum, bloggers should complete reading an entire intro micro textbook before writing about micro.

If you want to see Ironman mangle the use of economic statistics, see this post.

September. In Mr. Trump’s mind, Puerto Rico is eclipsed by NFL players kneeling, and (since September) just about anything else. From At Least Nero Fiddle:

From the Twitter feed of realDonaldTrump, commenting on the crisis in Puerto Rico this morning:

Such poor leadership ability by the Mayor of San Juan, and others in Puerto Rico, who are not able to get their workers to help. They want everything to be done for them when it should be a community effort. 10,000 Federal workers now on Island doing a fantastic job.

Mr. Trump has suggested the difficulty in delivering assistance to the 3.4 million American citizens in Puerto Rico is due to geography.

“We’ve gotten A-pluses on Texas and in Florida, and we will also on Puerto Rico,” Trump said at the White House. “But the difference is this is an island sitting in the middle of an ocean. It’s a big ocean, it’s a very big ocean. And we’re doing a really good job.”

Here is a relevant comparison, from WaPo:

After an earthquake shattered Haiti’s capital on Jan. 12, 2010, the U.S. military mobilized as if it were going to war.

Before dawn the next morning, an Army unit was airborne, on its way to seize control of the main airport in Port-au-Prince. Within two days, the Pentagon had 8,000 American troops en route. Within two weeks, 33 U.S. military ships and 22,000 troops had arrived. More than 300 military helicopters buzzed overhead, delivering millions of pounds of food and water.

No two disasters are alike. Each delivers customized violence that cannot be fully anticipated. But as criticism of the federal government’s initial response to the crisis in Puerto Rico continued to mount Thursday, the mission to Haiti — an island nation several hundred miles from the U.S. mainland — stands as an example of how quickly relief efforts can be mobilized.

By contrast, eight days after Hurricane Maria ripped across neighboring Puerto Rico, just 4,400 service members were participating in federal operations to assist the devastated island, an Army general told reporters Thursday. In addition, about 1,000 Coast Guard members were aiding the efforts. About 40 U.S. military helicopters were helping to deliver food and water to the 3.4 million residents of the U.S. territory, along with 10 Coast Guard helicopters.

Leaders of the humanitarian mission in Haiti said in interviews that they were dismayed by the relative lack of urgency and military muscle in the initial federal response to Puerto Rico’s catastrophe.

“I think it’s a fair ask why we’re not seeing a similar command and response,” said retired Lt. Gen. P.K. “Ken” Keen, the three-star general who commanded the U.S. military effort in Haiti, where 200,000 people died by some estimates. “The morning after, the president said we were going to respond in Port-au-Prince . . . robustly and immediately, and that gave the whole government clarity of purpose.”

Rajiv J. Shah, who led the U.S. Agency for International Development during the Haiti response, said he, too, was struggling to “understand the delays.”

“We were able to move more quickly in a foreign country, and with no warning because it was an earthquake, than a better-equipped agency was able to do in a domestic territory,” he said.

Here’s an assessment of Puerto Rico recovery effort, around a 100 days post-hurricane.

October. Why not base your entire CEA report on one unpublished study … From A Curiously Non-Quantitative Assessment of Deregulation Effects on Economic Growth

And a funny choice of citations.

The CEA released its first “report” under the leadership of Kevin Hassett. The report, entitled The Growth Potential of Deregulation, is summarized thusly:

Excessive regulation is a tax on the economy, costing the U.S. an average of 0.8 percent of GDP growth per year since 1980. This taxation by regulation has increased sharply in recent years, with approximately 500 new economically significant regulations created over the last eight years alone. Through a thorough review of the literature, the Council of Economic Advisers (CEA) finds that deregulation will stimulate U.S. GDP growth.

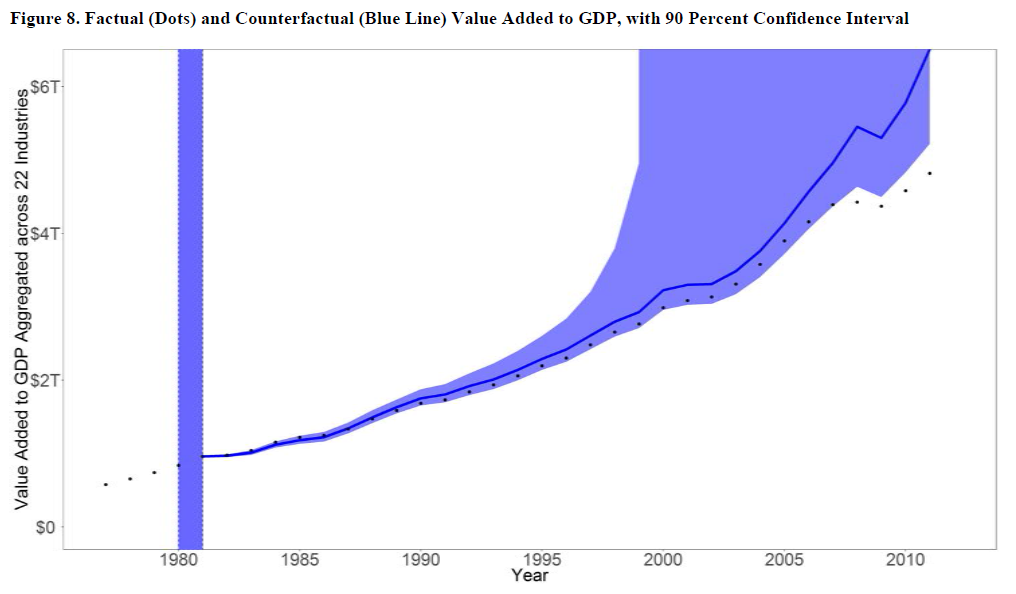

Interestingly, the report’s highlighted number is based on this paper:

Coffey et al. (2016) estimates that if we held fixed the number of industry relevant regulations at levels observed in 1980, the U.S. economy would have been about 25 percent larger (roughly $4 trillion) in 2012. According to the study, the cumulative effects of regulation have slowed economic growth in the United States by an average of 0.8 percent per year since 1980. This amounts to a loss of approximately $13,000 per capita.

The figure is from Coffey, Bentley, et al. “The Cumulative Costs of Regulation.” Mercatus Working Paper, Mercatus Center at George Mason University, Arlington, VA (2016).

In other words, the one quoted definitive number regarding output growth is drawn from an unpublished working paper. Now, endogenous growth models are not my specialty, but my impression is that the empirical evidence in favor of endogenous growth models is not overwhelming. The estimation approach is Bayesian, involving a nonlinear equation (as far as I can tell). My experience with estimating nonlinear equations is that they are sensitive to assumptions and starting points. It is interesting to note the several industries where under the counterfactual of no regulation, investment is lower than actual. Perhaps more interesting is the fact that only in 2008 does the actual level of GDP fall below the lower bound of the 90% confidence interval. In other words, 28 years after the simulation begins, output is significantly below predicted under the counterfactual. It’s troubling that the fall occurs in the year in which the economy suffers a major recession. This suggests that the deviation is due to model misspecification (i.e., the model cannot capture the dynamics of the recession) rather than necessarily regulation induces a deviation from predicted.

In any case, it is interesting that this is the source for essentially the only numerical prediction in the paper. The only other one is a regarding regulation in a cross country empirical framework (Djankov et al., 2006). Interestingly, they do not cite the fourth item that pops up when typing in the words “regulation economic growth” in google scholar: Jalilian et al. (2007). That paper concludes:

The results from both sets of modeling suggest a strong causal link between regulatory quality and economic growth and confirm that the standard of regulation matters for economic performance. The results are consistent with those of Olson et al. (1998) who found that productivity growth is strongly correlated with the quality of governance, and Kauffman et al. (2005) who found that the quality of governance has a positive effect on incomes.

In other words, the quality of regulatory framework might be as important, or even more important, than the quantity of regulation.

In any case, if I were to make a bold conclusion like “Excessive regulation is a tax on the economy, costing the U.S. an average of 0.8 percent of GDP growth per year since 1980”, I’d want just a tiny, tiny bit more empirical backing.

November. The (incredible) return of Bill Beach of the Heritage CDA. From Crimes against Economic Analysis:

Well, Sam Clovis is no longer under consideration to be the top scientist at USDA (a good thing given he has no scientific credentials). But Bill Beach is nominated to be Commissioner of Labor Statistics, i.e., heading BLS.

When last we heard of Bill Beach, he had just revised the fantastical forecasts of the Ryan (2011) plan. Recall:

Heritage (Center for Data Analysis) CDA re-adjusted the natural or structural rate of unemployment — and hence simulated unemployment — without having any reported impact on any of the other variables changing

In other words, Heritage’s CDA under Bill Beach’s leadership projected fantastical growth under the Ryan plan. As Macroeconomic Advisers put it:

- We don’t believe this finding, which was generated by manipulating an econometric model that would not otherwise have produced the result.

- That analysis implied other questionable results — some of them probably unintended — including over $1 trillion of net new borrowing from abroad over the coming decade and the construction of several million unoccupied houses.

- We consider the analysis both flawed and contrived, and are concerned it will create the false impression among some legislators that implementation of the Budget Resolution would entail no short-run macroeconomic pain.

Then when roundly criticized about the forecasted 2.8% natural rate of unemployment, CDA re-simulated the CDA model, and magically only the natural rate of unemployment changed, and not a single other one…

Since leaving Heritage at the beginning of 2013, he’s been at Mercatus, VP in charge of policy research.

Well, now he’ll be heading BLS. Here’s Dr. Beach’s bio.

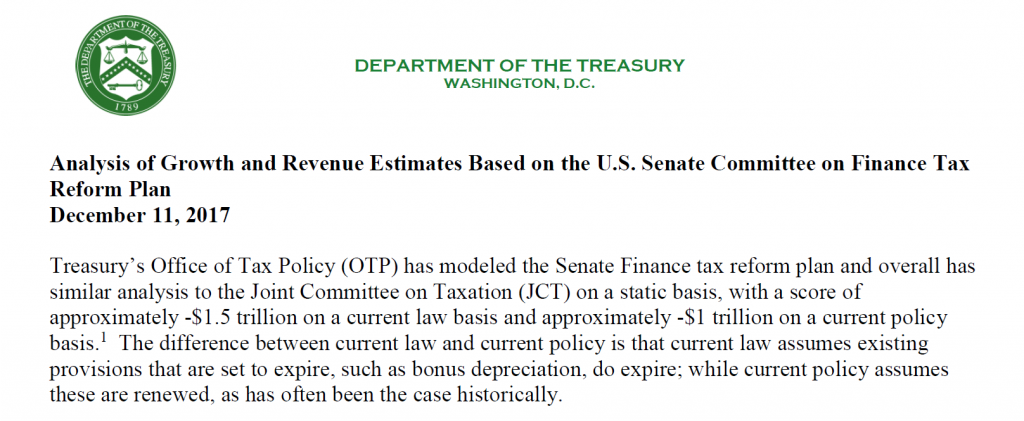

December. This is Mnuchin’s secret study? Pathetic is not the word. Term Papers Due this Friday:

In my classes. And if this were one, I’d fail the author.

Full “report”. All 490 words of it (not including the words in the letterhead). It fits on one page.

More at Bloomberg.

Let’s hope for a better 2018 — one where facts are respected, and the technocratic economic institutions are no longer under assault from the ignorant and the craven.

Menzie,

From a view down under It is pretty clear Trump has a lot of what we call ‘senior moments’. His cognitive abilities are in unquestionably in decline. combine that with a life long ability to boost the Trump brand and you have a person who clearly is delusional some of the time as old people tend to get. In my experience overweight old people deteriorate faster however that could be just my experience.

Remember Saint Ronald of Reagan frequently thought scenes from movies he had been in were real world experiences even the great Winston Churchill went to sleep in cabinet meetings!

IMHO Trump set up ‘fake news’ to avoid people realising what old age is doing to his faculties.

Having said that clearly lying has been part of the Trump repertoire most of his life so it is hard to determine what is deliberate lying and what is simply due to old age.

How is the current dissembling about the budget all that different to what occurred under Reagan? Insert the name Paul Craig Roberts and it is like Deju Vu all over again as your most famous intellectual once said!

It is actually quite shocking to what extent Trump supporters do not understand how Lie-a-Minute President Trump is hurting the US brand name.

It suggests that Americans are of substandard moral character and cannot be trusted in negotiations and deals. It also suggests that Americans are more than willing to disrespect their own so it is natural that they will have little or no regard for others.

It’s actually quite shocking how under-appreciated America is to some foreigners. Worthless words are more important to them than actions.

It suggests some foreigners are very ignorant about Americans, and don’t know how immoral and untrustworthy they are in comparison. It also suggest they’re willing to allow others to die fighting evil and are most generous with other people’s money.

And then there are the apologists for lying.

Just yesterday we had Rick Stryker saying about global warming: “I think Trump used the term “hoax” because he wanted his tweet to be memorable.”

So it doesn’t matter if Trump is lying. It is justified by his motivation to discourage investment in doing anything about global warming. Stryker says Trump is lying for a good cause. (And it isn’t just one tweet. Trump has repeated the same lie in every campaign speech over the last two years and still is today.

And then we have PeakTrader. We get it that he is a racist who just doesn’t like immigrants. But then he tries to justify it by saying that immigrants are the cause of wildfires! And then he says that immigrants are to blame for GDP not keeping up with population growth — despite the fact that GDP has and still is growing faster than population growth.

The way it works for conservatives like Stryker and PeakTrader is that first they decide their preferred policy — tax cuts for the rich, racist immigration policies, ignoring climate change, voter suppression, no health insurance for the poor — and then they invent lies to support those polices. For example, tax cuts pay for themselves, a tax cut for the rich is really a tax cut for the middle class, climate change is a hoax, immigrants cause crime wildfires GDP reduction terrorism whatever, Republican election losses are due to voter fraud, Trump really won the popular vote, Obamacare is failing.

The lies don’t matter, they are necessary, they are justified, because they lead the public to their preferred policy. Facts are meaningless.

Menzie,

I appreciate the award for Quote of the Year (subcategory: that highlights the intellectual and moral rot at the heart of the Trump era). I’m sure those were tough deliberations for the committee. This award will give me a lot of bragging rights in the faculty lounge at the Dept of Free Market Economics at Wossamotta U. So thank you.

However, I feel compelled to point out that on this New Year’s Day that a good New Year’s resolution for you would be to put up a (very long) special post apologizing to everyone you attacked with mistaken analysis over the previous year. You could start the post by apologizing to Stephen Moore. My initial point was that the actual size of the deficit didn’t matter for Moore’s argument. You of course want to distract from his actual point by fixating on whether the debt statistic quote was correct. I followed up in a comment to one of JDH’s posts that Moore had a legitimate reason for his 1 trillion quote. I’ve reproduced that comment below, for ease of reference when you write your apology post. I’d recommend studying the comment carefully so that you can learn how the debt actually works.

Comment on June 10, 2017

Yes, it’s a very good point that users of debt statistics need to be careful when using the numbers these days. A recent post on econbrowser illustrates the point well.

In a previous post, Menzie accused Steven Moore of being a liar or statistically incompetent (or both) since Moore said that the last time he checked the deficit was $1 trillion but in fact the budget deficit is on the order of $600 billion. Here, Menzie was making the incorrect assumption that the budget deficit is always an accurate estimate of the change in borrowing actually performed by the Treasury and that therefore the budget deficit is the only legitimate way to measure that change. I previously commented that the exact size of the deficit didn’t really matter for Moore’s argument, but I’d point out here that Moore was in fact correct. Rather than using the deficit as a proxy for actual borrowing, Moore was measuring actual borrowing as the change in public debt held by the public in the most recent fiscal year (Sept 30, 2015 to Sept 30, 2016), which was 1.05 trillion dollars. The Treasury actually borrowed $1.05 trillion dollars in fiscal 2016, not $600 billion as Menzie incorrectly implied.

However, how do we reconcile the actual fiscal 2016 deficit of $585 billion with the fact that the Treasury actually borrowed $1.05 trillion over fiscal 2016 as Steven Moore correctly asserted? The answer is the point of JDH’s post. In 2016 there were other factors that required the Treasury to borrow an additional $466 billion.

The first major factor JDH covers in this post: extraordinary measures. In 2015, the need to borrow $203 billion fewer dollars was due to the temporary suspension of the daily reinvestment of the Thrift Savings Plan (TSP) Government Securities Investment Fund (G-Fund). As one “extraordinary measure,” the Treasury suspended the reinvestment of the TSP-G fund in Treasury securities since issuances of debt would have caused the debt to exceed the debt ceiling. Treasury moved the balances to an “other” category until the debt ceiling was raised, in which case the TSP-G fund was reinvested with foregone interest repaid in November 2015, requiring $203 billion in additional borrowing.

The other main factor that jdh did not mention was the change in the Treasury operating cash balance. The Treasury increased its operating cash balance by $155 billion over the 2016 fiscal year. The reason for the increase was that in 2015 the Treasury announced that it intended to keep cash balances approximately equal to one week of cash outflows, with a minimum balance of $150 billion.

These two factors alone increased borrowing requirements by $358 billion in 2016 beyond what was required to finance the budget deficit. In the long run, the budget deficit should be a good approximation to the actual increase in borrowing. But in the short run, the budget deficit can depart significantly from the actual change in borrowing. Menzie’s post went awry because he was assuming that the budget deficit is a good approximation to the change in borrowing at any particular point in time. But Moore looked at the change in actual borrowing. On the other hand, it must be noted that Moore’s statement, although correct, was misleading. Borrowing in 2016 was exaggerated by some very significant temporary factors.

Rick Stryker: I’ve posted just for you. Try again.

Rick Stryker Rather than using the deficit as a proxy for actual borrowing, Moore was measuring actual borrowing as the change in public debt held by the public in the most recent fiscal year>/I>

I think you need to apologize to the English language. This is an abuse of language. There is clearly a difference between the concepts of borrowing and the budget deficit. The budget deficit reflects the difference between planned (i.e., “budgeted”) spending and actual spending. Borrowing is a completely different concept. The government can (and does) borrow even if there is no budget deficit. In fact, the government borrows across color-of-money accounts all the time without affecting the budget deficit at all. Anyone who has ever worked for or done studies for government comptrollers understands the difference between budget planning, budget execution and cash management. Borrowing is a cash management tool. A budget deficit is a budget execution term. Very different concepts.

Moore’s statement, although correct, was misleading.

And apparently Moore did not make any after-the-fact effort to correct his “misleading” statement. How difficult would it have been for Moore to fire up his browser and post a clarifying comment at this site? My mother always taught me that leaving a misleading statement uncorrected or unclarified is the ethical equivalent of lying. What did your mother teach you?

rick striker’s mom taught him that lying to achieve his goals is an acceptable action. this is why he has no problems with trump.

For those who missed it, it was only about a year ago that Kelly Ann Conway informed us that because of media laziness and political correctness, we had missed the terrorist-caused carnage of the Bowling Green Massacre. Spokesperson Spicer followed up on that by mentioning one in Atlanta (or maybe Miami?) that had also gone unreported.

We know that because of these tragic events, daily life in these besieged communities will never be the same.

Such fearlessness in search of the truth, especially in the face of liberal failure to report such events, should not go unrewarded.

Build that wall! Bowling Green’s survivors deserve no less.

noneconomist: You don’t understand Rick Stryker logic. Since there was a massacre somewhere in the US committed by someone, then misstating all the facts is perfectly acceptable if it conveys a deeper truth.

And so, Dr. Chinn, the validity of alternate facts. When the Bowling Green Massacre failed to materialize in Bowling Green, there was (no doubt, probably, maybe) a pair of evildoers somewhere doing evil.

Thus, Bowling Green becomes symbolic of a terrorist act that occurred (no doubt, probably, maybe) but went unreported because the lamestream media was unaware of its existence simply because it never happened.

Well, you have to give Stephen Moore credit when he accidentally tells the truth about the Republican tax bill in a Bloomberg interview:

“It’s death to Democrats,” said conservative economist Stephen Moore, who advised Trump’s campaign on tax policy. “They go after state and local taxes, which weakens public employee unions. They go after university endowments, and universities have become play pens of the left. And getting rid of the mandate is to eventually dismantle Obamacare,” Moore said in an interview, arguing that it would accelerate “a death spiral” in the health-care law’s marketplaces.

it is interesting that capping the salt deduction is equivalent to taxing a tax. one would have thought the conservative view would be against double taxation. except when it hurts the democrats…

St Paul-Minneapolis likely attracted more skilled labor from nearby states, has faster population growth, and its economy became even more diversified than Milwaukee.

“Minnesota state economist Laura Kalambokidis says the Minneapolis area has a diverse economy that helped it rebound from the recession more quickly than the rest of the country. “I see the state and the Twin Cities as a bellwether for the rest of the country.”

Minneapolis, where the unemployment rate was the lowest among large metro areas in the country, standing at just 2.3% in October. Weekly wages for private-sector workers increased by more than 4% from a year earlier during the second quarter, according to Labor Department data.”

It seems, a strong reinforcing virtuous economic cycle, like in Minneapolis or San Jose California, results in stronger growth than where an old cycle has slowed, is dying, hasn’t started, or is beginning to start slowly, like in Milwaukee or Wichita.

Humans have lied and exaggerated since we acquired language. Lying to protect or obtain economic and political gains is nothing new. The change is the loss of embarrassment when lies and exaggerations are uncovered. It’s not limited to the US, but we are taking it to new heights. I suppose that P. Trader and R. Stryker are bots used by powerful elites. They have yet to provide information in the sense of something unexpected that seems to be true.

As for Trump suffering from late life dementia that also fails to pass the test.

Why are my comments being deleted or otherwise not showing up???