Some observers argue the rise in unemployment insurance claims signals we are in, or soon to be, in a recession (e.g., [1]). Here’s an alternative view (A follow up on “So you think we might be in a recession today” Part I, Part II, Part III, Part IV, Part V, Part VI, as well as “So you think we might be in recession as of mid-June”, Part I and Part II, and “So you think we might be in a recession as of mid-July”.)

From R. Walker in Goldman Sachs today:

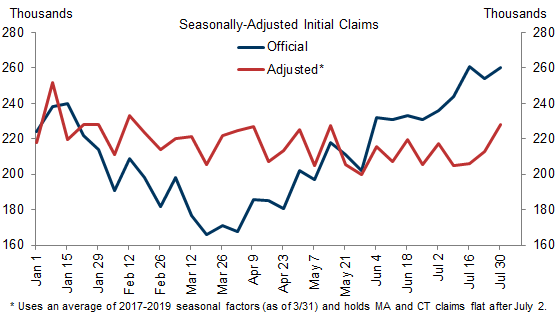

Initial jobless claims have increased by nearly 100k since their March low of 166k. While the level of claims remains historically low at 260k, the rapid deterioration has convinced some market participants that the labor market has slowed by more than other indicators might suggest.

However, we find that two distortions explain most of the increase in initial claims. First, about half of the rise appears to be a statistical illusion resulting from residual seasonality that appeared after the Labor Department reintroduced multiplicative seasonal adjustment to the series earlier this year. …

Second, there have been outsized increases in initial claims in Connecticut and Massachusetts over the last month (roughly +20k in total) that likely overstate the actual number of layoffs.

After adjusting for these two distortions, GS concludes there’s been a much less pronounced increase in unemployment insurance initial claims.

Source: Ronnie Walker, “Explaining Away the Recent Rise in Initial Jobless Claims,” Goldman Sachs, August 10, 2022.

If one is dubious of these adjustments, one can also calculate a 3 year change in the seasonally unadjusted series to see if indeed claims are rising rapidly.

If this has any relation to the decision to raise rates AGAIN .75, I’ll spare readers my skipping vinyl LP.

Great graph though, and quality post.

Off topic –

A number of recent comments have mentioned labor productivity, which has suffered a sharp drop in recent official data. Those data rely on the business output component of GDP data for recent quarters. Those data have yet to be fully revised and had raised a lot of questions.

I’m too lazy to jump through all the hoops necessary to reproduce the formal calculation of the GDP based productivity series with GDI. Here, though, is a simple GDP/aggregate hours vs GDI/aggregate hours picture:

https://fred.stlouisfed.org/graph/?g=SGde

Productivity may not have fallen off a cliff. We don’t know yet.

While we’re at it, aggregate hours worked rose at a 3.5% annualized are in Q1, 3.4% in Q2:

https://fred.stlouisfed.org/graph/?g=SGhD

That rise, combined with the decline in measured GDP, accounts for the rapid drop in measured labor productivity (more or less). Well, we know lots of people are being pulled into jobs who have limited wok experience, and that lots of people are moving from jobs in which they have greater experience to jobs inwhich they have less, so we should expect those people to be less productive than average in their new jobs, for a while.

However, a record-large two-quarter decline in productivity calls into question the management skills at U.S. firms. Driving down productivity at a record rate by expanding labor costs is just weird. It’s not what hiring managers have spent the past several decade doing. It could have bad consequences for one’s career. And it isn’t consist with high profit margins, which many firms continue to report despite rising input costs.

So maybe we need to hold off planning a funeral for U.S. productivity until the revisions are in.

These are great comments.

“However, a record-large two-quarter decline in productivity calls into question the management skills at U.S. firms. Driving down productivity at a record rate by expanding labor costs is just weird.”

Seems to me that’s consistent with a too-tight job market. The firms don’t do this because they want to. They do it because they have to. It’s a seller’s market for labor. For firms losing people left and right, the people left over are working longer hours and productivity is suffering for it. The firms that are getting workers are paying big premia for them and getting lower skill than they would have not long ago. Plus, with the exit threat, many workers feel less pressure to look productive.

It also shouldn’t be surprising that this is a time when there’s a perceived rise in the power of organized labor (see Amazon). It’s not much but it’s something.

All consistent with lower productivity and higher wages.

You know what I would love to see?? (And maybe it’s out there already and I didn’t know about it??) is a ratio that strictly depicts administrative/executive salaries and number of administrative/executive positions in relationship to U.S. forms productivity levels. Wouldn’t that in large part answer your question?? Because I am willing to bet that this hypothetical number not only doesn’t exist, but that it will never exist, because that is the number that would really hold corporations feet to the fire, instead of b*tching and moaning every time they have to raise a frontline worker’s salary 10cents.

Give me that damned number/stat, with a comparison to itself over the last 10 years, and I’ll show you who the real f*ck-ups of American productivity are.

https://www.cnbc.com/2022/07/18/mcdonalds-franchise-owners-back-no-confidence-vote-on-ceo-survey-says.html

* I obviously meant to type U.S. firms, not “forms”/

the Labor Department reintroduced multiplicative seasonal adjustment to the series

Hmmmm….I wonder why the BLS reintroduced multiplicative seasonal adjustments. You would only use a multiplicative adjustment if there was a change in the seasonal amplitudes. Just looking at the NSA data it isn’t obvious that there’s been any big change in the seasonal amplitudes:

https://fred.stlouisfed.org/series/M08297USM548NNBR

OK, just one more thing about productivity and GDP revisions –

Have a look at the divergence between the PCE deflator and the GDP deflator in the past couple of quarters:

https://fred.stlouisfed.org/graph/?g=SGiJ

Pretty big. There are a number of reasons that could happen. One possible reason is that too much of nominal GDP growth was attributed to inflation, too little to units produced. If real GDP is revised higher, then oddities in productivity, inflation and the gap between real GDP and real GDI would be resolved.

Plausible. Not hard to believe there’s lots more measurement error in an extreme economy.

I have a close relative who takes Levemir. They had to call 7 pharmacies in their town to find 1 vial. It is the strangest thing, since there is nothing about a shortage of Levemir in the news (there was a recall in May 2021, but I don’t think that effects now). Does anyone have any thoughts on this or reasons why there would be a shortage?? Could it be a regional thing specific to my area?? I just think it’s strange they had to phone 7 pharmacies to find a single vial, and no discussion of it in the news.

Looking at a longer time series on FRED makes this line of recession fear mongering even more dubious–it’s mostly a flattish squigly line except for that wicked big spike for the pandemic and smaller bumps during real recessions. Smart kids are supposed to look at LFPR, but even that doesn’t reveal much except for the demographic shifts in work culture. By the way, I’m not a smart kid, I just try to pay attention to folks like Menzie.

Anecdotally, the past 9 months have seem some churn in various sectors that include tech, finance, pharma, and residential real estate. I regard that as some necessary house cleaning of shaky businesses that were in trouble even before the Pandemic. In general, we have a labor shortage caused by racist immigration policies, bad incentives for families, and massive geographic distortions in housing affordability.

“a flattish squigly line except for that wicked big spike”

These are the correct technical terms.

‘about half of the rise appears to be a statistical illusion resulting from residual seasonality that appeared after the Labor Department reintroduced multiplicative seasonal adjustment to the series earlier this year’

So Princeton Steve’s entire case we are in a RECESSION comes from a statistical illusion in the only series he cares to mention. Never mind the rise in the employment to population rise, the high level of job vacancies etc.

Menzie, rapidly??? AFAIK yours is the only reference to rising rapidly. Why did you use this term?

“AFAIK” isn’t evidence. Here you are picking nits while ignoring the point being made. But then, economics doesn’t really matter to you, does it?

“if indeed claims are rising rapidly.”

Re-read as he did not say they were rising rapidly. He said IF … Now go re-read your good buddy’s Princeton Steve’s repeated claims that this series was rising rapidly.

Oh wait – you just undermined what your buddy has been saying!!!

@MD & Ole bark, bark, further adjusting already adjusted noisy data and then removing/lowering the two high outliers amounts to typical liberal economics analyses to allow some credibility to questioning the validity of the original NOISY DATA. Valid analysis just doesn’t matter to you, does it?

Wow! Removing two high outliers changes the trend line? Some times the blind acceptance and ignorance of you folks do amaze.

https://fred.stlouisfed.org/series/ICSA

Initial unemployment claims were 890 thousand as of Jan. 9, 2021. Anyone who claims 260 thousand is high either has no clue or has no integrity.

https://www.msn.com/en-us/news/world/russia-sent-steven-seagal-to-occupied-ukraine-to-spread-propaganda-part-of-his-role-as-a-kremlin-spokesman/ar-AA10wlmt

Steven Seagal joins the Putin poodles? I always thought he was so overrated. I guess he needed the cash.

https://www.cbsnews.com/news/gas-prices-below-4-first-time-5-months/

Gasoline prices dipped to just under the $4 mark for the first time in more than five months – good news for consumers who are struggling with high prices for many other essentials. AAA said the national average for a gallon of regular was $3.99 on Thursday.

Well the Michigan state guard how to come to the aid of one gasoline station when Bruce Hall went on a rampage demanding that gasoline be sold to him for $0.32 per gallon.

https://www.bls.gov/news.release/ppi.nr0.htm

BLS reports PRODUCER PRICE INDEXES – JULY 2022

The Producer Price Index for final demand fell 0.5 percent in July, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today…The index for final demand goods fell 1.8 percent in July, the largest decline since moving down 2.7 percent in April 2020. The July decrease can be traced to a 9.0-percent drop in prices for final demand energy.

Yea the producer price index is higher than it was as of July 2021. Stay tuned for the usual Bruce Hall two step: (1) claiming at first that this was a reduction in the rate of change of PPI; and when that is debunked (2) advocating PPI has to fall to its level in 1980.

https://jabberwocking.com/ppi-a-leading-indicator-for-consumer-inflation-plummeted-in-july/

Kevin graphs the good news from the BLS on PPI, which fell last month. OK excluding food and energy core inflation is still positive but lower.

An interesting site for some economic data. Shows month/month with individual links to press releases. I’m sure everyone else uses it all the time, but it’s new to me. Very clean presentation.

https://www.census.gov/economic-indicators/

I have consulted with this website since Bush43’s first term. Our host cites it often especially when it comes to international trade data.

Gee Bruce – you are indeed slow.

off topic, but continued work seems to indicate the coronavirus came from the wuhan wet market rather than the research lab.

https://www.wired.com/story/tracing-covid-pandemic-origins/

if that is indeed the case, it is quite unfortunate the lab was located so close to the origin. it resulted in wasted efforts focused on the lab, that could have been refocused on the contents of the wet market. time was lost. and a certain sector of politicians weaponized that coincidence in a way that has not been good for the world.

@ baffling

Not that what you stated isn’t important (it is important) but I think the broader and more important point to be made here, is that since the Covid-19 most likely came from bat feces that got on another animal and then was probably touched by human hands at the wet market. the important action now and going into the future is strong enforcement against and destruction of wet markets. This is the main way to eliminate future dangerous viruses originating out of China, and less weaponization of stereotypes relating to mainland Chinese and food hygiene. If those stereotypes truly bother mainland Chinese, they will destroy the wet markets, and enforce better hygiene habits at any and all street located markets.

Or…….. Birds virus circa 2002, Covid circa 2020, we can do this “It’s deja vu, all over again” inside the next 15–20 years and China can have another baby fit that all the world community is “picking on” China AGAIN.

I think if I were them, I would just eliminate the wet markets~~~but far be it from me to challenge “ancient Chinese wisdom”. I outlasted both of the major viruses originating in China, one while living in China. If they enjoy this stain on their culture they can “have at it again” See if I care.

https://www.sixthtone.com/news/1009250/saving-chinas-wet-markets

One thing I’ve noticed is, seemingly anyway, mainland Chinese have a hard time understanding the concept of microbial bacterium. Both tapeworm and hepatitis were still major problems when I lived there (post 2000). It reminds me of the old joke my Dad said he saw in an old Army training film back in the late 1940s. They were trying to teach young naive soldiers about the dangers awaiting them, including venereal disease. And the young man/victim in the film said “She sure looked clean”

IUCs continue to rise this week. Gasoline and diesel consumption recovered a bit, but remain depressed. Atlanta Fed has moved to +2.5%.

Why can’t you provide a link to FRED? Like this:

https://fred.stlouisfed.org/series/ICSA

Oh wait if you did everyone would see this series fell from July 16 to July 23. Yea it has risen back to 262,000 which is not that high.

So as I have said over and over – YOU LIE.

And of course as this post shows what little increase we have had of late is a statistical illusion.

Come on Steve – you have lied to us too often about too many things.

And there goes Ole if he’s writing he’s lying, at it again. Why didn’t he show the 1Y version of the chart? https://fred.stlouisfed.org/series/ICSA

Moreover why would he focus on a single week’s data? I think he is so ignorant to totally misunderstand how data movement works? (Hint: it’s not a single dot!)

Then he has the gall to call some one pointing out the CONTINUING upward trend for a major part of the current year a liar?????

If he’s writing he’s lying.

https://nypost.com/2022/08/11/armed-gunman-threatens-fbi-building-in-ohio-report/

Authorities in Ohio were locked in a standoff Thursday with an armed man who made threats against the FBI building in Cincinnati, sparking a chase and shootout. The incident began after the gunman “attempted to breach the Visitor Screening Facility” at around 9 a.m., the FBI’s Cincinnati office confirmed, adding that the suspect fled north “after an alarm and a response by FBI special agents.” NBC News, citing two sources, reported that the man fired a nail gun toward FBI personnel at the agency building and flashed an AR-15 style rifle before fleeing.

This the kind of MAGA domestic terrorism one would expect when even Republican members of the Senate falsely accuse the FBI the way they have of late in defense of their mob boss criminal traitor Donald Trump. Republicans are asking to defund the FBI? Some supporters of “law and order”.

I’m left to assume this is Bruce Hall’s an CoRev’s favorite Republican candidate right now, until donald trump runs for the 2024 presidency??

https://twitter.com/AccountableGOP/status/1556647005442789385

Surely Bruce Hall is going to come to “tough guy” American Football playing Herschel’s defense?? Nothing says “Republican tough guy” better than beating the crap out of your wife every other day. Choking your wife, aiming a gun at your wife’s head. That’s all “I’m a real man” Republican proof right there.

The people who ran this ad need to take their party back before Trump has us all killed.

Did “Not Trampis” write this editorial?? I thought even Professor Chinn might get a couple chuckles out of this one (found on Twitter):

https://www.theshovel.com.au/2022/08/10/the-shovels-view-on-the-fbis-raid-on-donald-trumps-home/

So many excellent lines, so little time. My personal fav?

As Trump supporters put it so clearly yesterday, if this can happen to a President, it could happen to anyone who has committed insurrection, assault or fraud. That’s a chilling thought.

I may get addicted to this Australian publication. Not Trampis has failed us by not notifying us of its existence:

https://www.theshovel.com.au/2022/08/10/donald-trump-offered-trade-commissioner-role-in-perrottet-government/

“Trump has listed himself as his personal referee. He has confirmed that he will be able to organise the best trade deals. Really beautiful trade deals, that a lot of people – smart people – will be talking about.”

Hahahahahahaha!!!!!! I’m dying!!! I’m dying people!!!!! Hahahahaahaha!!!!!!

However one government insider pointed out that Trump does not hold any formal qualifications, has never held a NSW trade role and has never lived overseas before. “So he ticks all of those boxes. He’s the ideal candidate really”.

That describes Peter Navarro, Lawrence Kudlow, and a lot of other advisors to the 45th “President”.

I’ve said it before and I’ll say it again. I’m Democrat, and I would consider voting for her for U.S. President. She and John Kasich fit into a minutely small group of Republicans I would consider voting for.

https://twitter.com/Liz_Cheney/status/1557737986812366852

Dude, DICK Cheney – Darth Vader himself – put out an ad for his daughter calling Trump the biggest threat to the Republic in its history.

This is like Bizarro America. My head can’t stop spinning.

I 100% agree. I was trying to think of some corollary situation. Give me a few hours to think of something, but nothing is hitting me right now. I was going to say when Ross Perot and Pat Buchanan agreed on trade issues, but I don’t even think that one comes close to this.

At the risk of sounding too reverent to Professor Chinn, we might ask him., I think he has shown a natural interest in history and politics. Maybe he can think of a similar freakish interrelationship during “interesting times”.

@ AndrewG

Well, this sad mechanical thing inside my cranium I call a “brain” has failed us. Luckily we have the internet. Here are some weird ones, Mark Meadows even made the list~~didn’t see that one coming:

https://www.businessinsider.com/nine-famous-political-friendships-transcend-party-lines-2018-11

AG Garland calls Trump’s bluff:

https://www.msn.com/en-us/news/politics/justice-dept-seeks-to-unseal-search-warrant-of-trump-home/ar-AA10yYAk?ocid=msedgdhp&pc=U531&cvid=33c02482b2ed4cbbab5d7061f1a715a6

The Justice Department has asked a court to unseal the warrant the FBI received before searching the Florida estate of former President Donald Trump, Attorney General Merrick Garland said Thursday, acknowledging the extraordinary public interest in the case.

The court has given Trump until 3PM tomorrow to object.

In a post to his Truth Social platform, Trump said that his “attorneys and representatives were cooperating fully” prior to the search, and that government officials “could have had whatever they wanted, whenever they wanted, if we had it.”

That is clearly a lie. News came out today that DOJ had issues subpoenas for these documents which Trump refused to comply with. Then again Trump lies about EVERYTHING.

If you can tolerate a 20 second commercial at the start, this is worth watching, Menzie, this is an 11 minute video. Lawyers talking on msnbc, very low chance of vulgarity:

https://www.msnbc.com/deadline-white-house/watch/andrew-weissmann-garland-s-message-to-trump-was-put-up-or-shut-up-145980485850

Pretty big news:

https://www.theguardian.com/us-news/2022/aug/12/fbi-search-trump-mar-a-lago-home-classified-nuclear-weapons-documents-report