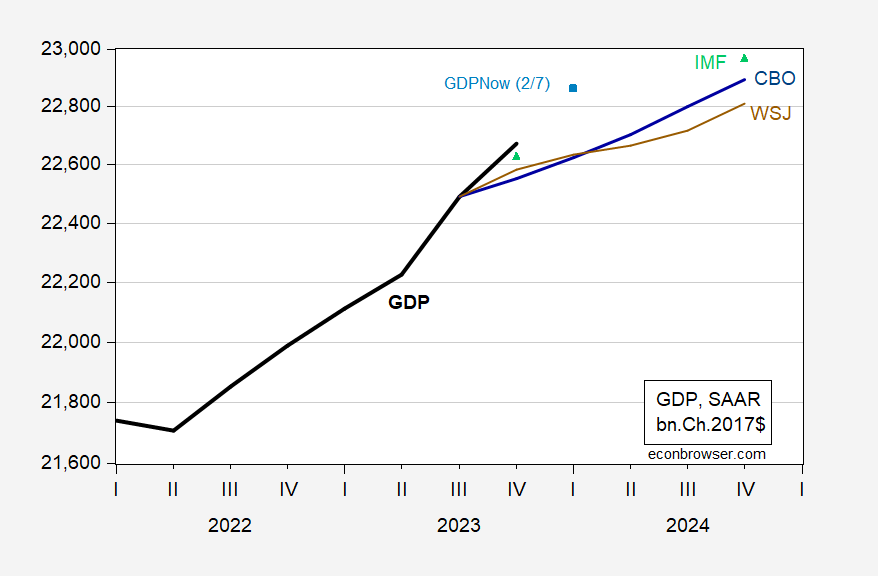

CBO has released its Budget and Economic Outlook, with projections for GDP (based on data from early December). This is their GDP projection based on current law, compared to other forecasts (IMF, WSJ survey mean), and today’s GDPNow.

Figure 1: GDP as reported (bold black), CBO (blue), WSJ (brown), IMF (light green triangles), GDPNow (2/7/2024) (sky blue square), all in bn.Ch.2017$ SAAR, on log scale. Source: BEA, CBO (February), WSJ (January), IMF (January), and Atlanta Fed (2/7), and author’s calculations.

Note that all the forecasts/projections were made or based on data before the release of 2023Q4 GDP figures.

Today’s GDPNow for Q1 reads 3.4% q/q AR.

Video of briefing, here.

CBO’s forecast for corporate profits taxes/GDP has it falling from 2.0% in 2024 to only 1.3% in 2034. Now I get a part of this is due to its forecast of the ratio of corporate profits to GDP falling from 9.7% in 2024 to 9.0% in 2034 but there seems to be some presumption that taxes/profits are supposed to fall. If any of the adults here (yea Jonny boy we do not want your stupid rants on this serious topic) know what’s going on here. After all, the Trump tax cut for the rich had already lowered the statutory rate as well as set up all sorts of means for gaming the tax system.

“there seems to be some presumption that taxes/profits are supposed to fall.” Why would anyone presume that? Does a leopard change its spots?

https://www.nakedcapitalism.com/2024/02/the-real-reason-your-grocery-bill-is-still-so-high.html

Hey dumba$$, try Reading the damn report

pgl didn’t read the report! What it says:, “ New information about corporate profits has prompted CBO to increase its projections of profits over the coming 10 years. After the previous projections were released, BEA revised data about the size of past profits, raising the value of domestic corporate profits at the end of 2022 from 9.2 percent of GDP to 10.4 percent. In addition, corporate profits declined less in the first three quarters of 2023 than CBO had expected. (Data for the fourth quarter of 2023 will be released in March.) For those reasons, CBO has raised its forecast of domestic corporate profits at the end of 2023 from 7.4 percent of GDP to 9.8 percent and its forecast of profits at the end of 2024 from 7.7 percent of GDP to 9.7 percent. And whereas last February CBO projected that domestic corporate profits would reach a long-term size of 7.9 percent of GDP by 2033, the agency now expects them to equal 8.9 percent of GDP in 2033.”

CBO got surprised this year by the recent strength of profits…no reason to believe they won’t be surprised next year, particularly since they have not suffered from high interest rates and real wage gains.

But pgl revels in telling us just how much Corporate America has been suffering, even with near record profits and near record profitability..corporate shill!

Johnny is once again pretending to read minds rather than addressing the issues:

“pgl didn’t read…”

“…pgl revels in telling us…”

“pgl thinks…”

“Ducky’s doppelganger slithers out…”

What’s the point of ad hominem attacks? Well, if someone position, say Johnny’s for instance, doesn’t hold water, then as a last, desperate attempt to avoid admitting defeat, one (Johnny, for instance) might attempt to distract us from substance by rolling in the mud.

Not a pleasant spectacle, but a spectacle, none the less.

“BEA revised data about the size of past profits, raising the value of domestic corporate profits at the end of 2022 from 9.2 percent of GDP to 10.4 percent. In addition, corporate profits declined less in the first three quarters of 2023 than CBO had expected.”

How mentally retarded are you? Seriously dumba$$. I originally was clear I was referring to the forecast from 2024 to 2034 not the past. And after your first asinine and stupid comment, I repeated that I was talking about the future.

Come on Jonny boy – your preK teacher is trying really hard to get her worst student ever up to a 1st grade reading level but it seems you are not even trying.

Macroduck

February 8, 2024 at 4:35 pm

Thank you but it is much worse than you can ever imagine. Read my original comment and my follow-up after Jonny boy jumped in with stupid comment.

I was crystal clear (on both occassions) I was referring to the CBO FORECAST over the next decade (2024 to 2034) but my mentally retarded stalker keeps taking about the past two years.

I have an extremely low estimate of Jonny boy’s IQ (which I said was in the single digits) but it seems I have been overestimating this moron’s IQ.

pgl is telling us to forget past trends, only look at unreliable forecasts!

“Those who forget history are doomed to repeat it.”

Oligopolistic price gouging and profits’ increasing share of GDP are not going away just because pgl chooses to ignore history.

JohnH: For a guy who thought the government was suppressing median wage data, and who mocked the Ukrainian counteroffensive in Sept. 2022, you are pretty cocky about criticizing those who are misunderstanding the past.

You might want to check the correct quotation of Santayana, which is: “Those who cannot remember the past are condemned to repeat it.”

If I may be so bold, here is a brief recounting of your many errors of statement.

https://econbrowser.com/archives/2024/02/recession-in-2022

https://econbrowser.com/archives/2024/01/re-post-distributional-data-from-the-national-income-and-product-accounts

https://econbrowser.com/archives/2023/12/russia-invasion-skeptics-on-the-eve-of-the-war

https://econbrowser.com/archives/2023/09/arguments-about-the-output-gap-2017

https://econbrowser.com/archives/2023/08/defense-equipment-investment-and-depreciation

https://econbrowser.com/archives/2023/08/whose-side-are-you-rooting-for

https://econbrowser.com/archives/2023/07/timing-chips-act-or-military-keynesianism

https://econbrowser.com/archives/2023/04/on-illiteracy

https://econbrowser.com/archives/2023/04/is-the-lagged-one-year-inflation-rate-a-good-predictor-of-five-year-ahead-inflation

https://econbrowser.com/archives/2023/01/lumber-prices-and-lumber-futures

https://econbrowser.com/archives/2022/11/how-to-end-and-endless-debate

https://econbrowser.com/archives/2022/10/lng-contribution-to-goods-exports-balance-of-payments-basis

This is a non-exhaustive list. However, please do continue posting comments. I use them in my classes as examples, now that CoRev has been banned.

Yves Smith talks about PAST inflation in the food sector and my mentally retarded stalker claims this undercuts any CBO forecast of overall corporate profits over the next decade? Not only is this dumber than a retarded rock but it does not address the question I asked – which is why is the CBO telling us corporate taxes will fall relative to corporate profits over the next decade.

Hey Jonny boy – I specifically told you not to comment. Do you know why? Because I recognized that any of your asinine and stupid comments would have nothing to do with the question I asked. So little baby troll – bug off as NO ONE here gives a rat’s rear end about any of the stupid trash you write.

pgl thinks the recent oligopolistic pricing behavior will just go away because it’s a new year! Keep dreaming, corporate shill. If anything, oligopolistic pricing abuse will get worse, since the price gouging of the pandemic years has shown them how much they can get away with with impunity.

Hey dumba$$. For the 3rd effing time – I have clearly been talking about the CBO’s forecast not the past. I did not endorse the forecast but rather asked a simple question about how it was translating this into a forecasted drop in profit tax collections/GDP.

Seriously dude – if you cannot read at a preK level, then you need to get off this blog and listen to your nursery school teacher.

Page 35 of the CBO report:

Other Factors. Various other factors are projected to reduce corporate income tax revenues as a share of GDP by an additional 0.3 percent between 2025 and 2034. Most significantly, profits on businesses’ domestic activity are projected to decline over the next decade, reducing taxes as a share of the economy. CBO further anticipates that businesses will claim more tax credits in future years, in part because international firms are expected to increasingly report foreign profits earned in jurisdictions with higher taxes. Collections of taxes for years other than firms’ most recent tax years are also projected to decrease over the next decade. Those collections

have been high as a share of tax liabilities over the past several years, but they decline in CBO’s projections to a level consistent with their average over the past decade

Read the 2nd sentence here which is consistent with what I said about the 2nd table in the CBO report. Jonny boy wants to suggest the opposite but he has to pull cherry picked comments which had not a damn thing with my original or follow up comments. Which is to say Jonny boy is a dumb dishonest little irrelevant twit. But what’s new?

BTW Jonny boy could not be bothered with my question about corporate taxes but it seems this passage goes a long way of doing so.

Yes my original comment asked my mentally retarded stalker NOT to comment. Everyone can see why.

An interesting discussion from Greg Ip:

A China-U.S. Decoupling? You Ain’t Seen Nothing Yet

Tariffs haven’t reduced U.S. trade links with China much. Would a 60% rate do it?

https://www.wsj.com/economy/trade/a-china-u-s-decoupling-you-aint-seen-nothing-yet-12c0828e?st=phzekhj1tk9rjes&reflink=desktopwebshare_permalink

The U.S. trade deficit with China fell last year to its lowest in over a decade. This looks, at first glance, like a decoupling of the two economies thanks to the steep tariffs President Donald Trump slapped on Chinese imports in 2018. Trump is spoiling to finish the job, floating a 60%, or higher, tariff on all Chinese imports if he’s re-elected this fall. The U.S., though, hasn’t kicked the Chinese import habit as much as the data suggest. Chinese and Western manufacturers have found numerous ways around tariffs; they are likely to redouble those efforts if the levies go higher. Last year, the overall U.S. trade deficit in goods shrank to $1.1 trillion from $1.2 trillion in 2022, the Commerce Department said Wednesday. As a share of gross domestic product, it fell to 3.9%, the lowest in over a decade. Most of the reduction came via the gap with China. This dropped by more than $100 billion to $281 billion last year, the lowest since 2010.

One reason the deficit shrank is that U.S. importers might have overordered in 2022, leading to swollen inventories and less imports in 2023 even as consumption stayed strong. More fundamentally, the shrinking trade deficit overstates how much the U.S. has reduced its consumption of Chinese-made products. As the trade war heated up, many manufacturers began moving production to other countries to avoid U.S. tariffs. So the U.S. trade deficit with Mexico leapt to $152 billion last year, more than double the 2017 figure. The U.S. last year imported more from Mexico than China for the first time in at least 15 years. The deficit with Vietnam ran at $105 billion last year, almost triple the level of 2017. A lot of the value of those increased imports from Vietnam and Mexico actually consisted of inputs originally sourced in China. It’s hard to say how much because of gaps in the data. Still, the McKinsey Global Institute recently reported that even as China’s share of U.S. manufactured imports declined from 2017 to 2020, its share of the value added in goods consumed in the U.S. actually rose. McKinsey noted, for example, that between 2017 and 2022, U.S. imports of laptop computers from Vietnam rose by the same amount as Vietnamese imports of laptop parts from China.

Furthermore, Chinese companies have been exploiting a decades-old provision in U.S. trade law that allows packages worth less than $800 to enter the U.S. duty-free. Federal data compiled by the Yale University economist Amit Khandelwal and a co-author show the number of packages entering the U.S. under that “de minimis” exception has tripled since 2017 to a billion last year.

I’ll see you one Ip and raise you a Paine.

On the subject of people who know a lot about important stuff, here’s an interview with Professor Sarah Paine on trade, institutions, continental vs oceanic powers and a bunch of other stuff. It’s important for an understanding of history, but also of current events – China’s and Russia’s behavior toward their neighbors, the western response to Houthi attacks, the value of and opposition to international institutions. And it’s short, so just read it, for goodness sake!

https://www.noahpinion.blog/p/interview-sarah-c-paine

The US navy should stick to Alfred Thayer Mahan! They have enough problems with Houthi.

Say an USAF retiree.

This first problem with Paine’s analysis is her simplistic division of the world into continental vs. maritime powers. China is a great maritime, economic power, not just a continental power. 46% of its exports go to countries outside Asia. This is very similar to the United States.

https://tradingeconomics.com/united-states/exports-by-country

https://tradingeconomics.com/china/exports-by-country

The second problem is the assumption that maritime powers are predisposed to democratically setting the rules for trade and finance. One of China’s main complaints is that her share of world trade has not been matched by her voting power in international rule setting bodies. Furthermore, the US imposition of unilateral sanctions and tariffs on China is hardly evidence of a democratic rules based order. From its members point of view, BRICS is a much more participatory and democratic organization than the US’ rules based order, which imposes sanctions and freezes on foreign reserves and bans countries from international financial messaging services without approval of many of the world’s major economic powers.

Johnny is pretending to expertise again. He tells little just-so stories as if they are enough to debunk the ideas of his betters.

Johnny’s little story leaves out China’s claim to owning most of the South China Sea. It ignores China’s threats to Taiwan – that’s “participatory”? It ignores the scolarship behind this interview.

I linked to this interview not because it’s the final word on anything, but because it is enlightening. Johnny’s response is the same knee-jerk response he has to everything – if it doesn’t fit his biases, he attacks with Johnny-mumbles.

And Johnny’s biases are well known. He backs Russia’s invasion of Ukranian, he favors monetary policy that risks recession and transfers income to the rich from the rest, he talks like a progressive but never criticizes Republcans, only Democrats, and he favors fake economics over real economics.

“This first problem with Paine’s analysis is her simplistic division of the world”

I fell out of my chair laughing at how a troll with an IQ in the single digits (assuming Jonny boy’s IQ is even that high) can refer to a smart discussion as “simplistic”. Jonny boy cannot even distinguish between forecasts v. historical data.

Sarah C. Paine is the author of:

• Japan caught between maritime and continental imperialism, in Hal Brands, The Makers of Modern Strategy: From the Ancient World to the Digital Age (Princeton University Press, 2023, pages 415-439).

• The Japanese Empire: Grand Strategy from the Meiji Restoration to the Pacific War (Cambridge University Press, 2017).

• The Wars for Asia 1911–1949 (Cambridge University Press, 2012). 2012 Winner of the PROSE award for European & World History[6] and longlisted for the Lionel Gelber prize.[7]

• The Sino-Japanese War of 1894–1895: Perceptions, Power, and Primacy (Cambridge University Press, 2003).

• Imperial Rivals: China, Russia, and Their Disputed Frontier, 1858–1924 (M.E. Sharpe, 1996). Winner of the 1997 Barbara Jelavich Book Prize.[8]

Co-author with Bruce A. Elleman:

• Modern China: Continuity and Change, 1644 to the Present (Prentice Hall, 2010).

Johnny is the author of blog-comment diatribes against economists and Democrats and in favor if authoritarian states.

Johnny says Paine is wrong about her area of scholarship. Just as he has claimed that the entire economics profession is wrong about economics, just as he has claimed that data series which exist do not exist. Funny how arrogance and ignorance so often go together; Johnny is their love-child.

I think I found the video version of the text interview you gave of Miss Paine. Plan on watching it sometime. People’s voice inflections and eyes can often tell you even more about their mental sharpness than even sometimes their writing can—though writing in and of itself is not a bad gauge.

Hey Johnny? Johnny, you like to assign homework. Turn-about is fair play, so here’s a test for you:

The U.S. has a blue-water navy. China doesn’t. Quick question: What factors limit the usefulness of corvettes in maritime warfare?

If you don’t have at least three answers WITHOUT LOOKING THEM UP, you don’t know enought to express an opinion about who is and who isn’t a modern maritime power.

How should one assess the value of naval combat vessel tonnage compared to number of combat vessels in determining maritime power?

If you don’t know WITHOUT LOOKING UP AN ANSWER, you are arrogant to express an opinion regarding maritime power.

What share of China’s border is land vs ocean? What share of the UK’s border is land ve ocean? Japan? The U.S.?

If you don’t have a rough idea without looking up the answer, your faking it when you pretend to know which powers are maritime and which are continental.

These are things the big kids think about. Johnny doesn’t, because facts don’t matter to him. Sarah Paine’s scholarship doesn’t flatter China, this time, so it must be wrong. If Paine’s scholarship were to flatter China in some other context, Johnny would change his tune. If you don’t believe me, just consider his cockamaime position on Monetary policy; high interest rates are good for the poor because if they have fewer jobs, their wages will rise faster than inflation. Really, that’s what his position amounts to. Or his position on Russia’s invasion of Ukraine; it’s Ukraine’s fault and Ukraine would be better off just to give up.

Oh, so Tricky Ducky wants to focus on maritime military power. But Ducky and Paine ignore that economic power typically precedes military power.

“China Is ‘World’s Sole Manufacturing Superpower’, With 35% of Global Output. China’s state-led economic development model and robust industrial policy has transformed it into what an influential European think tank calls “the world’s sole manufacturing superpower”, making up 35% of global gross production – more than the 9 next largest manufacturers combined.”

https://scheerpost.com/2024/02/08/china-is-worlds-sole-manufacturing-superpower-with-35-of-global-output/

Yes, the US currently maintains the world’s most expensive military, but China’s industrial, economic and technological prowess will at some point empower its military to rival the US. That day may come sooner than most expect, given the limits to US military power exposed in Iraq, Afghanistan, Ukraine, and now the Middle East. Heck, even the combined might of NATO can’t supply Ukraine with enough weapons!

The West needs to foreswear confrontation and embrace cooperation, allowing China to participate in setting the rules of the “rules based order” in proportion to its share of international trade. It’s the democratic thing to do, something that Paine argues comes naturally to maritime powers.

Can’t I just put my head under a heavy blanket with my eyes clasped shut than to go down these scenarios regarding the orange abomination?? Or better yet wait a few days until I have some strong drink in the house.

I’ll see you one Ip and raise you a Sachs: “The US government and therefore the mainstream media are promoting the view that China’s economy is in trouble. This is a bit of an echo chamber. One reporter close to the government writes it, and then other reporters repeat the same exaggerated story. They don’t know much about China or about the deep strengths of China’s economy, including major advances in technology, global export competitiveness, and high saving and investment rates.

US attempts to weaken the Chinese economy may have some modest short-run consequences (mainly slower export growth by Chinese companies and modest displacements of investments from China into ASEAN countries) but the adverse effects will not be large, in my view. The US government’s mischief will fail, as it should.

https://www.jeffsachs.org/newspaper-articles/rd6mln7g7taw4pmf4ntw578k6ljja9

ever hear of evergrande?

https://www.businessinsider.com/china-evergrande-property-real-estate-crisis-debts-collapse-what-happens-2024-2

you just can’t make this sh!t up Johnny. it really happened, no matter how much denial and propaganda you spout.

Yeah, and the US CRE market is in big trouble. What’s your point? China’s economy has deep strengths, like being the world’s leading auto exporter.

Underestimating and denigrating the bogeyman du jour is one the main reasons that the US blithely gets itself into pointless and futile quagmires.

My point is issues like evergrande exist in china. And are a big issue. Johnny you seem to be ignorant of both the issue and its implications for china. So consider my post a public service announcement for you in particular. Apparently you are missing important information about china. Thought i would catch you up a bit, even with your denial.

“the US CRE market is in big trouble.”

You have not presented a single bit of real world evidence that this statement is true. Now I did present a very good discussion. That discussion noted that certain regional banks are suffering from a mix of troubled loans and a high cost of funds. Now these banks might benefit if the FED lowered interest rates. But my mentally retarded stalker has said over and over that there is no benefit from lowering interest rates.

Yes – another of the thousands of issues that Jonny boy hasn’t an effing clue about.

Anyone who keeps us with current market news should be aware that “A commercial real estate crash is unfolding, and regional banks are feeling the pain.” https://www.businessinsider.com/commercial-real-estate-crash-svb-collapse-property-woes-regional-banks-2024-2?op=1

So, pgl…where’s your link to your “very good discussion?” Figment or your imagination or reality?

So are you agreeing that China has Evergrande and the US has CRE/regional banks? I wonder if China’s government and media outlets are chortling over the US’ real estate problems like the US media chortles over China’s.

Among his multiple other failings my mentally retarded stalker has a serious memory issue (as noted by our host quite a few times). Now this lying moron says I never posted anything on his little CRE tail. Just 4 days ago (see comments to the Zero Hedge post) I wrote this which is a lot better than the stupid trash we get from Jonny boy:

‘Little Jonny boy declared we do not need more “CRE” which likely means commercial real estate. OK I do not expect little Jonny boy to offer anything more than something a two year old might utter so I found this informative discussion:

https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/are-banks-vulnerable-to-a-crisis-in-commercial-real-estate

Yes remote working has lowered the demand for being in the office but the idea that we will no longer need offices to work in is dumb – even though it is less dumb than Jonny boy’s usual comment. This story, however, does note that the valuations of commercial real estate have fallen but not so much from lower operating profits or cash flows but from higher discount rates. Something little Jonny boy celebrates almost as much as he cheers for the deaths of innocent Ukrainians. Now we do have an issue with some regional banks being incredibly exposed to the fortunes of commercial real estate, And Issue made worse by higher interest rates. The FED chair says this is a manageable problem. Maybe so but only if they ignore the stupid rants from the likes of little Jonny boy.’

Now – someone remind little Jonny boy where he put his lunch money.

US media has reported on cre issues quite a bit. In fact another new york bank has been in the news for failing. But in china, the biggest real estate developers are failing in silence. And the recent liquidation of evergrande resulted in the worthlessness of their foreign bond holdings by the government. This tells you a fair business environment still does not exist in china for foreign investors. But you wont see that reported from the chinese news agencies, which are propaganda forums for the ccp.

Macroduck provides a relevant comment well worth reading and what does my mentally retarded off us? More of his stupid trash. Dude – read the room. NO ONE cares about your worthless stupidity.

‘GT: How do you view the 5.2 percent growth of China’s economy in 2023, the first year of the post-COVID recovery amid global gloom?

Sachs: This is a very respectable performance. US growth was about 2.5 percent. Remember too that the US population is growing about 0.5 percent per year, while population growth in China is essentially zero, so China’s growth advantage is even greater when expressed in per capita terms.’

It seems the esteemed Dr. Sachs never heard of the Solow growth model or the convergence hypothesis. Or maybe your favorite former economist forgot to check the fact that income per capita in China is only 1/4 that of the US.

You know – Dr. Chinn is rather hard on little Jonny boy for not knowing even the most basic economic concepts. Maybe he is being unfair as even Jeffrey Sachs has forgotten about seminal economics from 65 years ago.

What was the name of that movie? Oh yea – Dumb and Dumber!

Ducky’s doppelganger slithers out from his rock pile to insult Jeffrey Sachs! And then he takes a swipe at China’s per capita income, which has only doubled in the past decade…

Talk about Dumb and Dumber!

Yea I figured you have not read Solow’s 1957 seminal article. BTW Jonny boy – have you been watching Bert and Ernie trying to teach you how to tie your shoe laces?

the Chinese miracle relies on large economic growth to pull its many citizens out of poverty. if that growth slows, irregardless of how it compares to the usa, then the Chinese miracle ends. hundreds of millions of Chinese still live in poverty. in that context, this is not respectable performance. that is why xi has done so much to try and keep that growth as high as possible. what does xi tell those hundreds of millions of people who have been left behind because growth stalled? think about it, Johnny.

According to baffling’s metric of success, the US economy has failed because tens of millions of Americans live in poverty.

Maybe commenters on this blog should spend more time talking about the failures of their own economy and less time on GDP growth, which largely mirrors the rising incomes of the top 10%. But, no, of course not…it’s much more fun (for wealthy elites at least) to divert attention to some other guy’s problems…

The criteria is hundreds of millions, johnny. Hundreds of millions. You are off by an order of magnitude. That is a big deal. Obviously large numbers are difficult for you to grasp.

“According to baffling’s metric of success, the US economy has failed because tens of millions of Americans live in poverty.”

Yea Jonny boy is so stupid that he does not realize that the US poverty level of income is far above China’s average income per capita.

There is one comment by Sachs I agree with in full:

“China is the world’s low-cost producer of most green and digital technologies, such as EVs, photovoltaic systems and 5G equipment. This will put China in a strong global position for the coming decade, since the world needs to make a major energy transition and China will be a key provider of the new low-carbon infrastructure, connectivity and appliances.”

Jeffrey Sachs and a lot of other mainstream economists agree with this. But of course little Jonny boy goes on and on claiming we want tariffs on China’s green investment goods. But of course we all know Jonny’s only goal in life is to spread such pointless dishonest trash. Which of course is the major tone of his latest truly insulting rant.

Yeah, yeah, pgl forgets that the US has imposed tariffs on Chinese EVs, which will make them much more expensive to US consumers, delay their adoption, and slow the transition to green economy.”

Despite this, where is the outcry from mainstream economists, erstwhile free trade fundamentalists?

Everytime I think you cannot be more stupid, you prove me wrong. Both I and Dr. Frankel have both noted these tariffs on Chinese EVs and criticized them. Come on Jonny boy – you do not have to work so hard to prove to us that you are a totally retarded troll. We get that already!.

I been trying to sharpen up my economics tool set so have been going back over basic concepts and even trying to learn some of the simpler and more basic equations. While I was messing around online I found these two links on MPC, which I have always found to be a fascinating topic, and thought I would pass them along:

https://budgetmodel.wharton.upenn.edu/issues/2021/2/3/background-mpc-in-2021-economy

https://rstudio-pubs-static.s3.amazonaws.com/576989_b03f8b9569ec48a4af6f7d7ce196eb62.html

I cannot believe America’s MPC is over 0.8. I think 0.6 is much more apt. But then again if people are living “paycheck to paycheck” maybe 0.8 then is a believable figure. But honestly it’s hard for me to grasp it being that high. Maybe it’s my German genes, or maybe because my Dad was age 6 at the worst year of The Great Depression. Don’t think when I had 2 bites left on my plate or half an uneaten dessert he let me forget it.

“Empirical estimates of the aggregate marginal propensity to consume (MPC) in the U.S. range from 0.05 to 0.9 depending on the event and sample of the study.” Now that’s a wide range! Of course it depends on one’s view of Ricardian Equivalence the role of borrowing constraints etc.

BTW I used to teach this by assuming that the MPC out of disposable income (Y – T) = 0.8 but the marginal propensity to tax (t) was 0.25. So MPC(1 – t) would be your 0.6.

Now I gotta read stuff! Why do you do this to me?

@ Macroduck For me reading this is like cleaning up the house after letting it pile up for 6 months, for you the MPC stuff is like eating cherry covered cheesecake at some fancy café. You’ll be like, “Why did he even link this??”

@ pgl I forgot about the tax stuff, but the text I was reading actually mentions that, so I fumbled the ball again

For reference:

https://fred.stlouisfed.org/graph/?g=1gaRp

You can see one problem. That MPC rascal scampers around a lot. And there are lags that should probably be accounted for which this presentation ignores. I’m very happy I don’t do hard-core estimating to earn my bread.

https://history.iowa.gov/history/education/educator-resources/primary-source-sets/dust-bowl/iowa-public-televisions-dust-bowl

When you say “things just aren’t like they were the good ol’ days”, make sure you specify what the hell you are talking about. Sometimes it fits, sometimes it doesn’t.

And now Justice Gorsuch:: “Officer, Officer, Officer, Officer Officer Officer, noun, pronoun, Officer, Officer, Officer, Office, Officer, Officer Officer. [ clears throat ] Officer, Office, Officer, Officer, Officer, Officer. Damn…… am I smart or what people??”

so the interesting thing is that both the senate and house have already voted (bipartisan) and concluded that the January 6 even was an insurrection. and that trump engaged and incited this insurrection. so it is no longer a question of whether trump participated in an insurrection. that is a foregone conclusion.

so now one must consider only whether the office of the president is excluded from somebody who participated in insurrection. for instance, would Robert Lee or Jefferson Davis be permitted to run and be elected to hold office as President of the United States of America. That is the question the Supreme Court should be answering. Not sure they will do so (out of fear of where that answer takes them), but that is their duty. they have failed to perform their duty before, however.

and I will remind everyone, in Colorado, it is the REPUBLICANS who are trying to keep trump off of the ballot. it is a privilege, not a right, to serve office in the United States. personally, I believe trump no longer deserves the privilege of holding office. he should be found ineligible. and if he disagrees, there is a mechanism in place. 2/3 of the house and senate can vote to reinstate his privilege. let the constitution and democracy rule.

“Not sure they will do so (out of fear of where that answer takes them), but that is their duty. they have failed to perform their duty before, however.”

Wise words by you Sir. Odd how a group of people (SCOTUS) can be so pious and at the same time so fearful of making meaningful decisions.

What I heard (and I’m not legal expert) is that the Court will not turn down Colorado on this Officer thing or whether there was an insurrection (there clearly was). But they will turn the State’s Rights issue on its head. The Colorado guy had a great answer to that question which goes something like this. Colorado has served this ball up to the United States Supreme Court to actually enforce the clear language of the Constitution. But this Court is acting like it is too cowardly to doing its effing job to protect our Constitution from a traitor.

Is this what Chief Justice Roberts wants to be his legacy? That his Court was too gutless to save our democracy?

https://www.worldgovernmentbonds.com/bond-historical-data/china/10-years/

China’s 10-year government bond rate is only 2.45%. That is pretty low by world’s standards. Now one would think a high savings rate would lead to lower interest rates and more investment which is the one thing Jeffrey (I never learned the Solow growth model) Sachs got right. But wait JohnH has been telling us that low interest rates automatically means low investment rates. I called Sachs and Jonny boy “Dumb and Dumber”. Let’s be clear – Jonny boy is the Dumber. But you knew that a long time ago.

I wonder how many USA seniors who regularly watch FOX news know who is going to bat for them, while the former U.S. President was telling them to drink bleach:

https://www.usatoday.com/story/news/health/2024/02/01/biden-administration-launches-medicare-drug-price-negotiations/72411019007/

“Thursday’s effort was the opening salvo over Medicare drug price negotiations. Department of Health and Human Services officials did not reveal how much the government’s price negotiators initially offered to pay pharmaceutical companies that make drugs to treat conditions such as heart failure, stroke, diabetes and autoimmune disease.

The drugs include Eliquis, Jardiance, Xarelto, Januvia, Farxiga, Entresto, Enbrel, Imbruvica, Stelara and the insulins Fiasp and NovoLog.

Biden administration officials said the initial offers will start a back-and-forth with drug manufacturers over the spring and summer months. Final prices for the first batch of drugs will be made public Sept. 1, and the negotiated prices will take effect in January 2026.”

Do the above actions sound like a President in senility, or does a fat orange colored man telling them to “go drink a bottle of bleach to cure Covid” seem more close to senility?? These questions (and the decisions tied to them) really aren’t near being complex.

“Drug companies and their industry allies have filed nine lawsuits challenging different aspects of the federal law. So far, the legal challenges haven’t halted the administration’s efforts to haggle for cost savings. The Pharmaceutical Research and Manufacturers of America, a trade group representing drug manufacturers, has argued the federal efforts to implement price negotiations have lacked transparency, discounted patients’ input and could reduce drug industry investments to research lifesaving cures.”

It does seem price gougers can hire high price lawyers to spin all sorts of BS. Biden needs the government lawyer’s to fight back hard.

Here’s a partial explanation for China’s low rates:

https://www.theguardian.com/business/2024/feb/08/china-consumer-prices-plunge-at-fastest-rate-for-15-years-as-deflation-fears-deepen

And, contrary to Sach’s “echo chamber” claim, it comes straight from China’s government stats office.

Sach’s, which is to say Johnny’s, defensiveness about China’s economic performance doesn’t change the fact that China’s youth employment rate is now reported at “just” 15% rather than 20% before the break in reporting so the calculation could be adjusted. It doesn’t change the fact that the stock market recently hit a five-year low. It doesn’t change the fact that China is having to engage in an economic rescue plan. Evergrande has collapsed, and other big residential construction firms are in financial distress which Evergrande’s liquidation could worse. These are facts. Trot out all the Johnny-mumbling and Sach’s defensiveness you want, but facts are fact.

Good comment. And it may have prompted Dr. Chinn’s latest post.

https://jabberwocking.com/does-immigration-really-boost-gdp/

Kevin Drum has been reading this report (we already know from JohnN’s retarded comments that he has not) and takes a stab at this part of the report:

Greater immigration is projected to boost the growth rate of the nation’s real gross domestic product (GDP) by an average of 0.2 percentage points a year from 2024 to 2034, leaving real GDP roughly 2 percent larger in 2034 than it would be otherwise. Real GDP per person, however, would be 0.8 percent smaller in 2034 because of the increase in immigration than it would be otherwise, in CBO’s assessment.

Well yea one would expected income per capita to decline but also read Kevin’s footnote:

GDP will likely be unchanged for most of us. The per capita number goes down only because a bunch of low wage earners are pulling down the average.

We should also note that their “low wage” by US standards is likely going to be higher than they would have earned in their home nation.

I guess commenter Bruce Hall will have to query Mark Steyn to find out if any of the researchers co-authoring this paper are “akin to child molesters”. Isn’t that the Bruce-ie / QAnon way??

https://www.science.org/doi/epdf/10.1126/sciadv.adj4289

https://www.lankford.senate.gov/news/press-releases/lankford-votes-to-acquit-donald-trump/

https://apnews.com/article/congress-border-deal-rejected-lankford-immigration-045fdf42d42b26270ee1f5f73e8bc1b0

Watching Republicans cannibalize each other in the name of MAGA is entertaining. trump says he treasures loyalty. But Lankford was too dumb to realize that “loyalty” is a one-way street with donald trump. Republicans watched as Lankford stupidly walked right into the lion’s den. Now donald trump is spitting out Lankford’s bones from between his teeth, because Lankford tried to solve the same problem donald trump is bitching about. Actually solving the problem does nothing to help donald trump–who presents himself as the answer to “the dark people problem”.

McConnell plays chess, Lankford plays checkers.

Meanwhile, low-educated Hispanics, low-educated Blacks, and low-educated women cannot wait to vote for the orange abomination so he can turn around and crap on their foreheads.

I forgot that Lankford chickened out on the impeachment thing 4 years ago. McConnell and 41 other GOP Senators also ran scared of the Trump mob.

https://digbysblog.net/2024/02/08/the-colorado-case-thuds/

I’m not so sure that one should be so quick to crow about an immigration policy that increases GDP while lowering per capita GDP. Is this really the best we can do? We can’t do both. Or would that cut into corporate profits at the chicken slaughter houses?

As for “We should also note that their “low wage” by US standards is likely going to be higher than they would have earned in their home nation”, this sounds an awful lot like Ron DeSantis bragging about how slavery was a benefit to poor Africans. We can’t do better?

You raise a good point. Cesar Chavez would salute you!

Another reminder to the GOP that immigration has made America great – Immigration to Boost US GDP by $7 Trillion Over Decade, CBO Says

Migrant surge will lift demand and increase the labor force – CBO also projects $1 trillion more in government revenues https://www.bloomberg.com/news/articles/2024-02-08/immigration-to-boost-us-gdp-by-7-trillion-over-decade-cbo-says

Here is the line from CBO report – “In our projections, the deficit is also smaller than it was last year because economic output is greater, partly as a result of more people working. The labor force in 2033 is larger by 5.2 million people, mostly because of higher net immigration. As a result of those changes in the labor force, we estimate that, from 2023 to 2034, GDP will be greater by about $7 trillion and revenues will be greater by about $1 trillion than they would have been otherwise. We are continuing to assess the implications of immigration for revenues and spending.” https://www.cbo.gov/publication/59933

This is a report related to US Immigration from April. I would be surprised if the numbers have changed drastically.

https://www.cbo.gov/system/files/2023-04/58939-Immigration.pdf

Of course according to donald trump Mexican immigrants are not hard workers, they are all just “rapists and murderers”. Which is apparently why Hispanic men and women vote for him in droves, to reward him for labeling them “mostly a bunch of rapists”. Maybe Hispanics will include that in a large screen video of trump saying that during “Hispanic Pride Month”. I assume. This is how Hispanics plan to gain respect from the broader community I assume. “I voted for donald trump!!!–because he thinks I’m a rapist!!!!” Lots of brains there.

Thanks for this CBO report. My somewhat lazy reference to what Kevin Drum said has sparked a really useful dialogue here.

You raise another good point. I thought about adding this revenue boost matter but got a little too lazy. So thank you!

In other parts of CBO: the federal deficit projected to grow from $1.6T in 2024 to $2.6T in 2034.

https://www.axios.com/2024/02/07/us-deficit-interest-rates-cbo-projections

Climate Scientist Awarded $1 Million In Damages In Defamation Suit Win Against Conservative Writers

https://www.msn.com/en-us/money/news/climate-scientist-awarded-1-million-in-damages-in-defamation-suit-win-against-conservative-writers/ar-BB1i0VMa

A jury in the Superior Court of the District of Columbia found the defendants—Rand Simberg, a former adjunct scholar at the Competitive Enterprise Institute, and Mark Steyn, a National Review contributor—guilty of defaming Mann by making several false statements in a blog post and an article published in 2012.

I guess Simberg and Steyn messed up when they relied on Bruce Hall for their defense!

JohnH keeps telling us mainstream economists want to discourage imports of Chinese EVs but little Jonny boy can’t name one of them who has said that. Can we help Jonny boy out here?

https://www.msn.com/en-us/money/markets/cheap-chinese-evs-pose-a-security-risk-to-americans-keep-them-out-economist-warns/ar-BB1i28iG?ocid=msedgdhp&pc=U531&cvid=872b7c7ac72f4eb780401aa2eb3c8ce9&ei=40

Cheap Chinese EVs pose a ‘security risk’ to Americans: ‘Keep them out,’ economist warns

Some U.S. automakers are pulling back on electric vehicle production despite the Biden administration’s green energy push. The void leaves room for cheaper Chinese electric vehicles to potentially enter U.S. markets, which could present a new kind of “security risk” for Americans. Should a wave of CCP vehicles arrive, one economist emphasized the U.S. should “keep [the EVs] out.” “I think we should try and keep them out,” Heritage Foundation economist Diana Furchtgott-Roth said. “If people are worried about a Chinese spy balloon going overhead, they would be worried about these Chinese EVs sending telematics back to China,” she continued on “Varney & Co” Thursday. “Plus, car manufacturers now can disable cars from remote. What if we were in some foreign entanglement with China? And then China decided to stop all the EVs in the United States? It’s a security risk.”

I listened to Faux News Stuart Varney interviewing Diana Furchtgott-Roth and thought this was dumb even for him. But if Jonny boy want to tell us that this clown from Heritage is a “mainstream economist”, I’ll join the other kiddies in his preK class laughing at little Jonny boy.

Then again I bet Bruce Hall agreed with every bit of BS she uttered!

Truth wins in court:

https://www.npr.org/2024/02/08/1230236546/famous-climate-scientist-michael-mann-wins-his-defamation-case

Entertaining how Steyn’s lawyer wanted to ignore the dollar figure of the punitive damages. Bruce Hall must be the law firm accountant.

Gee – I thought Brucie boy thought this was an important trial. But now he is silent now that the jury has spoken!

If anyone is interested (probably not on Super Bowl weekend I guess) Warren Beatty’s “Reds” is showing for free (with ads) on Youtube right now. Overly long but still a good film. I’ll probably “check in” on the Super Bowl, and pulling for the Chiefs, but I don’t know, after I got back from China I just can’t seem to get into pro football anymore. It ‘s like either I’ve become a different person or pro football has become a different sport. I got Jim Plunkett’s autobiography the other day at a used books sale for $1, and I’d be happier flipping through that than watching Sunday’s game. I can’t relate to these young kids anymore, dancing around in the endzone like they got lice in their pants. I remember Jim Brown said when you get to the endzone you should act like you’ve been there before. That seems about right to me. Hand the ball directly to the ref, have SOME dignity. Not anymore…….

Thanks for the tip. Good alternative to playing the Taylor Swift drinking game.

One reason I don’t tune in to TV football is the commentary. Yeesh! Talk, talk, talk…saying nothing.

At least those yappy NBC clowns will not be covering this game charging us extra for having to go to Peacock.

Al Michaels is the last one left that I like at the national level. But I don’t have Amazon streaming, so they stole him from me. Now they got that Black dude who yammers on and can’t remember which team currently has possession of the ball. “Touchdown Eagles!! Uh!!! Ah !!!Er!!! Beh!!! Touchdown Cowboys!!!!” This old man (me) just doesn’t get it. My favorite Al Michaels moment: Quiet moment in the game and ABC MNF camera lingers on Marv Levy on the sidelines, Al Michaels says (my paraphrase) “Of course one of the things Marv Levy is well-known for is his vulgarity towards officials. But Marv Levy has a bachelor’s degree in English Literature from Coe College in Iowa and a master’s degree in English History from Harvard, so don’t worry folks, when Marv Levy curses at NFL officials he curses at them polysyllabically.”

Alas, I only drink about once very 10 days, so it will be soda pop for me during the Super Bowl. Maybe Iowa Women’s next BB game after the Super Bowl I can take a swig every time Caitlin Clark makes an assist?? 1040 WHO radio call should be good. I don’t know, maybe every 3 pointer, I can have more fun on threes, right?? Or I could do 10 swigs per Clark assist?? hmmmm, I have to think this out. Crucial life decisions…….