The FY 24 Budget was released today. Because the forecast was locked down in late November, and the macro outlook has changed so much, the administration felt compelled to add an “Update on the Administration’s Economic Assumptions”. Here’s the forecast (based on Table S-9 in the Budget).

Category Archives: budget

“Biden Trump Grows National Debt by 11% in Two Years”

This is a corrected title of a mendacious (and typically statistically incompetent) article by Craig Eyermann in an Independent Institute blogpost (previously highlighted as Ironman of PoliticalCalculations). He writes:

Debt Held by the Public as Share of GDP

From Treasury, and CBO.

The Cyclically Adjusted Budget Balance and Federal Debt Held by the Public: Time Series

As a share of potential GDP (CBO May 2022 estimates):

Reserve Currency Status Is No Vaccination against Recklessness – UK Edition

…although it helps.

I never thought an advanced economy government could pursue stupider policies than that implemented under the Trump administration. Consider me corrected on this point – case in point, the United Kingdom in 2022.

Weekly Economic Activity in the UK, and Two Self-Inflicted Wounds

So far, the UK economy is plugging along, according to the OECD Weekly Tracker (through 9/17). But (understatement of the year), challenges have arisen.

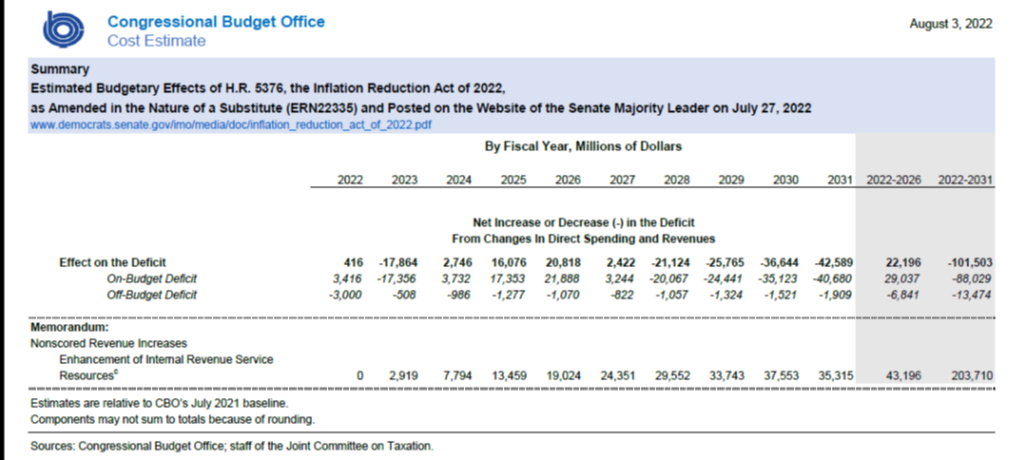

CBO Scored Inflation Reduction Act: 10 Year Deficit Reduction of $101.5 bn

More on Market Indicators pre- & post-Manchin

Following up on the previous post on expectations responses from the market to Manchin, Just putting together all the pieces of betting odds on the size of the reconciliation package, and the impact on implied expected inflation, real rates, and future economic activity. I plot on a 7 day frequency so as to include the odds from PredictIt, which do not stay constant over the weekend.

A “Fiscal Cliff Scenario” – A Symposium of Views in The International Economy

Macro Implications of BBB and IIJA Passage

We are still in the process of determining what’s in the Build Back Better (BBB) bill, but it approximates what is currently discussed, it in conjunction with the Infrastructure Investment and Jobs Act (IIJA) will not likely lead to much pressure in credit markets and upward pressure in prices, given it is largely paid for. Here (while we wait for the CBO) are Moody’s Analytics projections (as of 11/4).