Released today, in The International Economy symposium:

Category Archives: deficits

The Debt Ceiling As Kabuki

From Marketplace yesterday, “The debt ceiling explained” (Dylan Miettinen):

Debt Dynamics, and the Real Interest Rate

Debt-to-GDP dynamics are described by this expression.

The Real Cost of Treasury Borrowing

Halfway through November, TIPS 10 year at -0.876% and ten year adjusted for median expected inflation (from November Survey of Professional Forecasters, released today) at -1.264%.

Treasury Borrowing Rates – Nominal and Real

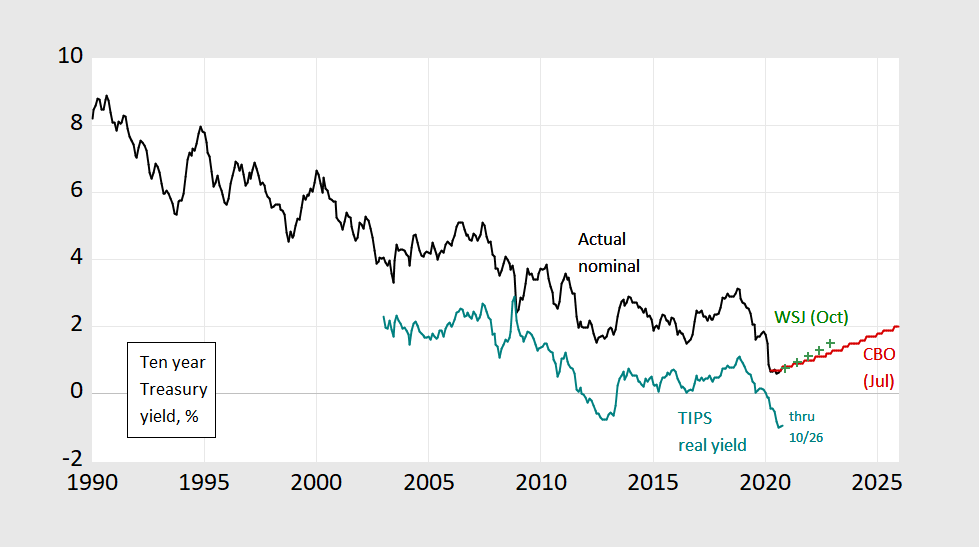

Rising government debt-to-GDP ratios should be viewed in the context of borrowing costs. Below, three-and-a-half decades of ten year Treasury yields.

What Are Current Borrowing Costs for the Federal Government?

Remember Δbt = (r-g)bt-1 + deft , where b is debt/GDP, r is the real interest rate, g is the GDP growth rate, and def is the primary budget deficit/GDP ratio. What’s r?

Figure 1: Ten year constant maturity Treasury yield (black), WSJ October survey mean forecast (green +), CBO July projection (red), and ten year TIPS (teal), all in %. October 2020 is data through 10/26. Source: Federal Reserve via FRED, WSJ, and CBO.

Guest Contribution: “The Relative Performance of the U.S. Federal Debt”

Today we are fortunate to have a guest contribution by Sam Williamson, Emeritus Professor of Economics at Miami University, and President of Measuring Worth. This is the second post in a series; the first post is here.

Fiscal Policy Efficacy in Times of Covid

Just in time for the module on fiscal policy in my macro policy course, multipliers in a time of Covid-19. From a CBO working paper by Seliski, Betz, Chen, Demirel, Lee, and Nelson, “Key Methods That CBO Used to Estimate the Effects of Pandemic-Related Legislation on Output”.

Implications of a “No Recovery Package” Outcome

From Deutsche Bank on Sunday:

In the US, fiscal uncertainty is a major issue. As outlined above, we now assume that significant further support will not be forthcoming until after the election. The resulting drop in income support for households is already beginning to depress activity and we see GDP growth slowing to near zero in Q4 as consumer spending slides. Growth will pick up in Q1 with some post-election fiscal support.

CBO on the Macro Impact of Pandemic Recovery Packages Thus Far

On Friday, the CBO released The Effects of Pandemic-Related Legislation on Output.