That’s the title of my October 18th Global Hot Spots talk, sponsored by the Wisconsin Foundation and Alumni Association (Fluno Center, 1:30-2:30).

Category Archives: financial markets

Guest Contribution: “A disaster under-(re)insurance puzzle: Home bias in disaster risk-bearing”

Today, we are pleased to present a guest contribution written Hiro Ito (Portland State University) and Robert N. McCauley (formerly Bank for International Settlements). The views presented represent those of the authors, and not necessarily those of the institutions the authors are affilliated with.

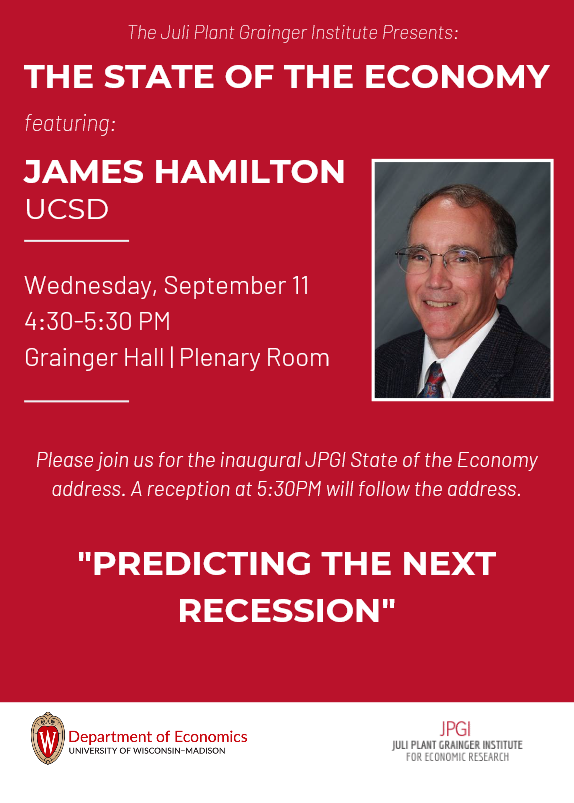

“Predicting the Next Recession” with James Hamilton

I’ll be at this UW Dept of Economics event, in order to learn what awaits us all…

(Actually, it’s required attendance for my Financial System course.)

Registration information here.

Estimated Probability of Recession in August 2020 = 49% 51%

…using plain vanilla 10yr-3mo probit regression, over 1986M01-2019M08 period, using data shown below in Figure 1 [corrections to data, update results 9/5]

Guest Contribution: “Oil Prices and the U.S. Economy: Evidence from the Stock Market”

Today, we’re fortunate to have Willem Thorbecke, Senior Fellow at Japan’s Research Institute of Economy, Trade and Industry (RIETI) as a guest contributor. The views expressed represent those of the author himself, and do not necessarily represent those of RIETI, or any other institutions the author is affiliated with.

An Ad Hoc Term Premium Adjusted Term Spread Recession Model

One criticism of the use of the term spread model to forecast recession in current times is that this time is different. [1] [2] [3] In particular, due to quantitative easing, the term premium is lower than in past episodes. Hence, in this interpretation, an inverted yield curve no longer signals as much future depressed interest rates as in the past.

Back-of-the-Envelope Calculation of Trump Induced Dollar Appreciation

Recession Probability If the Rest of August Is Like the First Half

…using plain vanilla 10yr-3mo probit regression, over 1986M01-2019M08 period, using data shown below in Figure 1

Does the Safe-Haven Aspect of the US Explain Declining Treasury Rates

That’s what reader Ed Hanson surmises:

Why are long term interest rate coming down. There is one obvious answer. The world sees the US as the safest and best place to invest with their bond holdings because of rigorous US economy brought on by the Trump administration with its tax and reduced regulation policy. Perhaps it is this circumstance of inversion that means it is not indicating recession, at least for the US.

Just glance at today’s Economist for an alternative interpretation:

Teaching Begins Early This Fall: News, Efficient Markets Hypothesis, Asset Prices

Figure 1: September 2019 corn futures, accessed 8/13/2019. Source: Barchart.com.