From the conclusion to NBER WP No 29687 (paper), coauthored with Caroline Jardet and Cristina Jude (both Banque de France):

Category Archives: international

“Covid Impact and Macroeconomic Policy in Asia”

That’s the title of a presentation at the ASSA meetings (YouTube video of the presentation is here) in the ACAES panel “Covid and Recovery in Asia” (see below). Calla Wiemer presented, and I discussed. [Updated 1/19, links to slides added]

Global Economic Prospects – January 2022

From the World Bank report:

US Exports in the Wake of the Trade War

Compiling graphs for a trade course, and lo what did I see:

Do Exchange Rate Movements Equalize Yields?

Fama (JME, 1984), and Tryon (1979) demonstrated that changes in the exchange rate do not equal the forward premium, in what came to be known as the forward premium puzzle. Since the forward premium equals the interest differential in the absence of current and incipient capital controls and in the absence of default risk — this finding is equivalent to the result that interest rates, after accounting for exchange rate changes, are not equalized on average.

In other words, if the yield on the US default-risk-free bond is 2% and the yield on a UK default-risk-free bond is 5%, then the US dollar does not on average appreciate by 3% against the pound in order to equalize returns. This finding could be explained, for instance, by the presence of a time-varying exchange risk premium on pound sterling assets (vs. dollar assets); however, it’s not been easy to find robust evidence of determinants of such a time varying premium.

While this puzzle has largely persisted in the ensuing 25 years, it seemingly disappeared during and after the global financial crisis — until re-appearing in recent years.

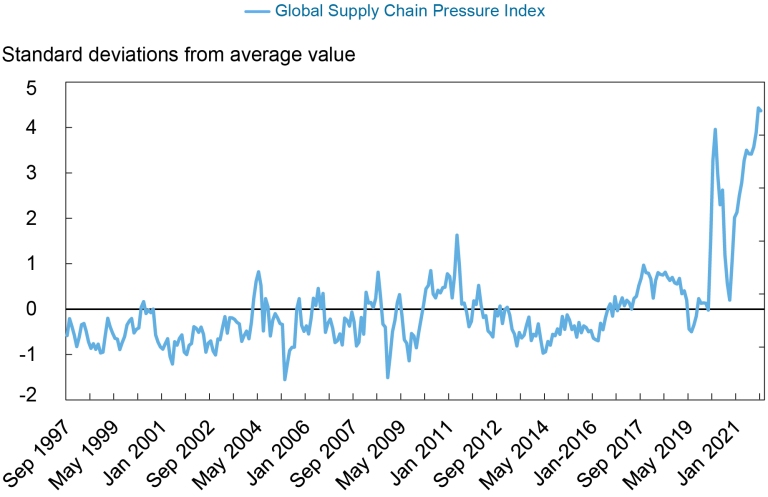

A Global Supply Chain Pressure Index

How Much of the Trade Deficit Is Government Spending Induced?

Some of it – but some indications are that it’s not the majority.

What Happens When One Runs Around Saying Things without a Model

Steven Kopits writes:

We might expect a massive stimulus coupled with a major loss of jobs to lead to an explosion of the trade deficit, which it has.

…

In extremis, such a stimulus might even generate record levels of goods imports, which it has.

…

This record level of imports would result in record levels of shipping, which it has, with LA in-bound port traffic running about 15% above its prior peak. (Let me add here that US shale oil production has meant that the historical US trade deficit in oil has disappeared. Since oil is imported chiefly through Houston and a couple of other ports — but not LA — the increase in port traffic is showing up in merchandise, not oil, imports. That is, imports are going to cargo ports like Long Beach and LA.) Such ports may not be equipped to handle surges of cargo imports well above historical peaks.

…

At the same time, a loss of jobs accompanied by record stimulus might lead to weak exports, which it has.

“Do Central Banks Rebalance Their Currency Shares?”

Some do; some don’t. Now published, an article in Journal of International Money and Finance (updated) by me, Hiro Ito, and Robert McCauley answering this question. From the abstract:

The Extent and Implications of the China Slowdown

According to official data published by the National Bureau of Statistics, China’s growth q/q seasonally adjusted slowed considerably in Q3, to 0.2% (not annualized), below the Bloomberg consensus of 0.5%. The four quarter growth rate was 4.9%, vs consensus of 5.2%.