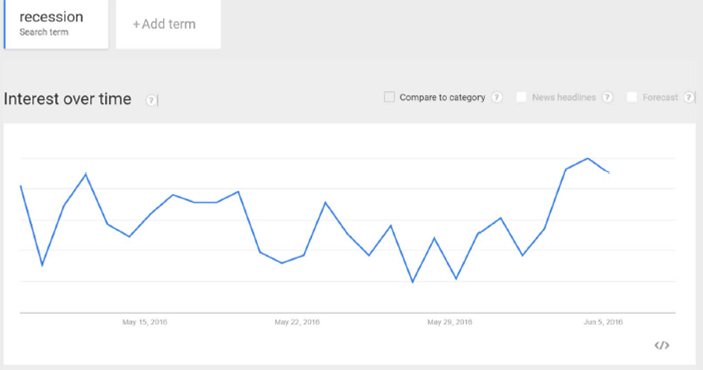

Since Friday’s employment release, [1] there’s been a surge in articles discussing the possibility of a recession.

Figure 1: Google Trends index for “Recession”, last 30 days, in Business and Finance category. Source: Google, accessed 6/7, 11PM Pacific.

Time for a look at some key indicators the NBER Business Cycle Dating Committee [1] has looked at in the past.