Increases in oil production in the United States and the Middle East were certainly key factors in the huge drop in oil prices over the last year. Nevertheless, one can’t help but be struck by the fact that the weekly changes in oil prices correlate with dramatic moves in other commodity and financial markets.

Continue reading

Category Archives: Uncategorized

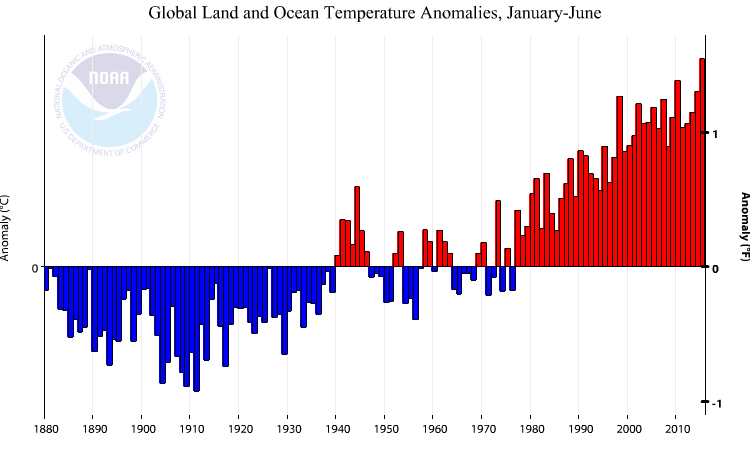

“Global warming is a total, and very expensive, hoax!”

Source: Donald J. Trump, 6 December 2013.

Here’s some data: Global surface anomaly, year-to-date (June):

Source: NOAA

Short Term Economic Prospects in Kansas

Philadelphia Fed coincident indices for Kansas have been revised downward, along with forecasts.

Norms for Employment Growth in Recoveries

Re-visiting Mitt Romney’s “We should be seeing numbers in the 500,000 jobs created per month.” [1]

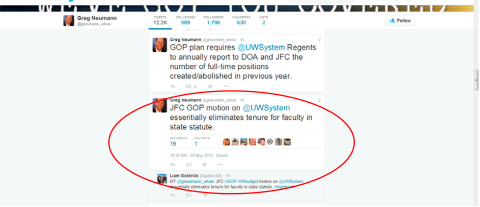

Wisconsin GOP Targets Faculty Tenure

From Greg Neumann/WKOW:

“JFC” is Joint Finance Committee. The text of the motion is here. Stein and Herzog/Journal Sentinel here. The article notes the following contrast: “Minnesota raised taxes with part of the new revenue set aside for higher education.”

Guest Contribution: “Asia Games: Not Zero-Sum”

Today we are fortunate to have a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99. An earlier version of this post appeared at Project Syndicate.

Some Conjectures Regarding the Effectiveness of Economic Boycotts

The events surrounding the signing into law of Indiana’s Religious Freedom Restoration Act provide an interesting test case to see if boycotts, or threats thereof, can successfully induce policy changes. I find this an interesting analogue to the ongoing debate whether Western sanctions, particularly “smart sanctions” imposed on Russia, can have an impact.

Fed moves the markets

As widely expected, at Wednesday’s FOMC meeting the Federal Reserve dropped its statement that “the Committee judges that it can be patient in beginning to normalize the stance of monetary policy”, the magic formula that many observers had thought would open the way for a hike in interest rates at the Fed’s June meeting. But the yield on a 10-year U.S. Treasury bond dropped 10 basis points immediately following the FOMC release.

Continue reading

Working with Qualitative Variables: Correlation, Causation, and Third Factors

I am fascinated by maps, including maps of the United States which display the geographic variation of institutional features. But qualitative features, such as institutions or laws, cannot be directly subjected quantitative analysis. Fortunately, as I’ve been discussing in my intro econometrics class, one can convert qualitative data into quantitative data by use of dummy variables, i.e., variables that take on a value of 1 or 0 (one could have ordinal values as well, but I’ll skip that aspect today).

The Congressional Budget Office at 40

The CBO has been providing nonpartisan budgetary and economic analyses for four decades. Whether that continues depends upon the willingness of leaders in Congress believe in the worth of serious analysis (see here for doubts). For now, we look back and (hopefully) forward, at events today. Yesterday, a forum at the Brookings Institution presented some additional views. Director Doug Elmendorf blogs on the anniversary today.