From M. Abecasis/GS today:

Employment Release and Business Cycle Indicators

NFP employment increase of 263K surprises on upside (vs. Bloomberg consensus of 200K). This is the resulting picture for some key indicators followed by the NBER Business Cycle Dating Committee.

Guest Contribution: “Let the WTO Referee Carbon Border Tariffs”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared at Project Syndicate.

Month-on-Month Inflation Seems to Have Peaked

That’s the message from PCE deflators today.

Business Cycle Indicators at the Beginning of December 2022

With the release of personal consumption and income for October, we have the following picture of key series followed by the NBER BCDC (along with monthly GDP from IHS Markit, formerly from Macroeconomic Advisers).

2022Q3 2nd Release, Alternative Measures of Activity, and a Recession of 2022H1?

Here’s GDP, GDO, and GDP+ through 2022Q3, and monthly indicators through 2022M10. I (still) don’t see a recession in 2022H1.

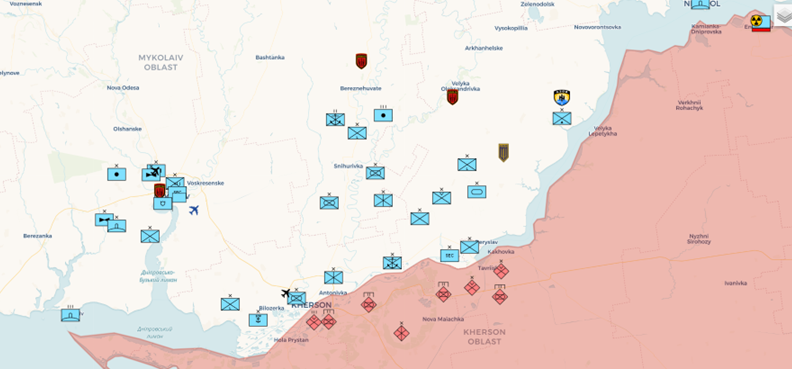

Disposition of Forces in Kherson Oblast, 28 Nov 2022

Here’s a picture from late yesterday:

Source: as of 28 Nov, militaryland.net, accessed 29 Nov 2022.

See latest report from ISW for context.

“Sky-high [natural] gas prices…”

What is “News”? What is an “Event study”? China Edition

Remarks by a reader indicate it’s worthwhile to recap this topic. Consider:

Guest Contribution: “The Strong Dollar, Global Inflation, and Global Recession”

Today, we are pleased to present a guest contribution by Steven Kamin (AEI), formerly Director of the Division of International Finance at the Federal Reserve Board. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affiliated with.