From Wells Fargo today:

Risk, noon March 1st

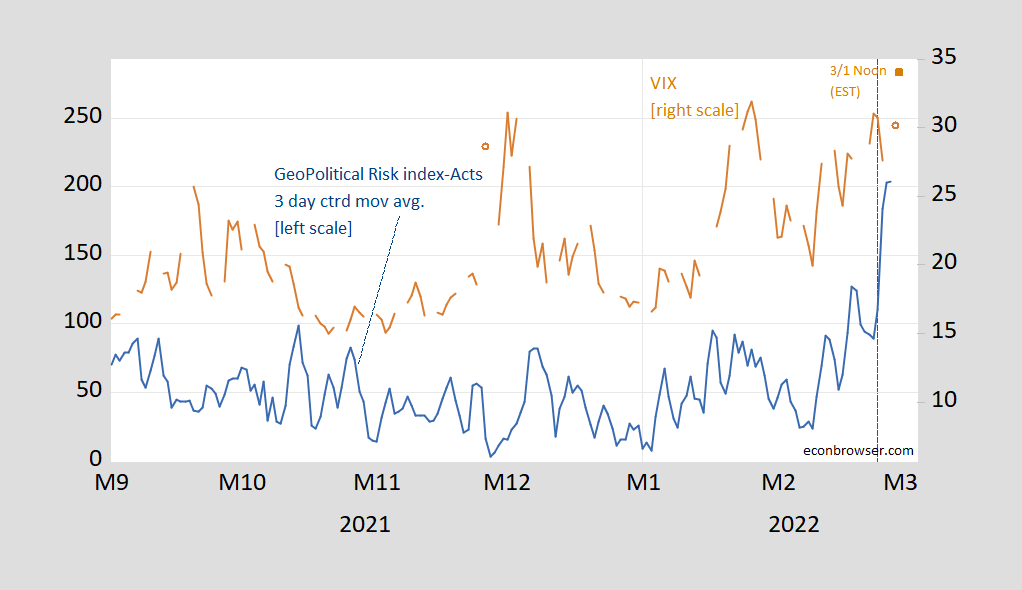

Figure 1: Geopolitical Risk index – Acts (blue, left scale) and VIX (brown, right scale). 3/1 observation for VIX as of noon EST. Source: CBOE via FRED, Caldara and Iacoviello, accessed 3/1/2022.

Russian Exchange Rate Pass Through into Consumer Prices

For Russia, it’s maybe 10%-17% for 1 quarter, 50%-70% for 4 quarters.

Risk and Safe Haven Effects

VIX up as GeoPolitical Risk rises. Dollar jumps on the invasion, but eases today, Treasury yields down due to safe haven effects. Anticipated interest rate increases moderate.

FT-IGM February Survey of Macroeconomists

Survey taken last week, published today here. The FT-IGM Survey of Macroeconomists median forecast implies this path for GDP:

Russia Deploys the Interest Rate Defense (and probably everything else)

Russia raises the policy rate to 20%, from 9.5%, which was itself raised on 2/11.

Ruble Futures

Front month, CME as of about 5pm Central:

Sanctions on Russia, International vs. Foreign Exchange Reserves, and Capital Controls

Interesting quote from 2020 IMF Article IV, Annex III: External Sector Assessment (distributed February 2021):

Guest Contribution: “Fighting the Last Inflation War”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared at Project Syndicate.

Business Cycle Indicators at End-February, January Inflation Recap

Personal income and consumption for January, and manufacturing and trade industry sales for December, were released last week. The PCE deflator for January was also released, rounding out January inflation numbers.